Answered step by step

Verified Expert Solution

Question

1 Approved Answer

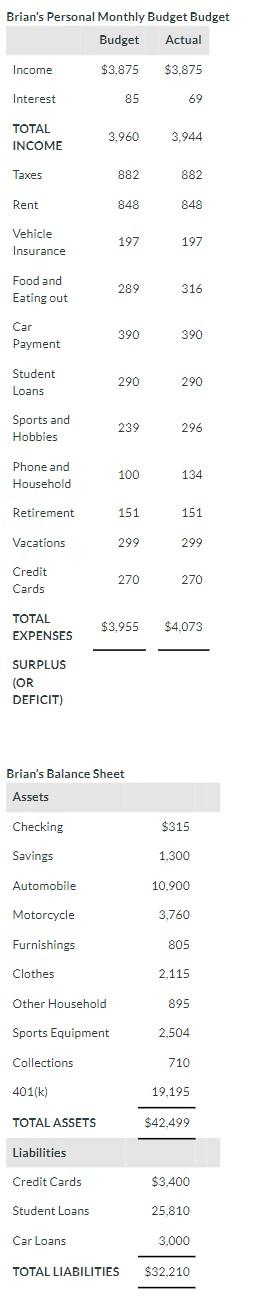

Brian's Personal Monthly Budget Budget Budget Actual $3,875 $3.875 Income Interest TOTAL INCOME Taxes Rent Vehicle Insurance Food and Eating out Car Payment Student

Brian's Personal Monthly Budget Budget Budget Actual $3,875 $3.875 Income Interest TOTAL INCOME Taxes Rent Vehicle Insurance Food and Eating out Car Payment Student Loans Sports and Hobbies Phone and Household Retirement Vacations Credit Cards TOTAL EXPENSES SURPLUS (OR DEFICIT) Automobile Motorcycle Furnishings Clothes Collections Other Household Sports Equipment 401(k) TOTAL ASSETS Liabilities Credit Cards Student Loans 3,960 Car Loans. 85 882 848 Brian's Balance Sheet Assets Checking Savings 197 289 390 290 239 100 151 299 270 TOTAL LIABILITIES 69 3,944 882 848 197 316 390 290 296 134 151 $3.955 $4.073 299 270 $315. 1,300 10.900 3,760 805 2.115 895 2,504 710 19.195 $42.499 $3,400 25,810 3,000 $32,210 Calculate the current ratio, debt ratio, debt-to-income ratio and long term debt coverage ratio. (Round answers to 2 decimal places, e.g. 52.75.). Current Ratio is Debt Ratio is Debt-to-income ratio is Long term debt coverage ratio is

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Current Ratio Total Assets Total Liabilities 42499 32210 13...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started