Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bright Horizons Skilled Nursing Facility, an investor-owned company constructed a new building to replace its outdated facility. The new building was completed on January 1,

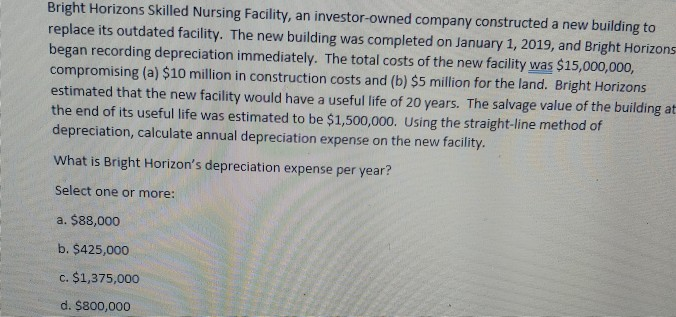

Bright Horizons Skilled Nursing Facility, an investor-owned company constructed a new building to replace its outdated facility. The new building was completed on January 1, 2019, and Bright Horizons began recording depreciation immediately. The total costs of the new facility was $15,000,000, compromising (a) $10 million in construction costs and (b) $5 million for the land. Bright Horizons estimated that the new facility would have a useful life of 20 years. The salvage value of the building at the end of its useful life was estimated to be $1,500,000. Using the straight-line method of depreciation, calculate annual depreciation expense on the new facility. What is Bright Horizon's depreciation expense per year? Select one or more: a. $88,000 b. $425,000 c. $1,375,000 d. $800,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started