Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Briefly list 3 4 risks that you perceive to Best Bargains growth plans, and therefore risks to the hoped-for equity return (they hope for 20%)

- Briefly list 3 4 risks that you perceive to Best Bargains growth plans, and therefore risks to the hoped-for equity return (they hope for 20%) for Bob and Randy.

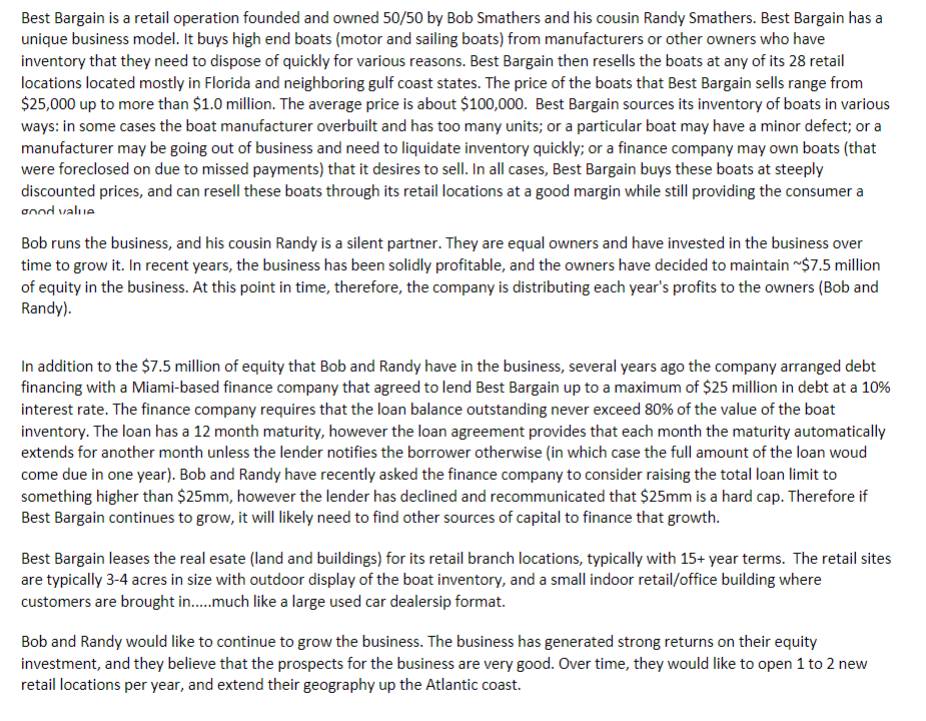

Best Bargain is a retail operation founded and owned 50/50 by Bob Smathers and his cousin Randy Smathers. Best Bargain has a unique business model. It buys high end boats (motor and sailing boats) from manufacturers or other owners who have inventory that they need to dispose of quickly for various reasons. Best Bargain then resells the boats at any of its 28 retail locations located mostly in Florida and neighboring gulf coast states. The price of the boats that Best Bargain sells range from $25,000 up to more than $1.0 million. The average price is about $100,000. Best Bargain sources its inventory of boats in various ways: in some cases the boat manufacturer overbuilt and has too many units; or a particular boat may have a minor defect; or a manufacturer may be going out of business and need to liquidate inventory quickly; or a finance company may own boats (that were foreclosed on due to missed payments) that it desires to sell. In all cases, Best Bargain buys these boats at steeply discounted prices, and can resell these boats through its retail locations at a good margin while still providing the consumer a annd wal Bob runs the business, and his cousin Randy is a silent partner. They are equal owners and have invested in the business over time to grow it. In recent years, the business has been solidly profitable, and the owners have decided to maintain $7.5 million of equity in the business. At this point in time, therefore, the company is distributing each year's profits to the owners (Bob and Randy). In addition to the $7.5 million of equity that Bob and Randy have in the business, several years ago the company arranged debt financing with a Miami-based finance company that agreed to lend Best Bargain up to a maximum of $25 million in debt at a 10% interest rate. The finance company requires that the loan balance outstanding never exceed 80% of the value of the boat inventory. The loan has a 12 month maturity, however the loan agreement provides that each month the maturity automatically extends for another month unless the lender notifies the borrower otherwise (in which case the full amount of the loan woud come due in one year). Bob and Randy have recently asked the finance company to consider raising the total loan limit to something higher than $25mm, however the lender has declined and recommunicated that $25mm is a hard cap. Therefore if Best Bargain continues to grow, it will likely need to find other sources of capital to finance that growth. Best Bargain leases the real esate (land and buildings) for its retail branch locations, typically with 15+ year terms. The retail sites are typically 3-4 acres in size with outdoor display of the boat inventory, and a small indoor retail/office building where customers are brought in.....much like a large used car dealersip format. Bob and Randy would like to continue to grow the business. The business has generated strong returns on their equity investment, and they believe that the prospects for the business are very good. Over time, they would like to open 1 to 2 new retail locations per year, and extend their geography up the Atlantic coast. Best Bargain is a retail operation founded and owned 50/50 by Bob Smathers and his cousin Randy Smathers. Best Bargain has a unique business model. It buys high end boats (motor and sailing boats) from manufacturers or other owners who have inventory that they need to dispose of quickly for various reasons. Best Bargain then resells the boats at any of its 28 retail locations located mostly in Florida and neighboring gulf coast states. The price of the boats that Best Bargain sells range from $25,000 up to more than $1.0 million. The average price is about $100,000. Best Bargain sources its inventory of boats in various ways: in some cases the boat manufacturer overbuilt and has too many units; or a particular boat may have a minor defect; or a manufacturer may be going out of business and need to liquidate inventory quickly; or a finance company may own boats (that were foreclosed on due to missed payments) that it desires to sell. In all cases, Best Bargain buys these boats at steeply discounted prices, and can resell these boats through its retail locations at a good margin while still providing the consumer a annd wal Bob runs the business, and his cousin Randy is a silent partner. They are equal owners and have invested in the business over time to grow it. In recent years, the business has been solidly profitable, and the owners have decided to maintain $7.5 million of equity in the business. At this point in time, therefore, the company is distributing each year's profits to the owners (Bob and Randy). In addition to the $7.5 million of equity that Bob and Randy have in the business, several years ago the company arranged debt financing with a Miami-based finance company that agreed to lend Best Bargain up to a maximum of $25 million in debt at a 10% interest rate. The finance company requires that the loan balance outstanding never exceed 80% of the value of the boat inventory. The loan has a 12 month maturity, however the loan agreement provides that each month the maturity automatically extends for another month unless the lender notifies the borrower otherwise (in which case the full amount of the loan woud come due in one year). Bob and Randy have recently asked the finance company to consider raising the total loan limit to something higher than $25mm, however the lender has declined and recommunicated that $25mm is a hard cap. Therefore if Best Bargain continues to grow, it will likely need to find other sources of capital to finance that growth. Best Bargain leases the real esate (land and buildings) for its retail branch locations, typically with 15+ year terms. The retail sites are typically 3-4 acres in size with outdoor display of the boat inventory, and a small indoor retail/office building where customers are brought in.....much like a large used car dealersip format. Bob and Randy would like to continue to grow the business. The business has generated strong returns on their equity investment, and they believe that the prospects for the business are very good. Over time, they would like to open 1 to 2 new retail locations per year, and extend their geography up the Atlantic coast

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started