Answered step by step

Verified Expert Solution

Question

1 Approved Answer

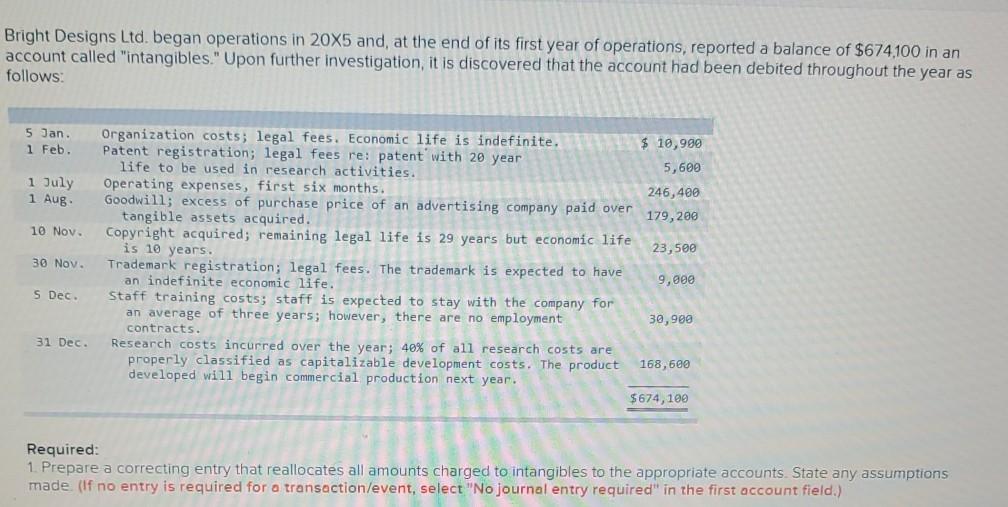

Bright Designs Ltd. began operations in 20X5 and, at the end of its first year of operations, reported a balance of $674,100 in an account

Bright Designs Ltd. began operations in 20X5 and, at the end of its first year of operations, reported a balance of $674,100 in an account called "intangibles." Upon further investigation, it is discovered that the account had been debited throughout the year as follows: 5 Jan. 1 Feb 1 July 1 Aug 10 Nov 30 Nov. Organization costs; legal fees. Economic life is indefinite. $ 10,990 Patent registration; legal fees re: patent with 20 year life to be used in research activities. 5,600 Operating expenses, first six months. 246,400 Goodwill; excess of purchase price of an advertising company paid over tangible assets acquired. 179,200 Copyright acquired; remaining legal life is 29 years but economic life 23,500 is 10 years. registration; legal fees. The trademark is expected to have an indefinite economic life. 9,eee Staff training costs; staff is expected to stay with the company for an average of three years; however, there are no employment 30,900 contracts. Research costs incurred over the year; 40% of all research costs are properly classified as capitalizable development costs. The product 168,600 developed will begin commercial production next year. $674,100 Trademark S Dec. 31 Dec. Required: 1. Prepare a correcting entry that reallocates all amounts charged to intangibles to the appropriate accounts. State any assumptions made. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet 1 Record the entry that reallocates all amounts charged to intangibles. Note: Enter debits before credits. Transaction General Journal Debit Credit 1 2. Calculate amortization expense on intangible assets for 20X5. Straight-line amortization, to the exact month of purchase, is used. All residual values are expected to be zero. (Round your answers to the nearest whole dollars.) 20X5 Amortization expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started