Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bridgewood Company produces two products: Standard espresso machines and Deluxe espresso machines. Bridgewood uses a Product Costing system. Bridgewood uses a Normal Costing System

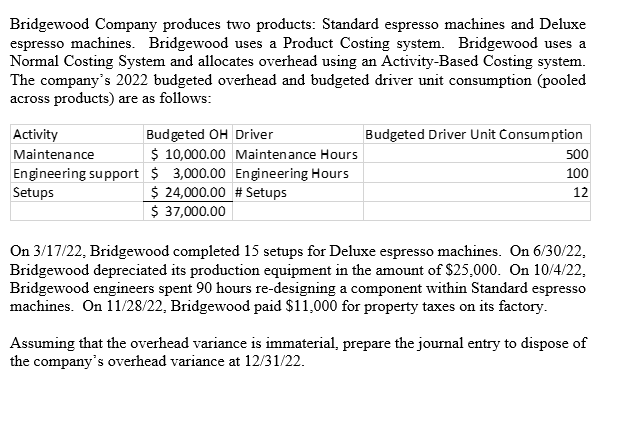

Bridgewood Company produces two products: Standard espresso machines and Deluxe espresso machines. Bridgewood uses a Product Costing system. Bridgewood uses a Normal Costing System and allocates overhead using an Activity-Based Costing system. The company's 2022 budgeted overhead and budgeted driver unit consumption (pooled across products) are as follows: Activity Maintenance Budgeted OH Driver $ 10,000.00 Maintenance Hours Engineering support $ 3,000.00 Engineering Hours Setups $ 24,000.00 #Setups $ 37,000.00 Budgeted Driver Unit Consumption 500 100 12 On 3/17/22, Bridgewood completed 15 setups for Deluxe espresso machines. On 6/30/22, Bridgewood depreciated its production equipment in the amount of $25,000. On 10/4/22, Bridgewood engineers spent 90 hours re-designing a component within Standard espresso machines. On 11/28/22, Bridgewood paid $11,000 for property taxes on its factory. Assuming that the overhead variance is immaterial, prepare the journal entry to dispose of the company's overhead variance at 12/31/22.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started