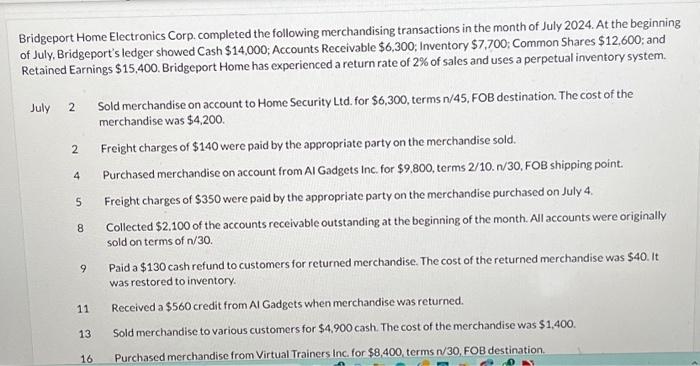

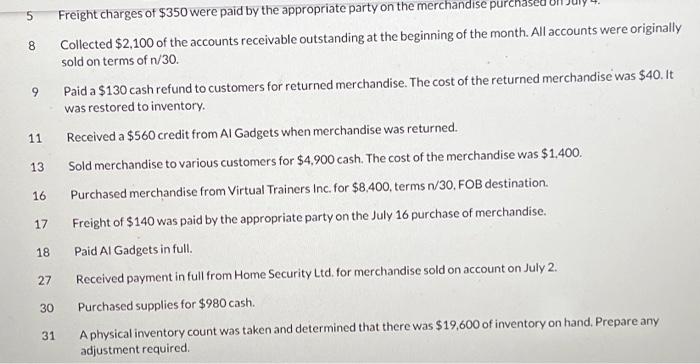

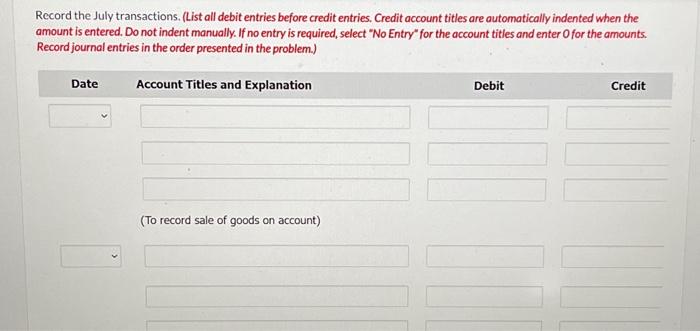

Bridgeport Home Electronics Corp. completed the following merchandising transactions in the month of July 2024. At the beginning of July, Bridgeport's ledger showed Cash $14,000; Accounts Receivable $6,300; Inventory $7,700; Common $ hares $12,600; and Retained Earnings $15,400. Bridgeport Home has experienced a return rate of 2% of sales and uses a perpetual inventory system. July 2 Sold merchandise on account to Home Security Ltd. for $6,300, terms n/45, FOB destination. The cost of the merchandise was $4,200. 2 Freight charges of $140 were paid by the appropriate party on the merchandise sold. 4 Purchased merchandise on account from AI Gadgets Inc. for $9,800, terms 2/10. n/30, FOB shipping point. 5 Freight charges of $350 were paid by the appropriate party on the merchandise purchased on July 4. 8 Collected $2.100 of the accounts receivable outstanding at the beginning of the month. All accounts were originally sold on terms of n/30. 9 Paid a $130 cash refund to customers for returned merchandise. The cost of the returned merchandise was $40. It was restored to inventory. 11 Received a $560 credit from Al Gadgets when merchandise was returned. 13 Sold merchandise to various customers for $4,900 cash. The cost of the merchandise was $1,400. 16 Purchased merchandise from Virtual Trainers Inc, for $8,400, terms n/30, FOB destination. 5 Freight charges of $350 were paid by the appropriate party on the merchandise purchased und 8 Collected $2,100 of the accounts receivable outstanding at the beginning of the month. All accounts were originally sold on terms of n/30. 9 Paid a $130 cash refund to customers for returned merchandise. The cost of the returned merchandise was $40. It was restored to inventory. 11 Received a $560 credit from Al Gadgets when merchandise was returned. 13 Sold merchandise to various customers for $4,900 cash. The cost of the merchandise was $1,400. 16 Purchased merchandise from Virtual Trainers Inc. for $8,400, terms n/30. FOB destination. 17 Freight of $140 was paid by the appropriate party on the July 16 purchase of merchandise. 18 Paid Al Gadgets in full. 27 Received payment in full from Home Security Ltd. for merchandise sold on account on July 2. 30 Purchased supplies for $980 cash. 31 A physical inventory count was taken and determined that there was $19,600 of inventory on hand. Prepare any adjustment required. Record the July transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem.)