Answered step by step

Verified Expert Solution

Question

1 Approved Answer

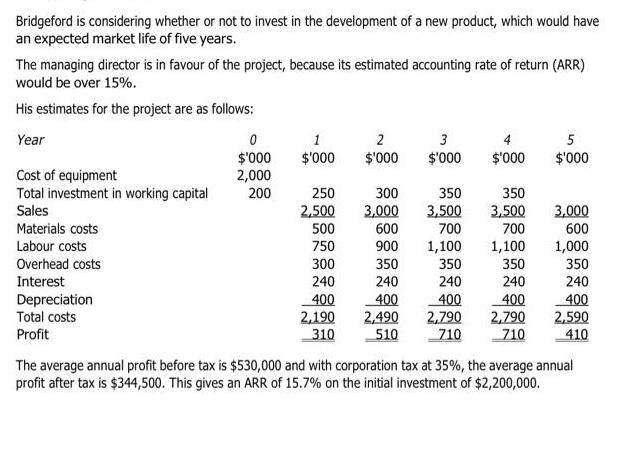

Bridgeford is considering whether or not to invest in the development of a new product, which would have an expected market life of five

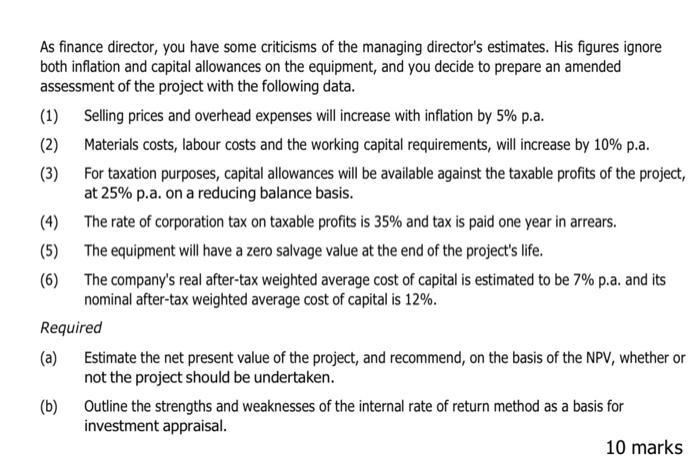

Bridgeford is considering whether or not to invest in the development of a new product, which would have an expected market life of five years. The managing director is in favour of the project, because its estimated accounting rate of return (ARR) would be over 15%. His estimates for the project are as follows: Year Cost of equipment Total investment in working capital Sales Materials costs Labour costs Overhead costs Interest Depreciation Total costs Profit 0 $'000 2,000 200 1 $'000 250 2,500 500 750 300 240 400 2,190 310 2 $'000 300 3,000 600 900 350 240 400 2,490 510 3 $'000 350 3,500 700 1,100 350 240 $'000 350 3,500 700 1,100 350 240 400 400 2,790 2,790 710 710 5 $'000 3,000 600 1,000 350 240 400 2,590 410 The average annual profit before tax is $530,000 and with corporation tax at 35%, the average annual profit after tax is $344,500. This gives an ARR of 15.7% on the initial investment of $2,200,000. As finance director, you have some criticisms of the managing director's estimates. His figures ignore both inflation and capital allowances on the equipment, and you decide to prepare an amended assessment of the project with the following data. Selling prices and overhead expenses will increase with inflation by 5% p.a. Materials costs, labour costs and the working capital requirements, will increase by 10% p.a. For taxation purposes, capital allowances will be available against the taxable profits of the project, at 25% p.a. on a reducing balance basis. (1) (2) (3) (4) (5) (6) The rate of corporation tax on taxable profits is 35% and tax is paid one year in arrears. The equipment will have a zero salvage value at the end of the project's life. The company's real after-tax weighted average cost of capital is estimated to be 7% p.a. and its nominal after-tax weighted average cost of capital is 12%. Required (a) (b) Estimate the net present value of the project, and recommend, on the basis of the NPV, whether or not the project should be undertaken. Outline the strengths and weaknesses of the internal rate of return method as a basis for investment appraisal. 10 marks

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Revised Income Statement Year Cost of equipment 2000 Total investment in working capital 200 Sales M...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started