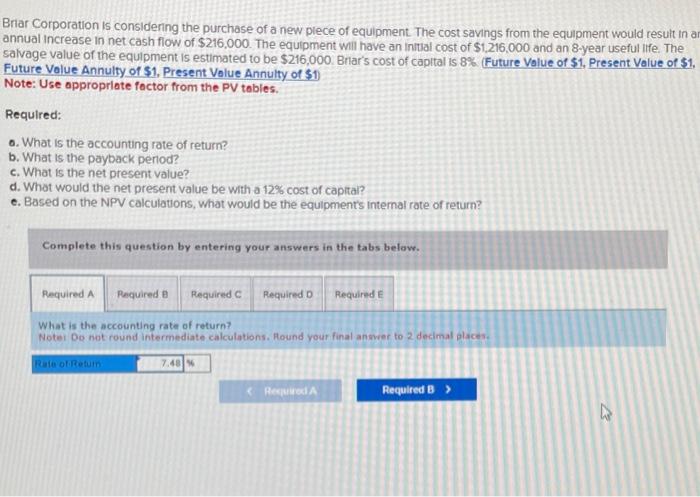

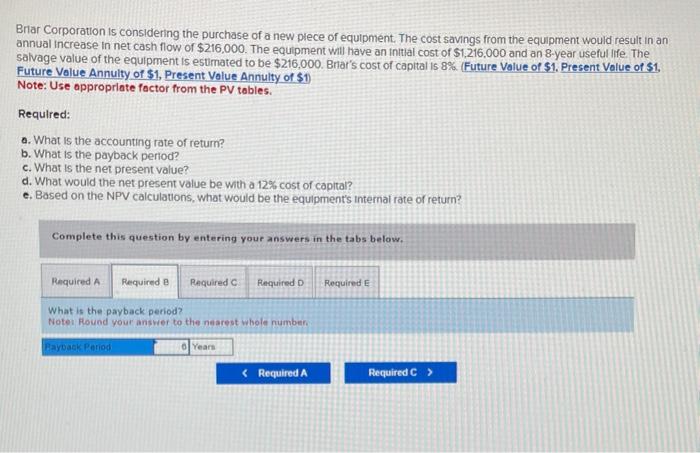

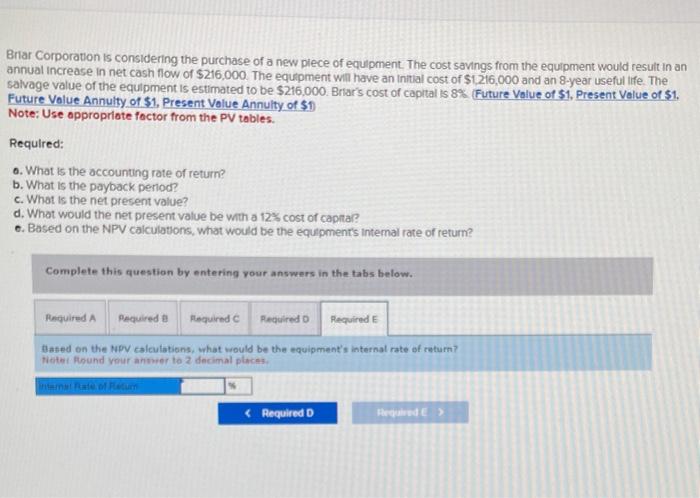

Briar Corporation is considering the purchase of a new plece of equipment. The cost savings from the equipment would resuit in ai annual increase in net cash flow of $216,000. The equipment will have an initual cost of $1,216,000 and an 8 year useful life. The salvage value of the equipment is estimated to be $216,000. Briar's cost of capltal is 8%. Future Volue of $1, Present Volue of $1, Future Volue Annulty of \$1, Present Value Annulty of \$1) Note: Use approprlate foctor from the PV tables. Required: 0. What is the accounting rate of return? b. What is the payback perlod? c. What is the net present value? d. What would the net present value be with a 12% cost of capital? e. Based on the NPV calculations, what would be the equipment's intemal rate of return? Complete this question by entering your answers in the tabs below. What is the accounting rate of return? Notei bo not round intermediate calculations. Hound your final answer to 2 decimal plsces. Briar Corporation is considering the purchase of a new plece of equipment. The cost savings from the equipment would result in an annual increase in net cash flow of $216,000. The equipment wit have an initial cost of $1,216,000 and an 8 -year useful life. The salvage value of the equipment is estimated to be $216,000. Brar's cost of capital is 8%. Future Value of $1. Present Volue of $1. Future Volue Annulty of $1, Present Volue Annulty of $1 Note: Use appropriate factor from the PV tables. Requlred: a. What is the accounting rate of return? b. What is the payback period? c. What is the net present value? d. What would the net present value be with a 12% cost of capital? e. Based on the NPV calculations, What would be the equipment's internal rate of retum? Complete this question by entering your answers in the tabs below. What is the payback period? Noten Plovod your answer to the nearest whole number. Bnar Corporation is considering the purchase of a new plece of equipment. The cost savings from the equipment would result in an annual increase in net cash flow of $216,000. The equipment will have an initial cost of $1,216,000 and an 8 year useful life. The salvage value of the equipment is estimated to be $216,000. Briar's cost of capital is 8%. (Future Volue of $1, Present Value of $1, Future Value Annulty of \$1, Present Volue Annulty of \$1) Note: Use opproprlate factor from the PV tables. Required: o. What is the accounting rate of return? b. What is the payback period? c. What is the net present value? d. What would the net present value be with a 12% cost of capitar? c. Based on the NPV calculations, what would be the equipment's internal rate of return? Complete this question by entering your answers in the tabs below. What is the net present value? Notet Negathe amounts should be indicated by a minus sign. Round your ariawer to nearest dollar ameunt. Bnar Corporation is considening the purchase of a new plece of equipment. The cost savings from the equipment would result in an annual increage in net cash flow of $216,000. The equipment with have an intsil cost of $1216,000 and an 8 -year useful hife. The solvage value of the equipment is estimbted to be $216.000. Brar's cost of capital is 8%. Future Value of \$1. Present Value of 51 . Euture Volue Annulty of \$1, Present Volue Annulty of $1 i) Note: Use appropriote factor from the PV tables. Requlred: 6. What is the accounting rote of return? b. What is the poybock pertod? c. What is the net present value? d. What would the net present value be whth a 12% cost of capita? 6. Bosed on the NPP calcilltions, what would be the equipments intemal rate of return? fiote fi de Briar Corporation is considering the purchase of a new piece of equipment. The cost savings from the equipment would result in an annual increase in net cash flow of $216,000. The equipment will have an intitial cost of $1,216,000 and an 8 -year useful ife. The salvage value of the equipment is estimated to be $216,000. Briar's cost of capital is 8%. Future Volue of $1, Present Volue of $1. Future Volue Annulty of \$1, Present Volue Annulty of $1 Note: Use appropriate factor from the PV tables. Requlred: 0. What is the accounting rate of return? b. What is the payback period? c. What is the net present value? d. What would the net present value be with a 12% cost of capita? c. Based on the NPV calculatons, what would be the equipment's intemal rate of return? Complete this question by entering your answers in the tabs below. Hased on the NPY calculations, what would be the equipment's internat rate of return? Ficter found yeur anower to 2 decimal places