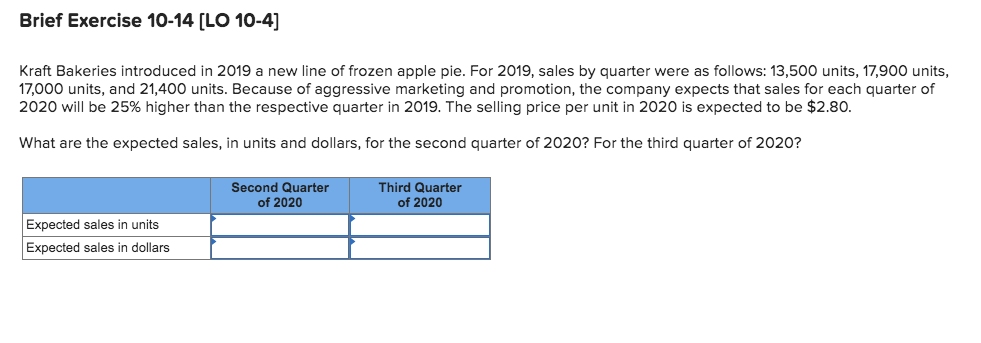

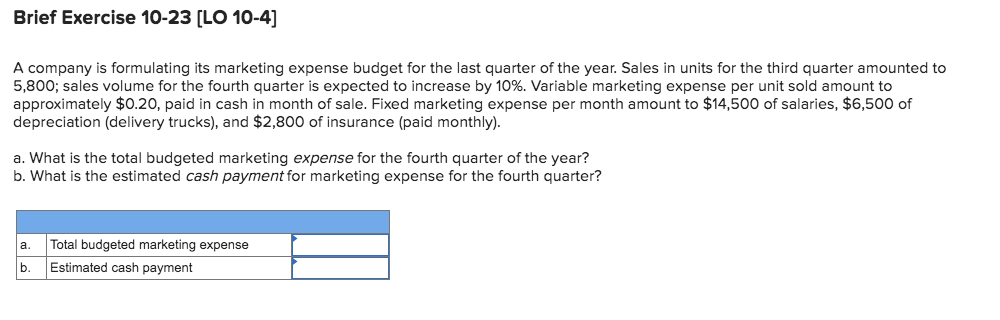

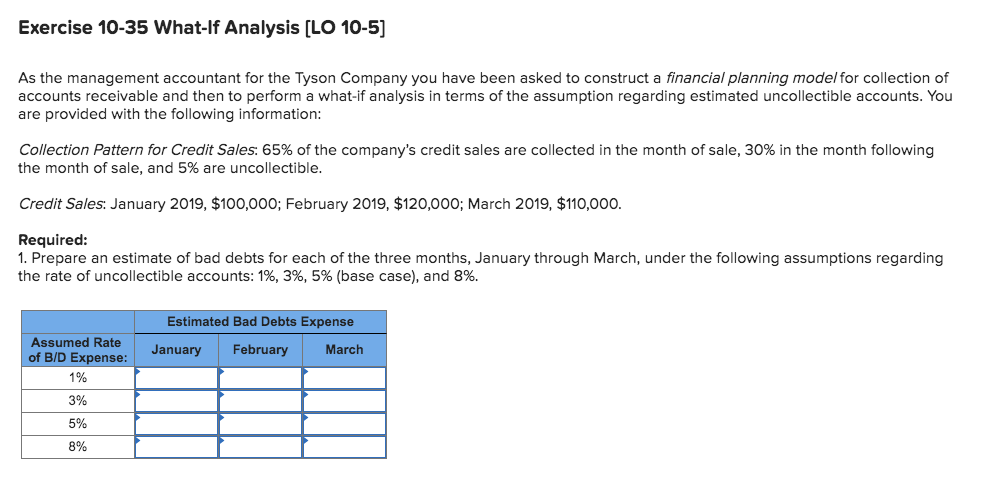

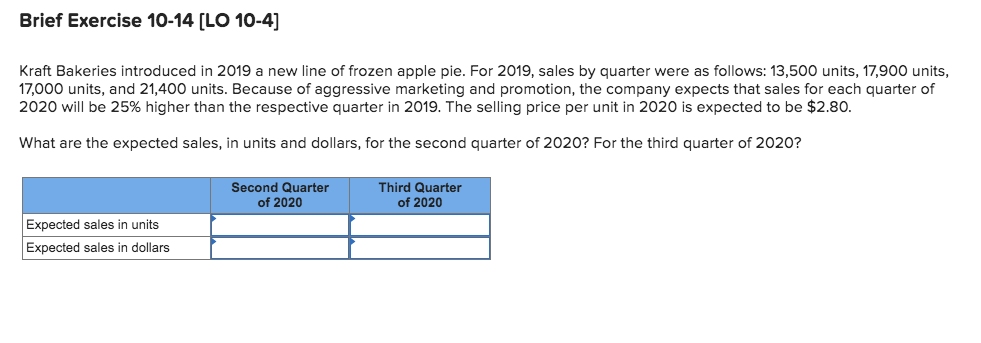

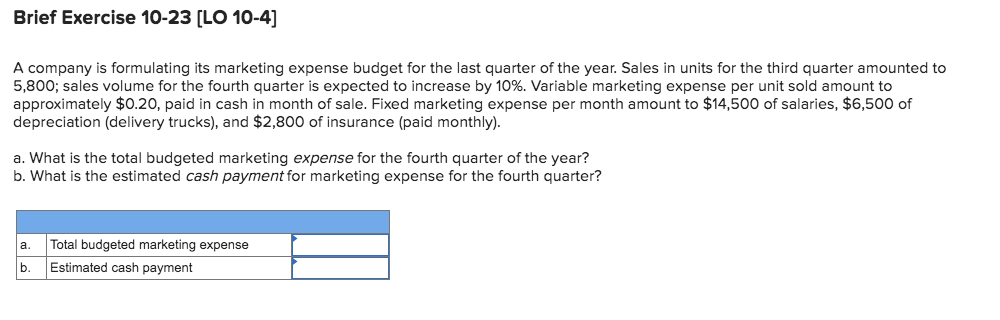

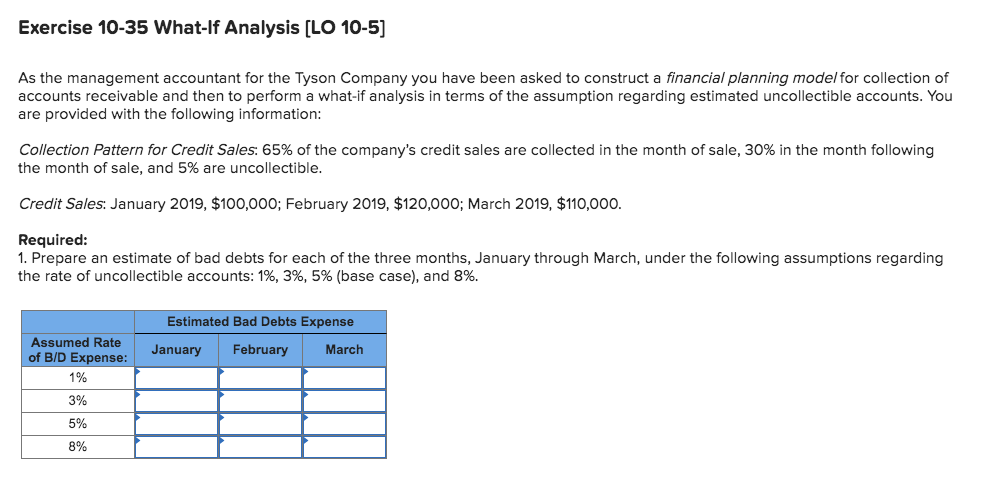

Brief Exercise 10-14 [LO 10-4] Kraft Bakeries introduced in 2019 a new line of frozen apple pie. For 2019, sales by quarter were as follows: 13,500 units, 17,900 units, 17,000 units, and 21,400 units. Because of aggressive marketing and promotion, the company expects that sales for each quarter of 2020 will be 25% higher than the respective quarter in 2019. The selling price per unit in 2020 is expected to be $2.80. What are the expected sales, in units and dollars, for the second quarter of 2020? For the third quarter of 2020? Second Quarter of 2020 Third Quarter of 2020 Expected sales in units Expected sales in dollars Brief Exercise 10-23 [LO 10-4] A company is formulating its marketing expense budget for the last quarter of the year. Sales in units for the third quarter amounted to 5,800; sales volume for the fourth quarter is expected to increase by 10%. Variable marketing expense per unit sold amount to approximately $0.20, paid in cash in month of sale. Fixed marketing expense per month amount to $14,500 of salaries, $6,500 of depreciation (delivery trucks), and $2,800 of insurance (paid monthly). a. What is the total budgeted marketing expense for the fourth quarter of the year? b. What is the estimated cash payment for marketing expense for the fourth quarter? a. Total budgeted marketing expense Estimated cash payment b. Exercise 10-35 What If Analysis (LO 10-5] As the management accountant for the Tyson Company you have been asked to construct a financial planning model for collection of accounts receivable and then to perform a what-if analysis in terms of the assumption regarding estimated uncollectible accounts. You are provided with the following information: Collection Pattern for Credit Sales: 65% of the company's credit sales are collected in the month of sale, 30% in the month following the month of sale, and 5% are uncollectible. Credit Sales: January 2019, $100,000; February 2019, $120,000; March 2019, $110,000. Required: 1. Prepare an estimate of bad debts for each of the three months, January through March, under the following assumptions regarding the rate of uncollectible accounts: 1%, 3%, 5% (base case), and 8%. Estimated Bad Debts Expense January February March Assumed Rate of B/D Expense: 1% 3% 5%