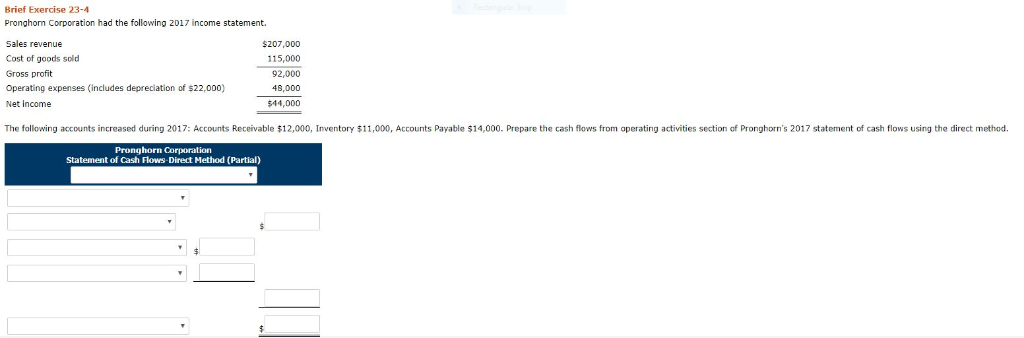

|  | | Brief Exercise 23-4 Pronghorn Corporation had the following 2017 income statement. | Sales revenue | | $207,000 | | Cost of goods sold | | 115,000 | | Gross profit | | 92,000 | | Operating expenses (includes depreciation of $22,000) | | 48,000 | | Net income | | $44,000 | The following accounts increased during 2017: Accounts Receivable $12,000, Inventory $11,000, Accounts Payable $14,000. Prepare the cash flows from operating activities section of Pronghorns 2017 statement of cash flows using the direct method. | Pronghorn Corporation Statement of Cash Flows-Direct Method (Partial)  December 31, 2017For the Year Ended December 31, 2017For the Quarter Ended December 31, 2017 December 31, 2017For the Year Ended December 31, 2017For the Quarter Ended December 31, 2017

| |  Cash at Beginning of PeriodCash at End of PeriodCash Flows from Financing ActivitiesCash Flows from Investing ActivitiesCash Flows from Operating ActivitiesNet Cash Provided by Financing ActivitiesNet Cash Provided by Investing ActivitiesNet Cash Provided by Operating ActivitiesNet Cash Used by Financing ActivitiesNet Cash Used by Investing ActivitiesNet Cash Used by Operating ActivitiesNet Decrease in CashNet Increase in Cash Cash at Beginning of PeriodCash at End of PeriodCash Flows from Financing ActivitiesCash Flows from Investing ActivitiesCash Flows from Operating ActivitiesNet Cash Provided by Financing ActivitiesNet Cash Provided by Investing ActivitiesNet Cash Provided by Operating ActivitiesNet Cash Used by Financing ActivitiesNet Cash Used by Investing ActivitiesNet Cash Used by Operating ActivitiesNet Decrease in CashNet Increase in Cash

| | | |  Depreciation ExpenseCash Received from CustomersCash Payment to SuppliersCash Payment for Operating ExpensesDecrease in InventoryNet IncomeIncrease in Accounts PayableDecrease in Accounts ReceivableIncrease in Accounts ReceivableIncrease in InventoryDecrease in Accounts Payable Depreciation ExpenseCash Received from CustomersCash Payment to SuppliersCash Payment for Operating ExpensesDecrease in InventoryNet IncomeIncrease in Accounts PayableDecrease in Accounts ReceivableIncrease in Accounts ReceivableIncrease in InventoryDecrease in Accounts Payable

| | $

| |  Cash Received from Customers Increase in Inventory Cash Payment to Suppliers Increase in Accounts Receivable Cash Payment for Operating Expenses Decrease in Accounts Payable Depreciation expense Decrease in Accounts Receivable Decrease in Inventory Net Income Increase in Accounts Payable Cash Received from Customers Increase in Inventory Cash Payment to Suppliers Increase in Accounts Receivable Cash Payment for Operating Expenses Decrease in Accounts Payable Depreciation expense Decrease in Accounts Receivable Decrease in Inventory Net Income Increase in Accounts Payable

| $

| | |  Decrease in Inventory Cash Received from Customers Cash Payment to Suppliers Cash Payment for Operating Expenses Decrease in Accounts Receivable Decrease in Accounts Payable Depreciation expense Increase in Inventory Net Income Increase in Accounts Receivable Increase in Accounts Payable Decrease in Inventory Cash Received from Customers Cash Payment to Suppliers Cash Payment for Operating Expenses Decrease in Accounts Receivable Decrease in Accounts Payable Depreciation expense Increase in Inventory Net Income Increase in Accounts Receivable Increase in Accounts Payable

|

| | | | |

| |  Cash at Beginning of PeriodCash at End of PeriodCash Flows from Financing ActivitiesCash Flows from Investing ActivitiesCash Flows from Operating ActivitiesNet Cash Provided by Financing ActivitiesNet Cash Provided by Investing ActivitiesNet Cash Provided by Operating ActivitiesNet Cash Used by Financing ActivitiesNet Cash Used by Investing ActivitiesNet Cash Used by Operating ActivitiesNet Decrease in CashNet Increase in Cash Cash at Beginning of PeriodCash at End of PeriodCash Flows from Financing ActivitiesCash Flows from Investing ActivitiesCash Flows from Operating ActivitiesNet Cash Provided by Financing ActivitiesNet Cash Provided by Investing ActivitiesNet Cash Provided by Operating ActivitiesNet Cash Used by Financing ActivitiesNet Cash Used by Investing ActivitiesNet Cash Used by Operating ActivitiesNet Decrease in CashNet Increase in Cash

