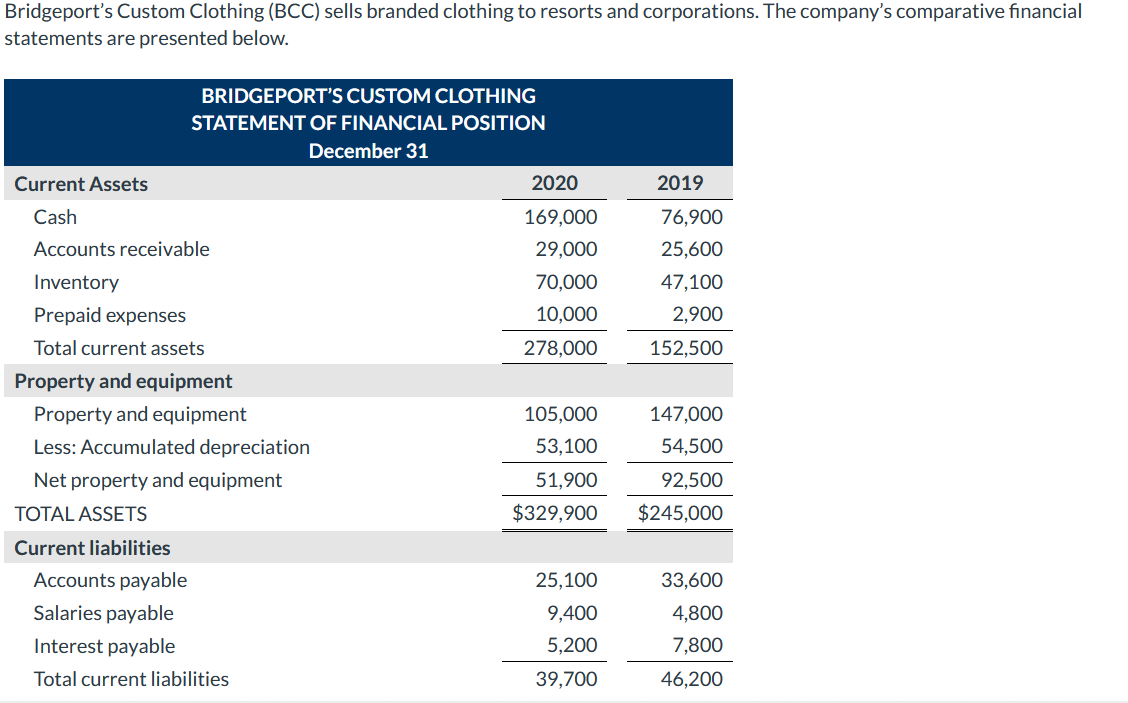

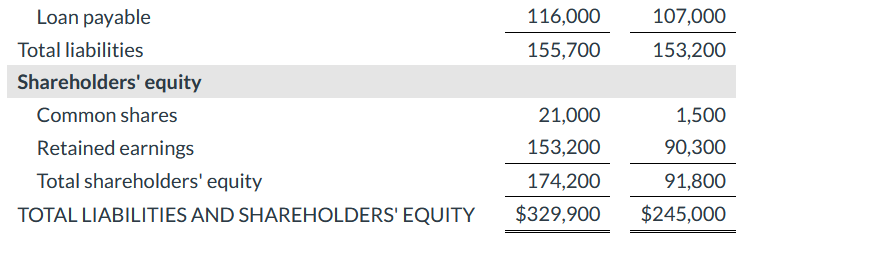

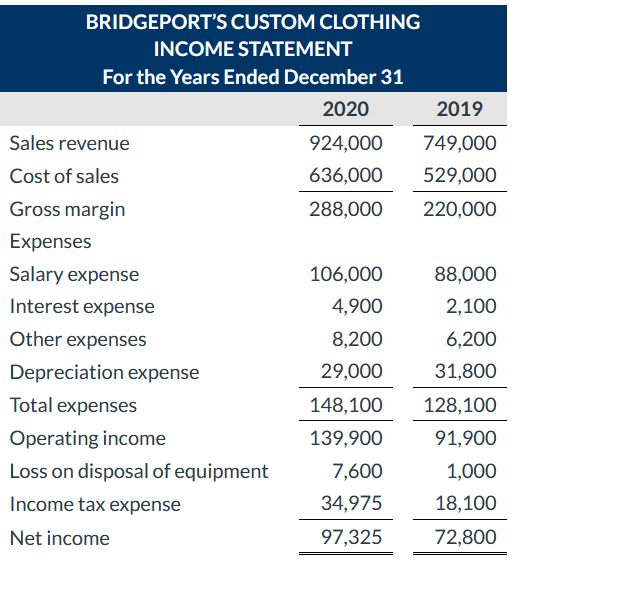

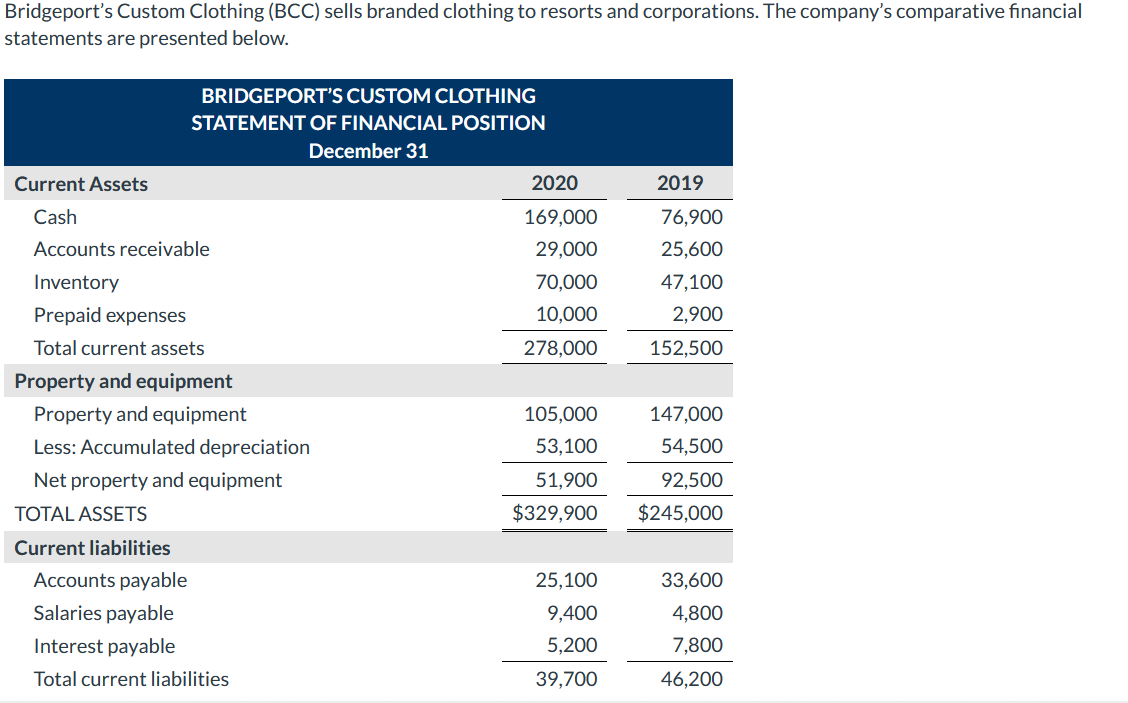

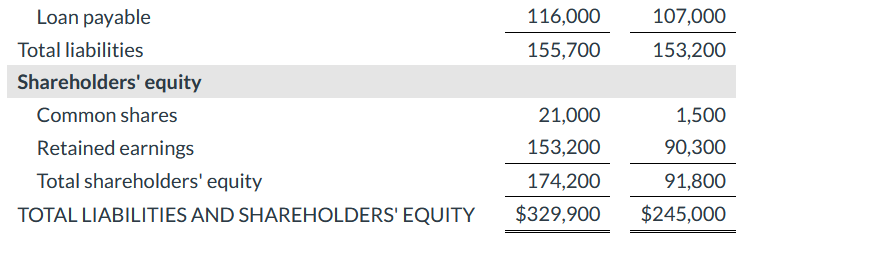

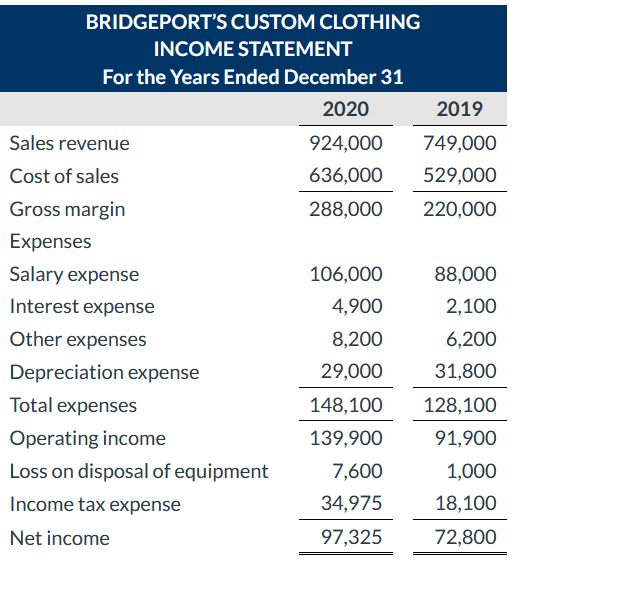

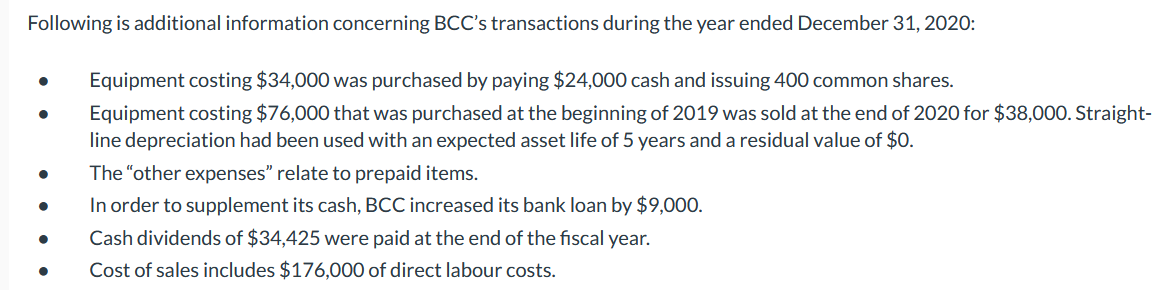

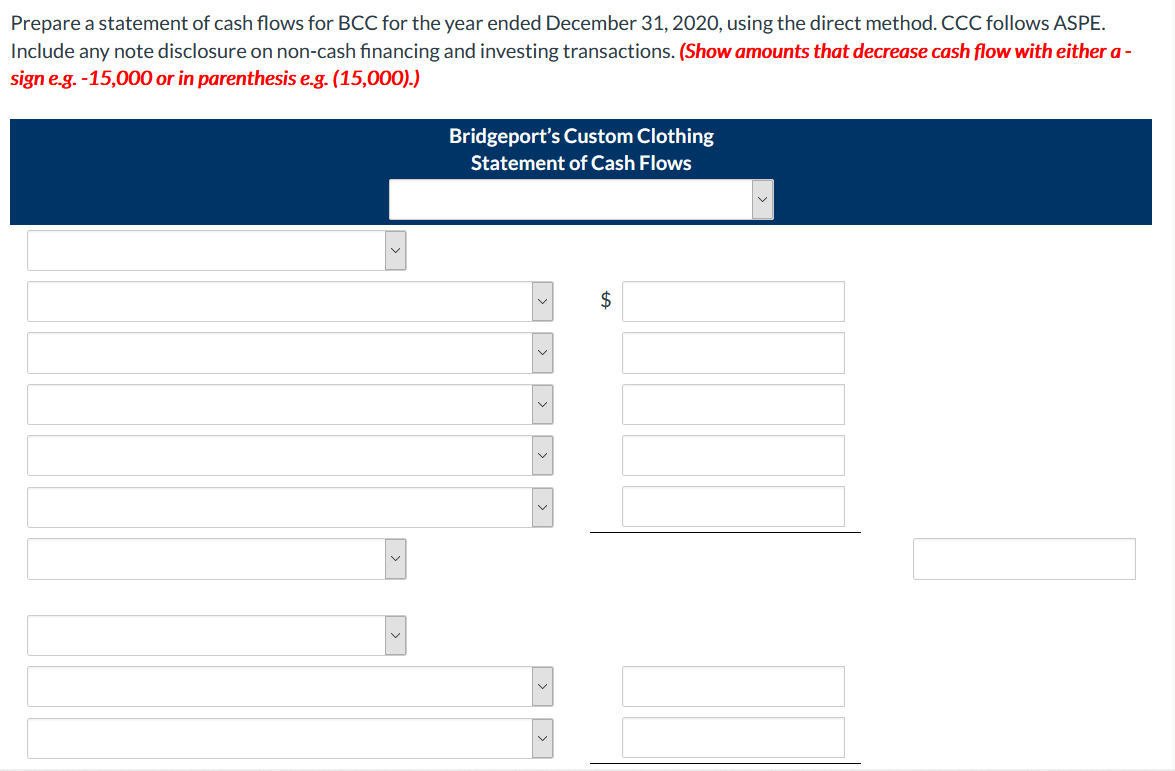

Bridgeport's Custom Clothing (BCC) sells branded clothing to resorts and corporations. The company's comparative financial statements are presented below. BRIDGEPORT'S CUSTOM CLOTHING STATEMENT OF FINANCIAL POSITION December 31 2020 169,000 29,000 70,000 10,000 278,000 2019 76,900 25,600 47,100 2,900 152,500 Current Assets Cash Accounts receivable Inventory Prepaid expenses