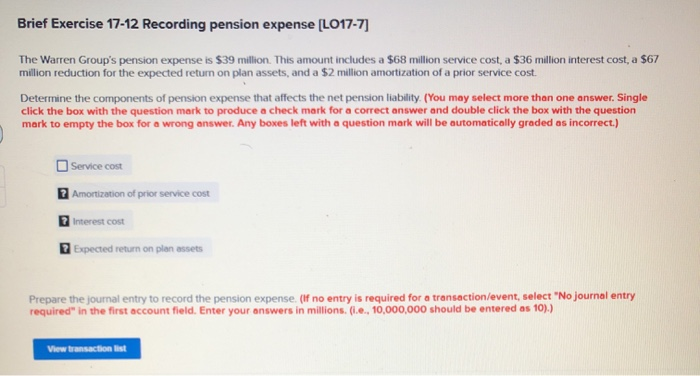

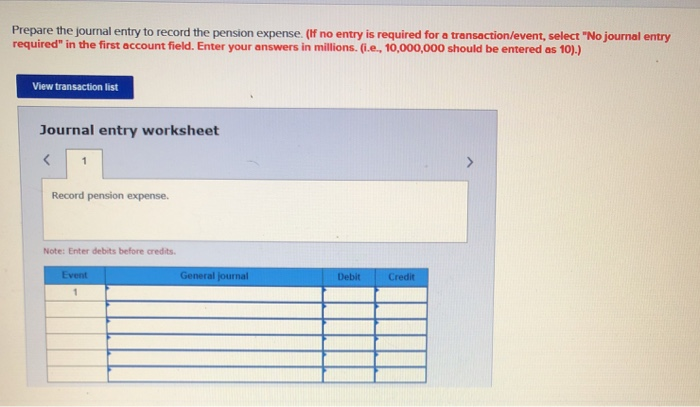

Brief Exercise 17-12 Recording pension expense (L017-7] The Warren Group's pension expense is $39 million. This amount includes a $68 million service cost, a $36 million interest cost, a $67 million reduction for the expected return on plan assets, and a $2 million amortization of a prior service cost. Determine the components of pension expense that affects the net pension liability. (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) Service cost 2 Amortization of prior service cost Interest cost Expected return on plan assets Prepare the journal entry to record the pension expense. (If no entry is required for a transaction/event, select "No journal entry required in the first account field. Enter your answers in millions (ie., 10,000,000 should be entered as 10).) View transaction list Prepare the journal entry to record the pension expense. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions. (i.e., 10,000,000 should be entered as 10).) View transaction list Journal entry worksheet Record pension expense. Note: Enter debits before credits General journal Debit Credit Brief Exercise 17-12 Recording pension expense (L017-7] The Warren Group's pension expense is $39 million. This amount includes a $68 million service cost, a $36 million interest cost, a $67 million reduction for the expected return on plan assets, and a $2 million amortization of a prior service cost. Determine the components of pension expense that affects the net pension liability. (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) Service cost 2 Amortization of prior service cost Interest cost Expected return on plan assets Prepare the journal entry to record the pension expense. (If no entry is required for a transaction/event, select "No journal entry required in the first account field. Enter your answers in millions (ie., 10,000,000 should be entered as 10).) View transaction list Prepare the journal entry to record the pension expense. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions. (i.e., 10,000,000 should be entered as 10).) View transaction list Journal entry worksheet Record pension expense. Note: Enter debits before credits General journal Debit Credit