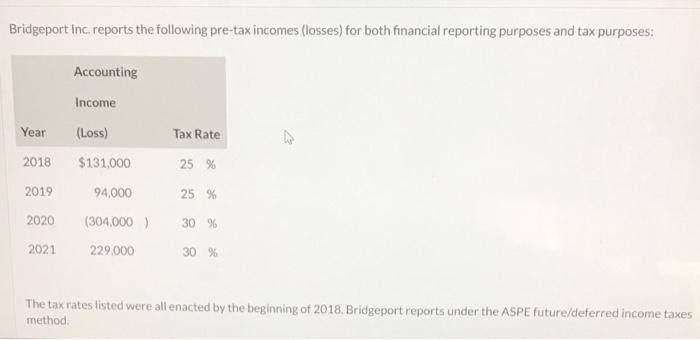

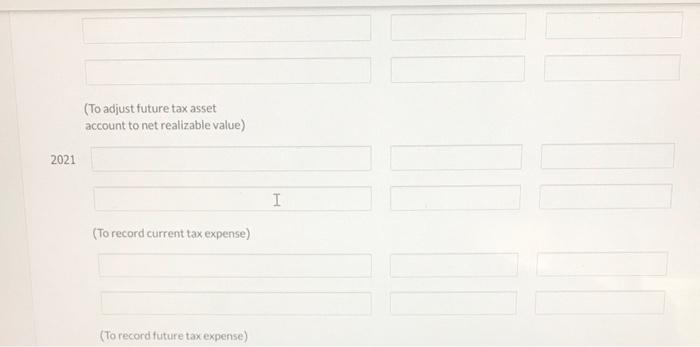

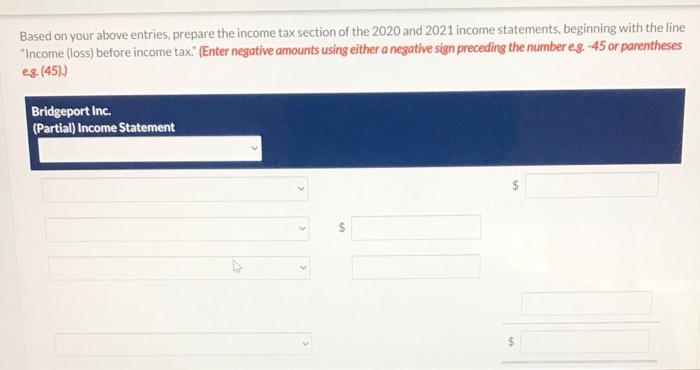

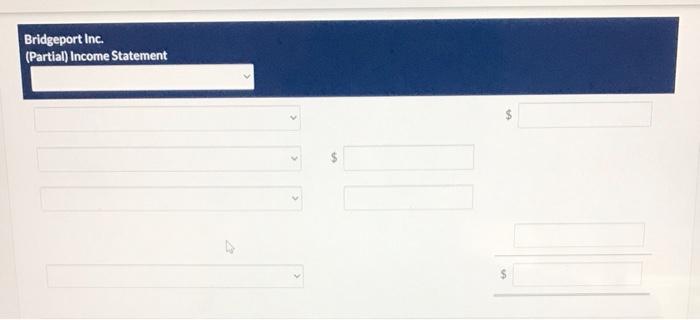

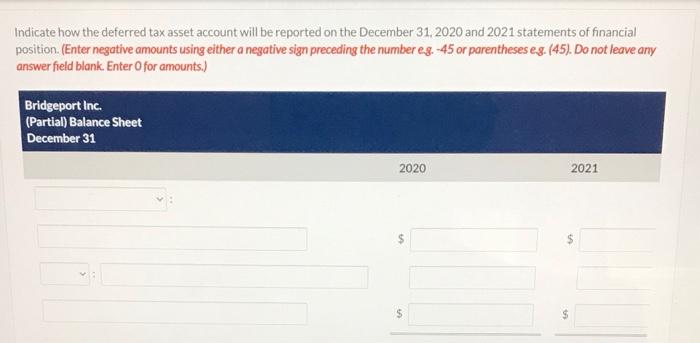

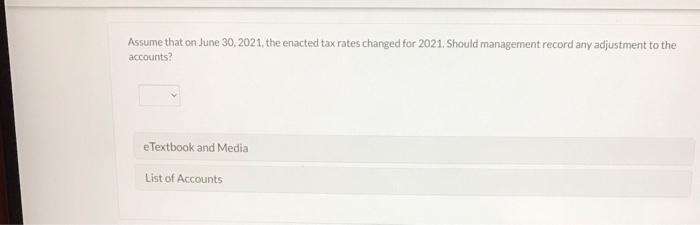

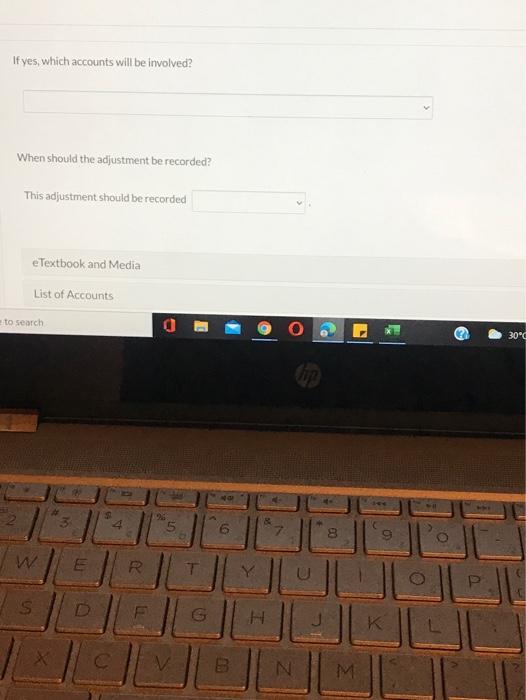

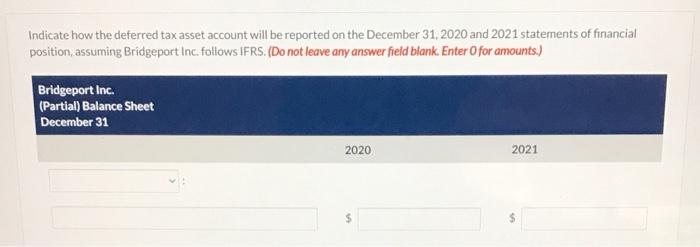

Bridgeporting reports the following pre-tax incomes (losses) for both financial reporting purposes and tax purposes: Accounting Income Year (Loss) Tax Rate 2018 $131.000 25 % 2019 94,000 25 % 2020 (304,000) 30 96 2021 229,000 30 % The tax rates listed were all enacted by the beginning of 2018. Bridgeport reports under the ASPE future/deferred income taxes method Assume that Bridgeport Inc. uses a valuation allowance to account for deferred tax assets, and also that it is more likely than not that 25% of the carryforward benefits will not be realized. Prepare the journal entries for 2020 and 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit 2020 I (To record benefit from loss carryback) (To record future benefit from loss carryforward) (To adjust future tax asset account to net realizable value) 2021 I (To record current tax expense) (To record future tax expense) (To record current tax expense) (To record future tax expense) Toadjust future taxa account to netrable value) Textbook and Media List of Accounts ONG 8 w R Y 1 SolEll H KILUL v N M Based on your above entries, prepare the income tax section of the 2020 and 2021 income statements, beginning with the line "Income (loss) before income tax." (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses eg. (451) Bridgeport Inc. (Partial) Income Statement $ Bridgeport Inc. (Partial) Income Statement Indicate how the deferred tax asset account will be reported on the December 31, 2020 and 2021 statements of financial position(Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses eg. (45). Do not leave any answer field blank. Enter for amounts.) Bridgeport Inc. (Partial) Balance Sheet December 31 2020 2021 $ $ Assume that on June 30, 2021, the enacted tax rates changed for 2021. Should management record any adjustment to the accounts? e Textbook and Media List of Accounts If yes, which accounts will be involved? When should the adjustment be recorded? This adjustment should be recorded e Textbook and Media List of Accounts to search 1 E 9 30C 0 4 LG 00 9 W E R T Y U P S G H K. Elle LS CIL c B N M Indicate how the deferred tax asset account will be reported on the December 31, 2020 and 2021 statements of financial position, assuming Bridgeport Inc. follows IFRS. (Do not leave any answer field blank. Enter for amounts.) Bridgeport Inc. (Partial) Balance Sheet December 31 2020 2021 $