Answered step by step

Verified Expert Solution

Question

1 Approved Answer

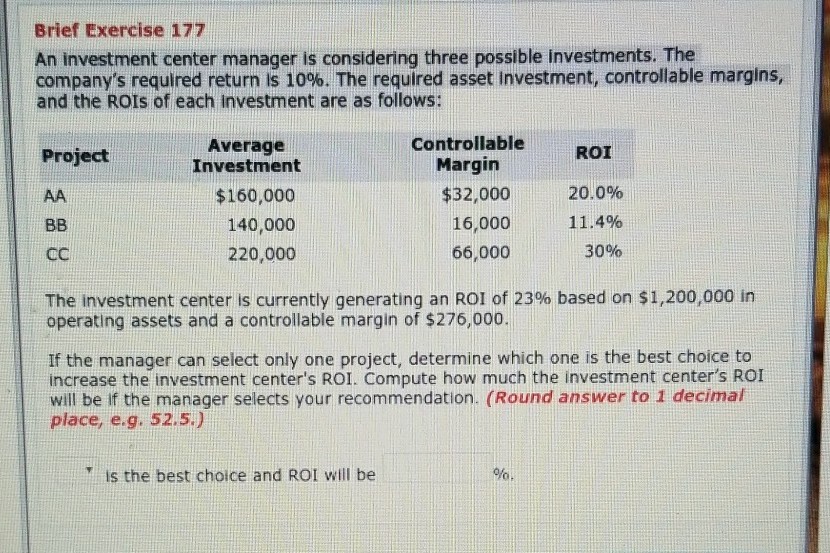

Brief Exercise 177 An investment center manager is considering three possible investments. The company's required return is 10%. The required asset investment, controllable margins, and

Brief Exercise 177 An investment center manager is considering three possible investments. The company's required return is 10%. The required asset investment, controllable margins, and the ROTs of each investment are as follows: Average Controllable Ro Project Margin Investment $160,000 140,000 220,000 $32,000 16,000 66,000 20.0% 11.4% 30% The investment center is currently generating an ROI of 23% based on $1,200,000 in operating assets and a controllable margin of $276,000. If the manager can select only one project, determine which one is the best choice to increase the investment center's ROI. Compute how much the investment center's ROI will be if the manager selects your recommendation. (Round answer to 1 decimal place, e.g. 52.5.) is the best choice and ROI will be 9%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started