Question

Briefly, indicate the tax or legal issue presented by each of the following situations and the advice you might give to the following taxpayers (each

Briefly, indicate the tax or legal issue presented by each of the following situations and the advice you might give to the following taxpayers (each situation is independent):

(a) Marvin is part of a group that is forming a corporation. Each of the 5 investors in the corporation is contributing $200,000 in value for a 20 percent interest. Marvin has equipment that the corporation could sell for $200,000 (Marvin's basis is $250,000). He's planning to contribute the equipment in exchange for his stock.

(b) Mr. Lerner owns 50% of the stock of Nats Corporation, which operates a temporary employment business. Late last year, Mr. Lerner was short of cash in his personal checking account. Consequently, he paid several personal bills by writing checks on the corporate account and recorded the payments as miscellaneous expenses. Three months later he repaid the corporation in full.

(c) Martin is forming a C corporation that will own an antique car themed restaurant. He intends to decorate the restaurant with his extensive antique car collection. To form the corporation, he plans to contribute seed capital of $500,000 and his antique car collection, purchased five years ago (FMV $1,000,000; adjusted basis $100,000). (Note: Martin informs you that the antique car market is very hot and is expected to remain that way for many years). Hence, he expects the car displays to attract numerous customers.)

(d) Mr. and Mrs. Jetson own 100 percent of the stock in Jetson Inc., a small bookstore, which recently hired the couple's nephew at a $75,000 annual salary. The nephew, age 20, has been in several scrapes with the law and needs financial help, and the Jetson family agreed that a low-stress job with the family business is just what he needs for a year or two. The nephew will be responsible for restocking books that have been removed from the shelves by customers and were not purchased.

(e) Dr. P is a physician with his own medical practice. For the past several years, his marginal income tax rate has been 37 percent. Dr. P's daughter, who is a college student, has no taxable income. During the last two months of the year, Dr. P instructs some of his patients to remit their payments for his services directly to his daughter, who includes the income on her tax return.

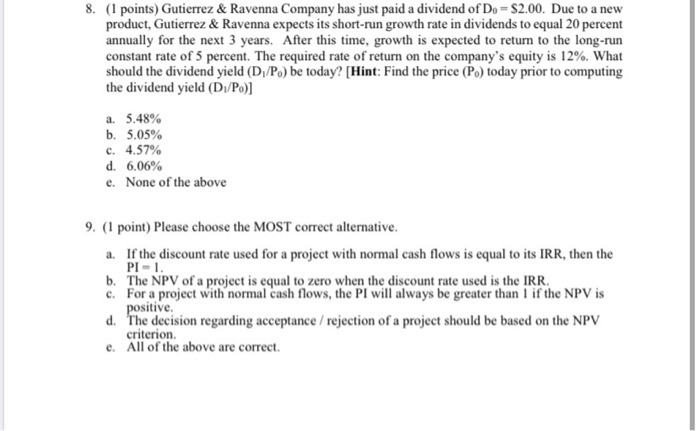

8. (1 points) Gutierrez & Ravenna Company has just paid a dividend of Do= $2.00. Due to a new product, Gutierrez & Ravenna expects its short-run growth rate in dividends to equal 20 percent annually for the next 3 years. After this time, growth is expected to return to the long-run constant rate of 5 percent. The required rate of return on the company's equity is 12%. What should the dividend yield (D/Po) be today? [Hint: Find the price (Po) today prior to computing the dividend yield (D/Po)] a. 5.48% b. 5.05% c. 4.57% d. 6.06% e. None of the above 9. (1 point) Please choose the MOST correct alternative. a. If the discount rate used for a project with normal cash flows is equal to its IRR, then the PI=1. b. The NPV of a project is equal to zero when the discount rate used is the IRR. c. For a project with normal cash flows, the PI will always be greater than 1 if the NPV is positive. d. The decision regarding acceptance / rejection of a project should be based on the NPV criterion. e. All of the above are correct.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are my responses a Tax issue Marvin will recognize a taxable gain on the contribution of the eq...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started