Question

Brian owns a corn dog stand that will generate $182,000 per year forever, but since corn dogs are out of favor, the first cash

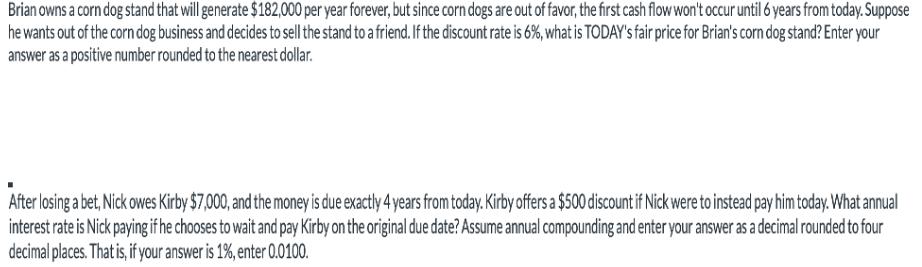

Brian owns a corn dog stand that will generate $182,000 per year forever, but since corn dogs are out of favor, the first cash flow won't occur until 6 years from today. Suppose he wants out of the corn dog business and decides to sell the stand to a friend. If the discount rate is 6%, what is TODAY's fair price for Brian's corn dog stand? Enter your answer as a positive number rounded to the nearest dollar. After losing a bet, Nick owes Kirby $7,000, and the money is due exactly 4 years from today. Kirby offers a $500 discount if Nick were to instead pay him today. What annual interest rate is Nick paying if he chooses to wait and pay Kirby on the original due date? Assume annual compounding and enter your answer as a decimal rounded to four decimal places. That is, if your answer is 1%, enter 0.0100.

Step by Step Solution

3.52 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting for Decision Making and Control

Authors: Jerold Zimmerman

8th edition

78025745, 978-0078025747

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App