Total current assets Property and equipment Property and equipment Less: Accumulated depreciation Net property and equipment TOTAL ASSETS Current liabilities Accounts payable Salaries payable Interest payable Total current liabilities 147,000 54,500 105,000 53,100 51,900 $329,900 92,500 $245,000 25,100 9,400 5,200 39,700 33,600 4,800 7,800 46,200 116,000 155,700 107,000 153,200 Loan payable Total liabilities Shareholders' equity Common shares Retained earnings Total shareholders' equity TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY 21,000 153,200 174,200 $329,900 1,500 90,300 91,800 $245,000 BRIDGEPORT'S CUSTOM CLOTHING INCOME STATEMENT For the Years Ended December 31 2020 2019 Sales revenue 924,000 749,000 Cost of sales 636,000 529,000 Gross margin 288,000 220,000 Expenses Salary expense 106,000 88,000 Interest expense 4,900 2,100 Other expenses 8,200 6,200 Depreciation expense 29,000 31,800 Total expenses 148,100 128,100 Operating income 139,900 91,900 Loss on disposal of equipment 7,600 1,000 Income tax expense 34,975 18,100 Net income 97,325 72,800 Following is additional information concerning BCC's transactions during the year ended December 31, 2020: Equipment costing $34,000 was purchased by paying $24,000 cash and issuing 400 common shares. Equipment costing $76,000 that was purchased at the beginning of 2019 was sold at the end of 2020 for $38,000. Straight- line depreciation had been used with an expected asset life of 5 years and a residual value $0. The "other expenses relate to prepaid items. In order to supplement its cash, BCC increased its bank loan by $9,000. Cash dividends of $34,425 were paid at the end of the fiscal year. Cost of sales includes $176,000 of direct labour costs. O Prepare a statement of cash flows for BCC for the year ended December 31, 2020, using the direct method. CCC follows ASPE. Include any note disclosure on non-cash financing and investing transactions. (Show amounts that decrease cash flow with either a - sign e.g.-15,000 or in parenthesis e.g. (15,000).) Bridgeport's Custom Clothing Statement of Cash Flows $ > Non-cash investing and financing activities $