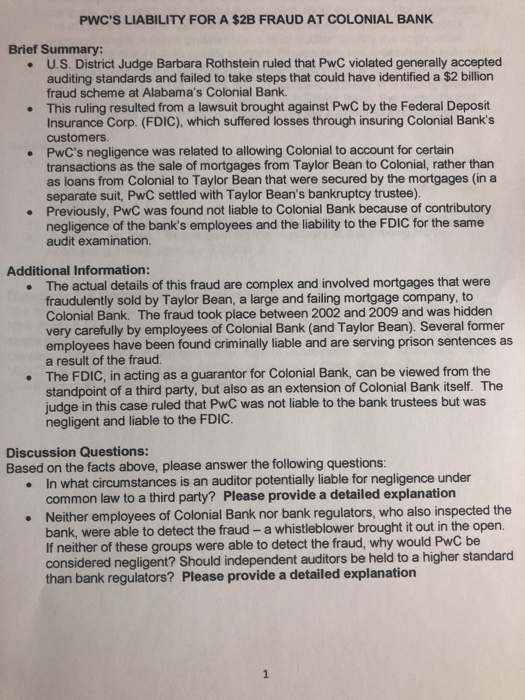

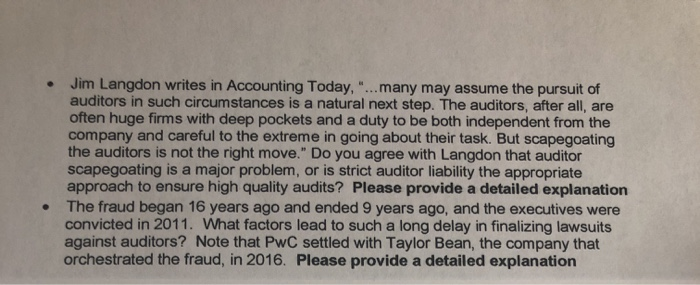

Brief Summary: U.S. District Judge Barbara Rothstein ruled that PwC violated generally accepted auditing standards and failed to take steps that could have identified a $2 billion fraud scheme at Alabama's Colonial Bank This ruling resulted from a lawsuit brought against PwC by the Federal Deposit Insurance Corp. (FDIC), which suffered losses through insuring Colonial Bank's customers. PwC's negligence was related to allowing Colonial to account for certain transactions as the sale of mortgages from Taylor Bean to Colonial, rather than as loans from Colonial to Taylor Bean that were secured by the mortgages (in a separate suit, PwC settled with Taylor Bean's bankruptcy trustee). Previously, PwC was found not liable to Colonial Bank because of contributory negligence of the bank's employees and the liability to the FDIC for the same audit examination. The actual details of this fraud are complex and involved mortgages that were fraudulently sold by Taylor Bean, a large and failing mortgage company, to Colonial Bank. The fraud took place between 2002 and 2009 and was hidden very carefully by employees of Colonial Bank (and Taylor Bean). Several former employees have been found criminally liable and are serving prison sentences as a result of the fraud. The FDIC, in acting as a guarantor for Colonial Bank, can be viewed from the standpoint of a third party, but also as an extension of Colonial Bank itself. The judge in this case ruled that PwC was not liable to the bank trustees but was negligent and liable to the FDIC. Discussion Questions: Based on the facts above, please answer the following questions: In what circumstances is an auditor potentially liable for negligence under common law to a third party? Please provide a detailed explanation Neither employees of Colonial Bank nor bank regulators, who also inspected the bank, were able to detect the fraud - a whistleblower brought it out in the open. If neither of these groups were able to detect the fraud, why would PwC be considered negligent? Should independent auditors be held to a higher standard than bank regulators? Please provide a detailed explanation Jim Langdon writes in Accounting Today, "...many may assume the pursuit of auditors in such circumstances is a natural next step. The auditors, after all, are company and careful to the extreme in going about their task. But scapegoating the auditors is not the right move." Do you agree with Langdon that auditor approach to ensure high quality audits? Please provide a detailed explanation The fraud began 16 years ago and ended 9 years ago, and the executives were convicted in 2011. What factors lead to such a long delay in finalizing lawsuits against auditors? Note that PwC settled with Taylor Bean, the company that orchestrated the fraud, in 2016. Please provide a detailed explanation