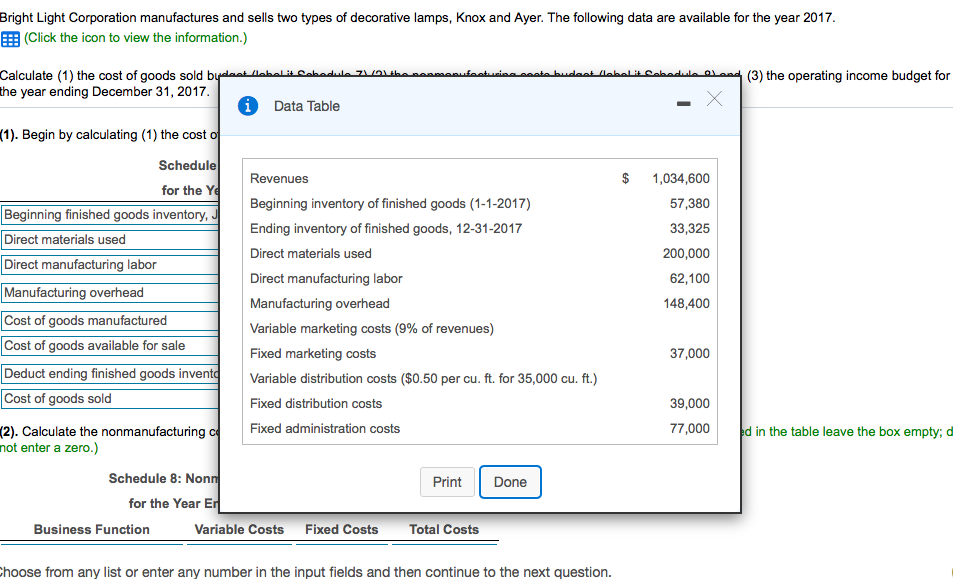

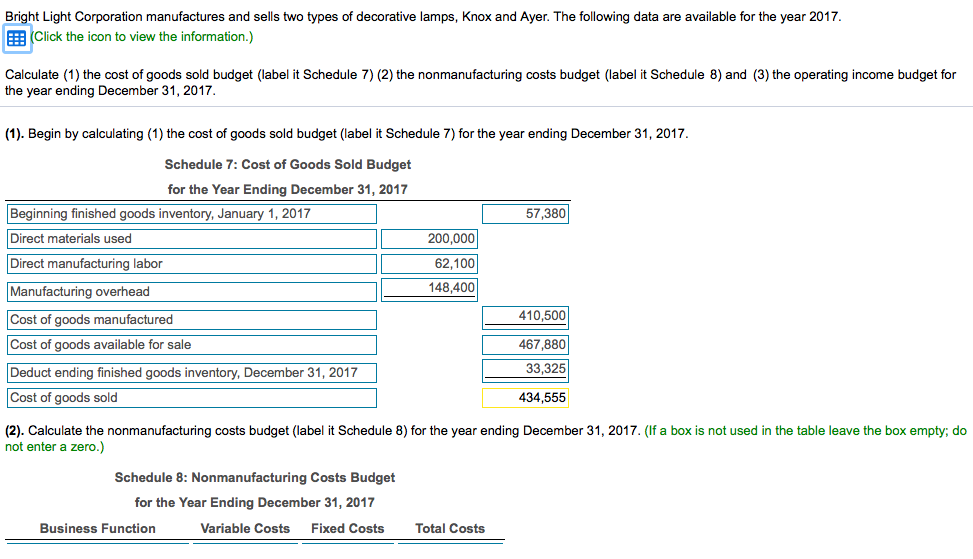

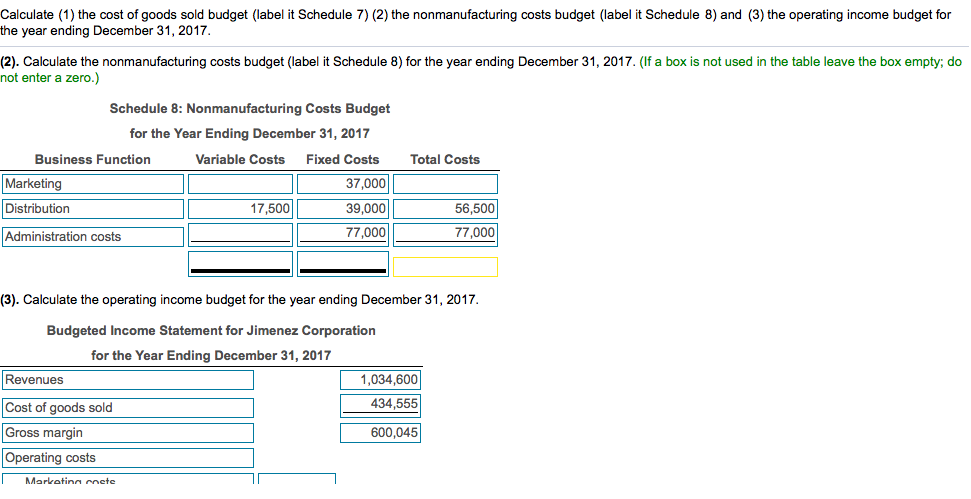

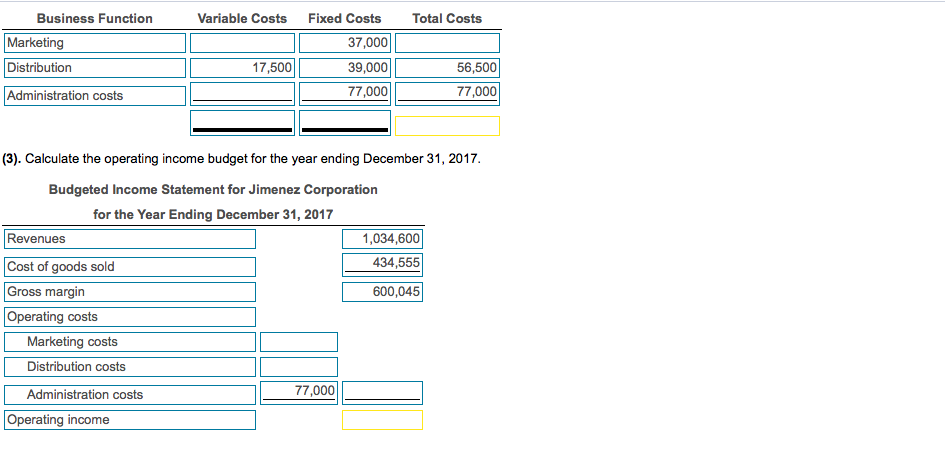

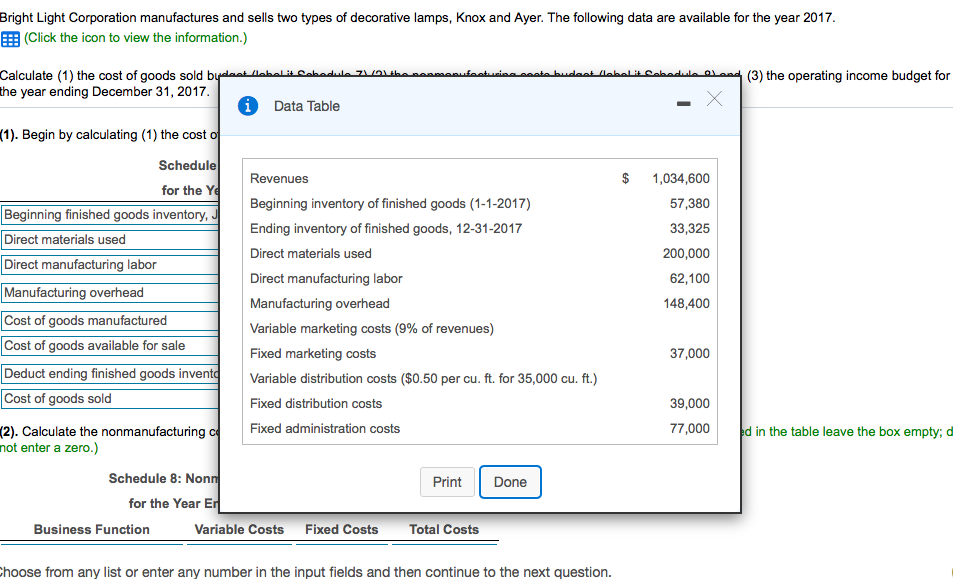

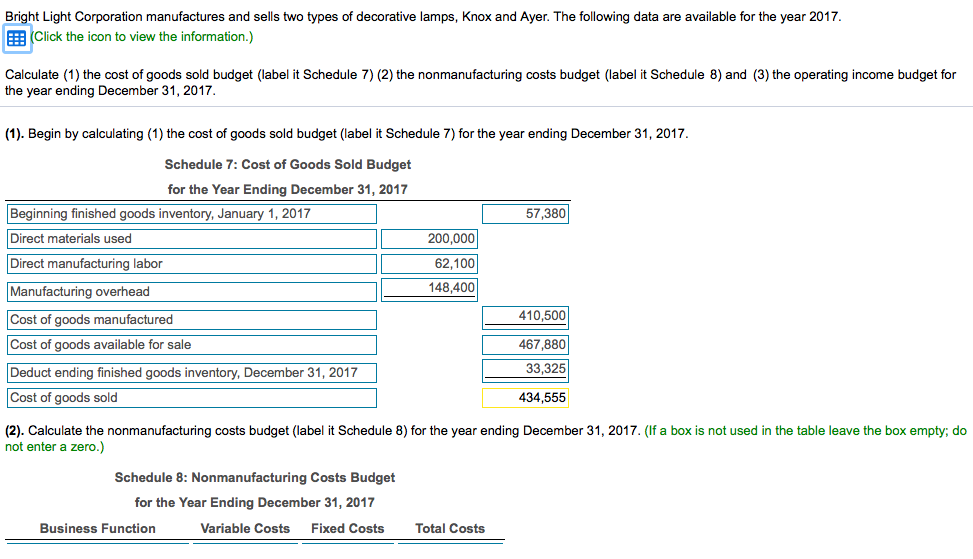

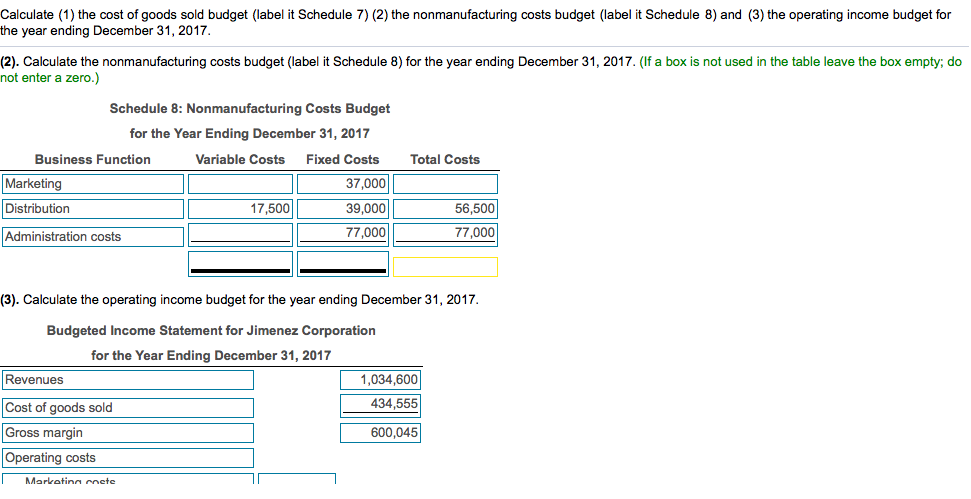

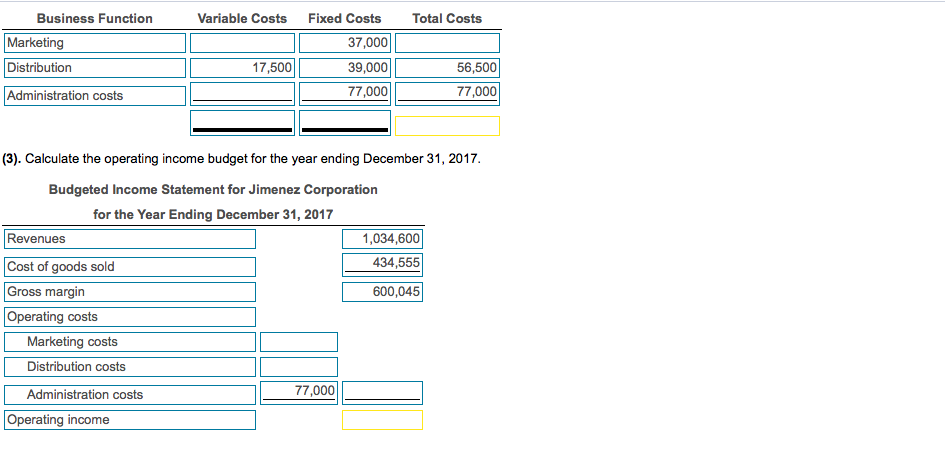

Bright Light Corporation manufactures and sells two types of decorative lamps, Knox and Ayer. The following data are available for the year 2017. (Click the icon to view the information.) Calculate (1) the cost of goods sold bydlent llabolit Robedule without costs budaat diabolit Cobedula Bland (3) the operating income budget for the year ending December 31, 2017. i Data Table X (1). Begin by calculating (1) the cost o Schedule Revenues $ 1,034,600 for the Yd 57,380 Beginning finished goods inventory, Beginning inventory of finished goods (1-1-2017) Ending inventory of finished goods, 12-31-2017 33,325 Direct materials used Direct materials used 200,000 Direct manufacturing labor Direct manufacturing labor 62,100 Manufacturing overhead