Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BRIEF EXERCISE 3 . 2 Record the following selected transactions in general journal form for Sun Orthopedic Clinic Limited. Include a brief explanation of the

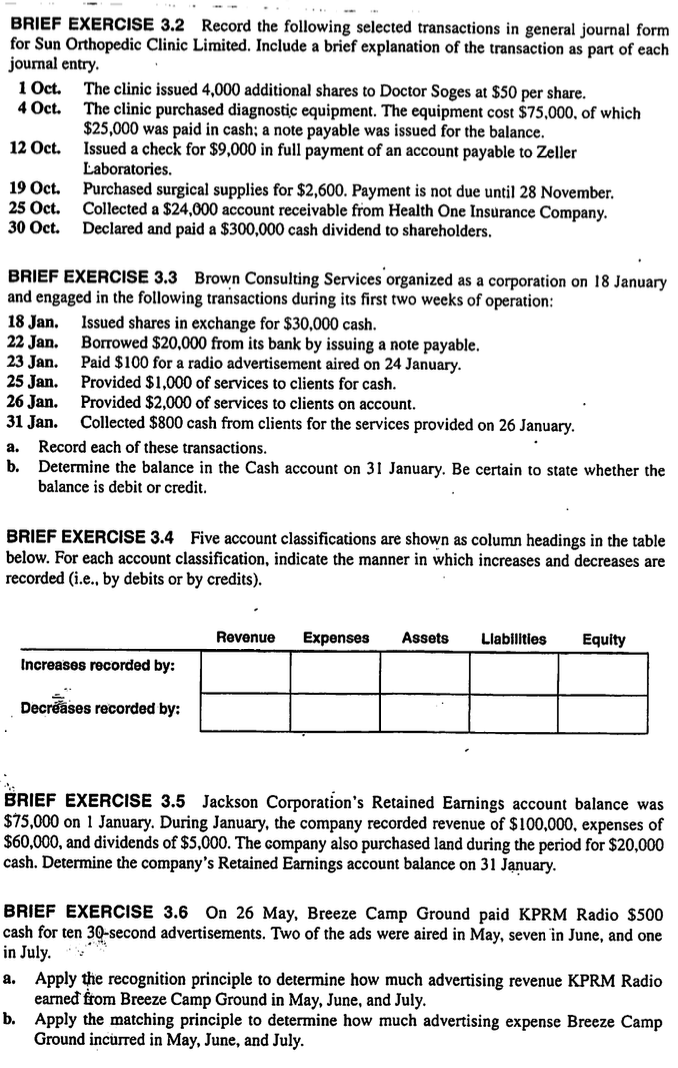

BRIEF EXERCISE Record the following selected transactions in general journal form

for Sun Orthopedic Clinic Limited. Include a brief explanation of the transaction as part of each

journal entry.

Oct. The clinic issued additional shares to Doctor Soges at $ per share.

Oct. The clinic purchased diagnostic equipment. The equipment cost $ of which

$ was paid in cash; a note payable was issued for the balance.

Oct. Issued a check for $ in full payment of an account payable to Zeller

Laboratories.

Oct. Purchased surgical supplies for $ Payment is not due until November.

Oct. Collected a $ account receivable from Health One Insurance Company.

Oct. Declared and paid a $ cash dividend to shareholders.

BRIEF EXERCISE Brown Consulting Services organized as a corporation on January

and engaged in the following transactions during its first two weeks of operation:

Jan. Issued shares in exchange for $ cash.

Jan. Borrowed $ from its bank by issuing a note payable.

Jan. Paid $ for a radio advertisement aired on January.

Jan. Provided $ of services to clients for cash.

Jan. Provided $ of services to clients on account.

Jan. Collected $ cash from clients for the services provided on January.

a Record each of these transactions.

b Determine the balance in the Cash account on January. Be certain to state whether the

balance is debit or credit.

BRIEF EXERCISE Five account classifications are shown as column headings in the table

below. For each account classification, indicate the manner in which increases and decreases are

recorded ie by debits or by credits

BRIEF EXERCISE Jackson Corporation's Retained Earnings account balance was

$ on January. During January, the company recorded revenue of $ expenses of

$ and dividends of $ The company also purchased land during the period for $

cash. Determine the company's Retained Earnings account balance on Jnuary

BRIEF EXERCISE On May, Breeze Camp Ground paid KPRM Radio $

cash for ten second advertisements. Two of the ads were aired in May, seven in June, and one

in July.

a Apply the recognition principle to determine how much advertising revenue KPRM Radio

earned from Breeze Camp Ground in May, June, and July.

b Apply the matching principle to determine how much advertising expense Breeze Camp

Ground incurred in May, June, and July.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started