| | $

| | | | |

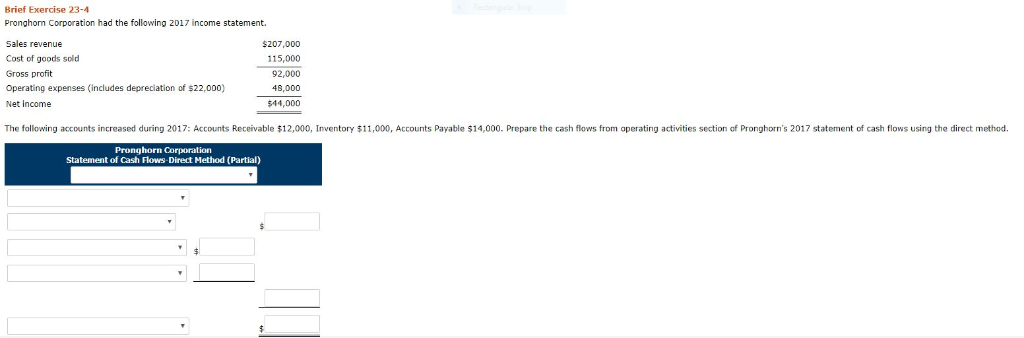

Brief Exercise 23-4 Pronghom Corporation had the following 2017 income statement. Sales revenue Cost of goods sold Gross profit Operating expenses (includes depreciation of $22,000) Net Income $207,000 115,000 92,000 43,000 $14,000 The following accounts increased during 2017: Accounts Receivable $12,000, Inventory $11,000, Accounts Payable $14,000. Prepare the cash flows from operating activities section of Pronghorn's 2017 statement of cash flows using the direct method. Pronghorn Corporation Statement of Cash Flows Direct Method (Partial)

December 31, 2017For the Year Ended December 31, 2017For the Quarter Ended December 31, 2017

December 31, 2017For the Year Ended December 31, 2017For the Quarter Ended December 31, 2017 Cash at Beginning of PeriodCash at End of PeriodCash Flows from Financing ActivitiesCash Flows from Investing ActivitiesCash Flows from Operating ActivitiesNet Cash Provided by Financing ActivitiesNet Cash Provided by Investing ActivitiesNet Cash Provided by Operating ActivitiesNet Cash Used by Financing ActivitiesNet Cash Used by Investing ActivitiesNet Cash Used by Operating ActivitiesNet Decrease in CashNet Increase in Cash

Cash at Beginning of PeriodCash at End of PeriodCash Flows from Financing ActivitiesCash Flows from Investing ActivitiesCash Flows from Operating ActivitiesNet Cash Provided by Financing ActivitiesNet Cash Provided by Investing ActivitiesNet Cash Provided by Operating ActivitiesNet Cash Used by Financing ActivitiesNet Cash Used by Investing ActivitiesNet Cash Used by Operating ActivitiesNet Decrease in CashNet Increase in Cash Depreciation ExpenseCash Received from CustomersCash Payment to SuppliersCash Payment for Operating ExpensesDecrease in InventoryNet IncomeIncrease in Accounts PayableDecrease in Accounts ReceivableIncrease in Accounts ReceivableIncrease in InventoryDecrease in Accounts Payable

Depreciation ExpenseCash Received from CustomersCash Payment to SuppliersCash Payment for Operating ExpensesDecrease in InventoryNet IncomeIncrease in Accounts PayableDecrease in Accounts ReceivableIncrease in Accounts ReceivableIncrease in InventoryDecrease in Accounts Payable

Cash Received from Customers Increase in Inventory Cash Payment to Suppliers Increase in Accounts Receivable Cash Payment for Operating Expenses Decrease in Accounts Payable Depreciation expense Decrease in Accounts Receivable Decrease in Inventory Net Income Increase in Accounts Payable

Cash Received from Customers Increase in Inventory Cash Payment to Suppliers Increase in Accounts Receivable Cash Payment for Operating Expenses Decrease in Accounts Payable Depreciation expense Decrease in Accounts Receivable Decrease in Inventory Net Income Increase in Accounts Payable

Decrease in Inventory Cash Received from Customers Cash Payment to Suppliers Cash Payment for Operating Expenses Decrease in Accounts Receivable Decrease in Accounts Payable Depreciation expense Increase in Inventory Net Income Increase in Accounts Receivable Increase in Accounts Payable

Decrease in Inventory Cash Received from Customers Cash Payment to Suppliers Cash Payment for Operating Expenses Decrease in Accounts Receivable Decrease in Accounts Payable Depreciation expense Increase in Inventory Net Income Increase in Accounts Receivable Increase in Accounts Payable

Cash at Beginning of PeriodCash at End of PeriodCash Flows from Financing ActivitiesCash Flows from Investing ActivitiesCash Flows from Operating ActivitiesNet Cash Provided by Financing ActivitiesNet Cash Provided by Investing ActivitiesNet Cash Provided by Operating ActivitiesNet Cash Used by Financing ActivitiesNet Cash Used by Investing ActivitiesNet Cash Used by Operating ActivitiesNet Decrease in CashNet Increase in Cash

Cash at Beginning of PeriodCash at End of PeriodCash Flows from Financing ActivitiesCash Flows from Investing ActivitiesCash Flows from Operating ActivitiesNet Cash Provided by Financing ActivitiesNet Cash Provided by Investing ActivitiesNet Cash Provided by Operating ActivitiesNet Cash Used by Financing ActivitiesNet Cash Used by Investing ActivitiesNet Cash Used by Operating ActivitiesNet Decrease in CashNet Increase in Cash