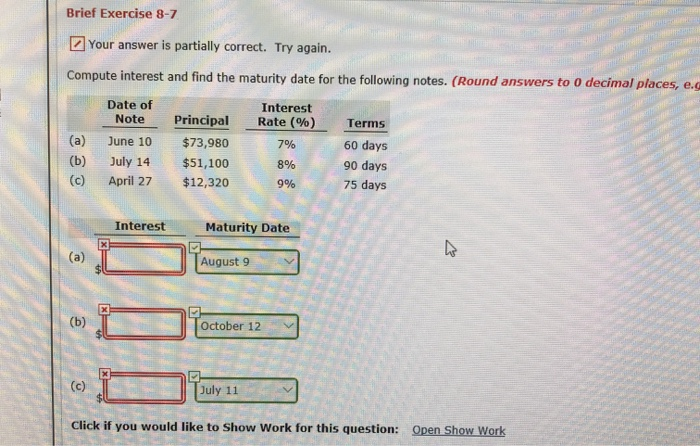

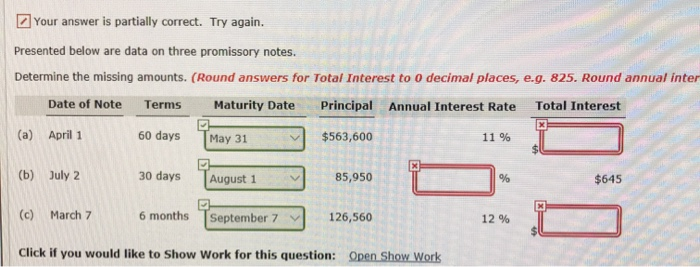

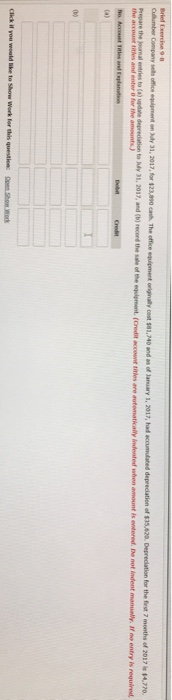

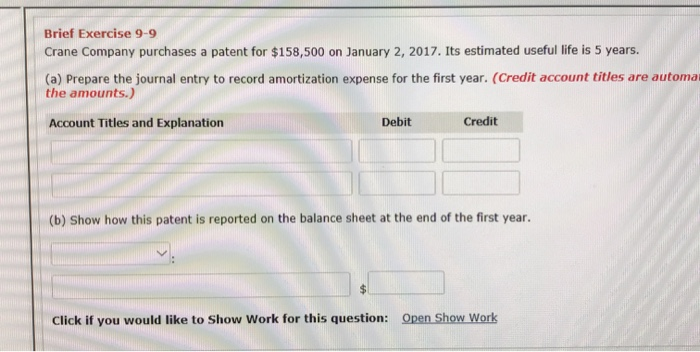

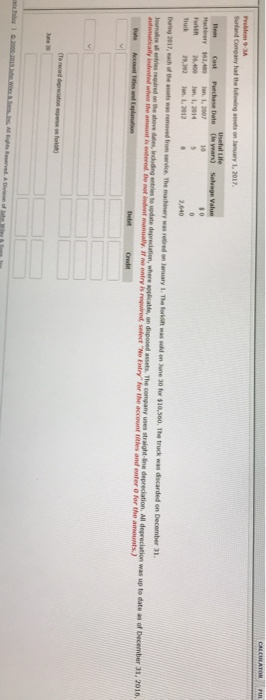

Brief Exercise 8-7 Your ans wer is partially correct. Try again. Compute interest and find the maturity date for the following notes. (Round answers to 0 decimal places, e.c Date of Interest Rate (%) Note Principal Terms (a) June 10 $73,980 7% 60 days (b) July 14 $51,100 8% 90 days (c) April 27 $12,320 75 days 9% Interest Maturity Date (a) August 9 (b) October 12 (c) July 11 Click if you would like to Show Work for this question: Open Show Work swer is partially correct. Try again. Presented below are data on three promissory notes. Determine the missing amounts. (Round answers for Total Interest to 0 decimal places, e.g. 825. Round annual inter Date of Note Terms Maturity Date Principal Annual Interest Rate Total Interest (a) April 1 60 days $563,600 11 % May 31 (b) July 2 30 days 85,950 % August 1 $645 6 months September 7 (c) March 7 126,560 12 % Click if you would like to Show Work for this question: Open Show Work Brief Esercise 9- Cullumber Company sels office equipment on July 31, 2017, for $23,890 cash The office equipment originally cost s01,240 and as of January 1, 2017, had accumulahed depreciation of $35,620. Depreciation for the first 7 months of 2017 is $4,770. Prepare the joumal entries to (a) update deprediation to Jly 31, 2017, and (b) record the sale of the equipment. (Credit account titles are automatically indented when amount is entered. De not indent manually, If no entry is required, the accoust ttles and enter for the amounts) No. Accoset Titles and Explanation Debt Credit (a) 00 Click if you would like to Show Work for this question Open how Brief Exercise 9-9 Crane Company purchases a patent for $158,500 on January 2, 2017. Its estimated useful life is 5 years. (a) Prepare the journal entry to record amortization expense for the first year. (Credit account titles are automai the amounts.) Credit Debit Account Titles and Explanation (b) Show how this patent is reported on the balance sheet at the end of the first year. Open Show Work Click if you would like to Show Work for this question: CALCULATON FUE Problem 9-3A Sunland Company had the followling assets on January 1, 2017 Useful Life Perchase Date ( years) tem Cost Selvage Value 10 Machinery 62,40 Forkit Jan. 1, 2007 26,400 Jan. 1, 2014 Truck 29,392 Jan. 1, 201 2,640 During 2017, each of the assets was removed from service. The machinery was retired on January 1. The forkit was sold on June 30 for $10,500. The truck was discarded on December 31. Journare all entries required on the above dates, including entries to update deprediation, where applicable, on disposed assets. The company uses straight-ine depreciation. All depreciation was up to date as of December 31, 2016. automatcally indented when the amnt is entered De ot indent menually. If no entry is required select "No Entry" for the acceunt titles and enter o for the amounts.) Date Account Tales and Esplanation Debit Credt (Te ecard deprecation pee on fori Jne 30 ohlo192000 2013 he S Ins Rights RvedAD of