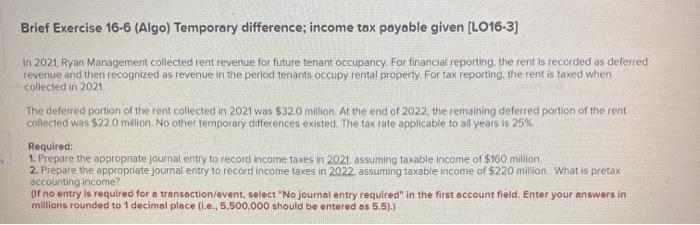

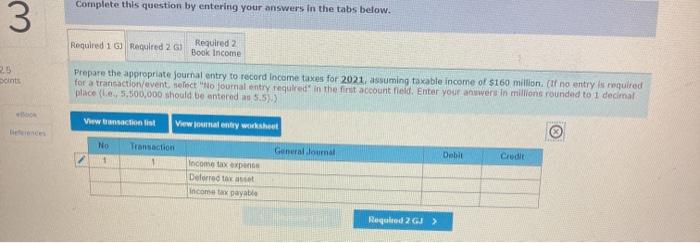

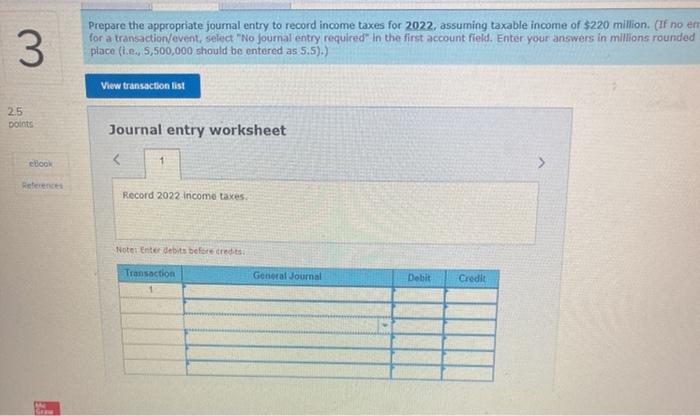

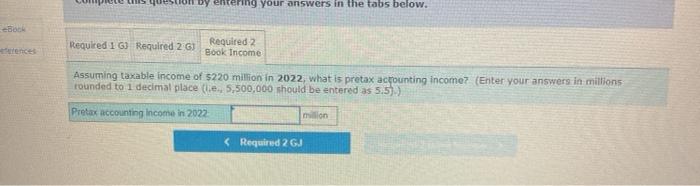

Brief Exercise 16-6 (Algo) Temporary difference; income tax payable given (LO16-3) In 2021, Ryan Management collected rent revenue for future tenant occupancy. For financial reporting, the rent is recorded as deferred reverse and then recognized as revenue in the period tenants occupy rental property. For tax reporting, the rent is taxed when collected in 2021 The deferred portion of the rent collected in 2021 was $320 million. At the end of 2022, the remaining deferred portion of the rent collected was $220 milion. No other temporary differences existed. The tax rate applicable to all years is 25% Required: 1. Prepare the appropriate journal entry to record income taxes in 2021, assuming taxable income of $160 million 2. Prepare the appropriate journal entry to record income taxes in 2022 assuming taxable income of $220 million What is pretax accounting income? (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (ie., 5,500,000 should be entered as 5,5). Complete this question by entering your answers in the tabs below. 3 Required 1 6 Required 2G) Required 2 Book Income soints Prepare the appropriate Journal entry to record Income taxes for 2021, assuming taxable income of $160 millionar no entry is required for a transaction/event. Helect "No journal entry required in the first account feld. Enter your answers in millions rounded to 1 decimal place le 5.500,000 should be entered a 5.5)) View transaction list View ournal entry worksheet NO 1 Transaction 1 General Journal Debit Credit Income tax expen Deferred taxat Income tax payable Required 2GJ > 3 Prepare the appropriate journal entry to record income taxes for 2022, assuming taxable income of $220 million. (If no en for a transaction/event, select "No journal entry required in the first account field. Enter your answers in millions rounded place (ie, 5,500,000 should be entered as 5.5).) View transaction list 2.5 points Journal entry worksheet con 1 Reference Record 2022 income taxes Noter Enter debits before credits Transaction General Journal Dobit Credit ering your answers in the tabs below. Required 1 G Required 2G Required 2 Book Income Assuming taxable income of 5220 million in 2022, what is pretax acrounting income? (Enter your answers in millions rounded to 1 decimal place e, 5,500,000 should be entered as 5.5)) Pretax accounting income in 2022 million