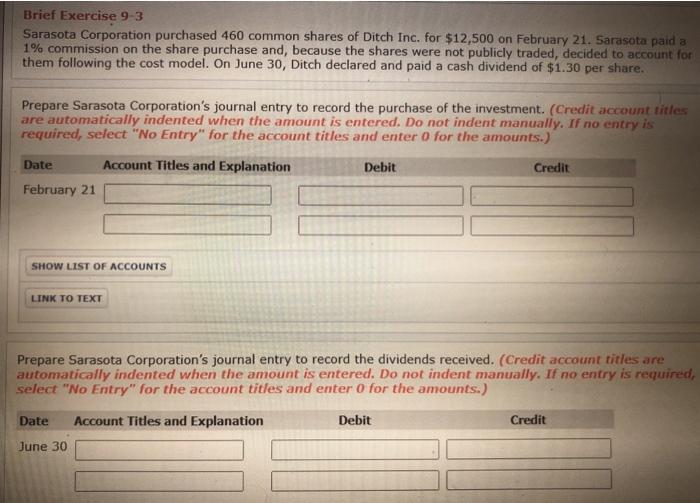

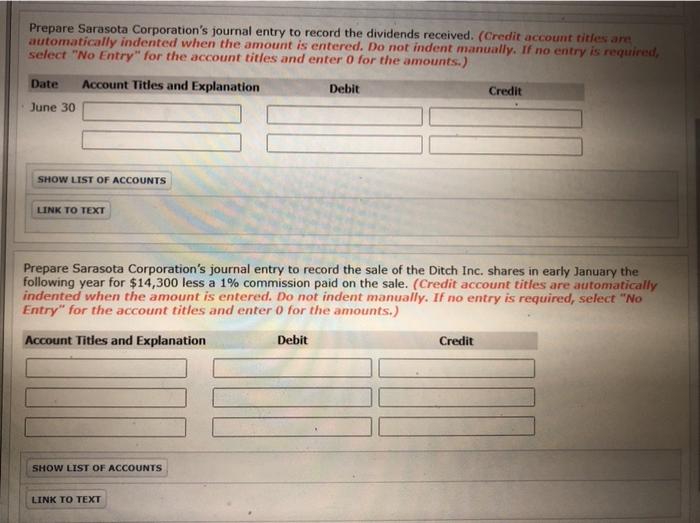

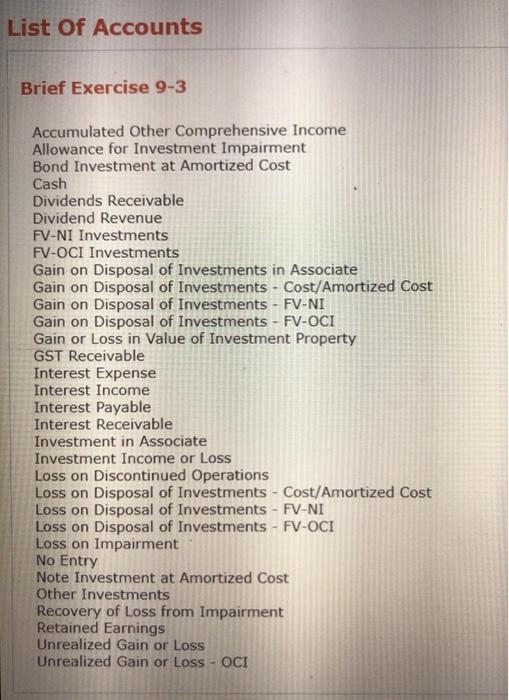

Brief Exercise 9-3 Sarasota Corporation purchased 460 common shares of Ditch Inc. for $12,500 on February 21. Sarasota paid a 1% commission on the share purchase and, because the shares were not publicly traded, decided to account for them following the cost model. On June 30, Ditch declared and paid a cash dividend of $1.30 per share. Prepare Sarasota Corporation's journal entry to record the purchase of the investment. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Debit Credit Date Account Titles and Explanation February 21 SHOW LIST OF ACCOUNTS LINK TO TEXT Prepare Sarasota Corporation's journal entry to record the dividends received. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit June 30 Prepare Sarasota Corporation's journal entry to record the dividends received. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit June 30 SHOW LIST OF ACCOUNTS LINK TO TEXT Prepare Sarasota Corporation's journal entry to record the sale of the Ditch Inc. shares in early January the following year for $14,300 less a 1% commission paid on the sale. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit SHOW LIST OF ACCOUNTS LINK TO TEXT List Of Accounts Brief Exercise 9-3 Accumulated Other Comprehensive Income Allowance for Investment Impairment Bond Investment at Amortized Cost Cash Dividends Receivable Dividend Revenue FV-NI Investments FV-OCI Investments Gain on Disposal of Investments in Associate Gain on Disposal of Investments - Cost/Amortized Cost Gain on Disposal of Investments - FV-NI Gain on Disposal of Investments - FV-OCI Gain or Loss in Value of Investment Property GST Receivable Interest Expense Interest Income Interest Payable Interest Receivable Investment in Associate Investment Income or Loss Loss on Discontinued Operations Loss on Disposal of Investments - Cost/Amortized Cost Loss on Disposal of Investments - FV-NI Loss on Disposal of Investments - FV-OCI Loss on Impairment No Entry Note Investment at Amortized Cost Other Investments Recovery of Loss from Impairment Retained Earnings Unrealized Gain or Loss Unrealized Gain or Loss - OCI