Manufacturing overhead 148,400 Cost of goods manufactured Variable marketing costs (9% of revenues) Cost of goods available for sale Fixed marketing costs 37,000 Deduct ending finished goods invento Variable distribution costs ($0.50 per cu. ft. for 35,000 cu. ft.) Cost of goods sold Fixed distribution costs 39,000 (2). Calculate the nonmanufacturing co Fixed administration costs 77,000 ed in the table leave the box empty; not enter a zero.) Schedule 8: Nonn Print Done for the Year Er Business Function Variable Costs Fixed Costs Total Costs Choose from any list or enter any number in the input fields and then continue to the next question. Bright Light Corporation manufactures and sells two types of decorative lamps, Knox and Ayer. The following data are available for the year 2017. Click the icon to view the information.) Calculate (1) the cost of goods sold budget (label it Schedule 7) (2) the nonmanufacturing costs budget (label it Schedule 8) and (3) the operating income budget for the year ending December 31, 2017. (1). Begin by calculating (1) the cost of goods sold budget (label it Schedule 7) for the year ending December 31, 2017. 57,380 200,000 62,100 Schedule 7: Cost of Goods Sold Budget for the Year Ending December 31, 2017 Beginning finished goods inventory, January 1, 2017 Direct materials used Direct manufacturing labor Manufacturing overhead Cost of goods manufactured Cost of goods available for sale Deduct ending finished goods inventory, December 31, 2017 Cost of goods sold 148,400 410,500 467,880 33,325 434,555 (2). Calculate the nonmanufacturing costs budget (label it Schedule 8) for the year ending December 31, 2017. (If a box is not used in the table leave the box empty; do not enter a zero.) Schedule 8: Nonmanufacturing Costs Budget for the Year Ending December 31, 2017 Business Function Variable Costs Fixed Costs Total Costs Calculate (1) the cost of goods sold budget (label it Schedule 7) (2) the nonmanufacturing costs budget (label it Schedule 8) and (3) the operating income budget for the year ending December 31, 2017 (2). Calculate the nonmanufacturing costs budget (label it Schedule 8) for the year ending December 31, 2017. (If a box is not used in the table leave the box empty; do not enter a zero.) Total Costs Schedule 8: Nonmanufacturing Costs Budget for the Year Ending December 31, 2017 Business Function Variable Costs Fixed Costs Marketing 37,000 Distribution 17,500 39,000 Administration costs 77,000 56,500 77,000 (3). Calculate the operating income budget for the year ending December 31, 2017 Budgeted Income Statement for Jimenez Corporation for the Year Ending December 31, 2017 Revenues 1,034,600 434,555 600,045 Cost of goods sold Gross margin Operating costs 1 Marketinn mete Variable Costs Total Costs Business Function Marketing Distribution Administration costs Fixed Costs 37,000 39,000 77,000 17,500 56,500 77,000 (3). Calculate the operating income budget for the year ending December 31, 2017 Budgeted Income Statement for Jimenez Corporation for the Year Ending December 31, 2017 Revenues 1,034,600 Cost of goods sold 434,555 Gross margin 600,045 Operating costs Marketing costs Distribution costs Administration costs 77,000 Operating income