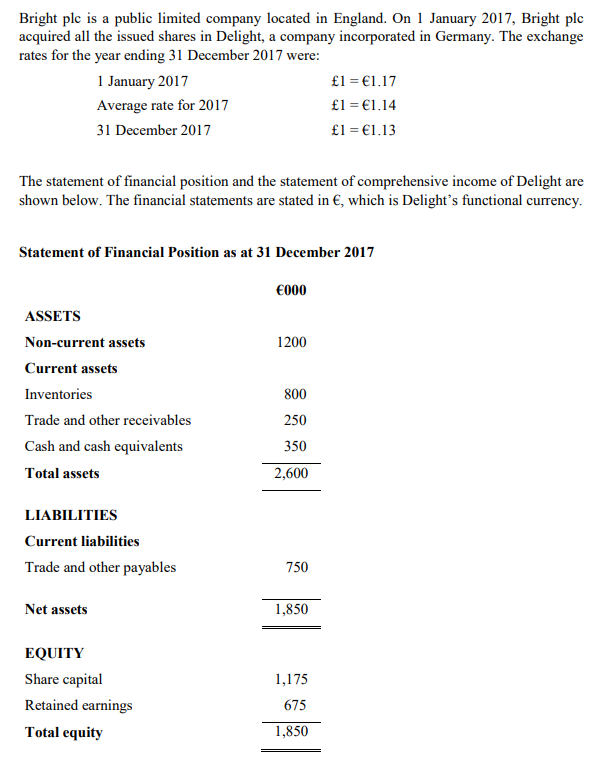

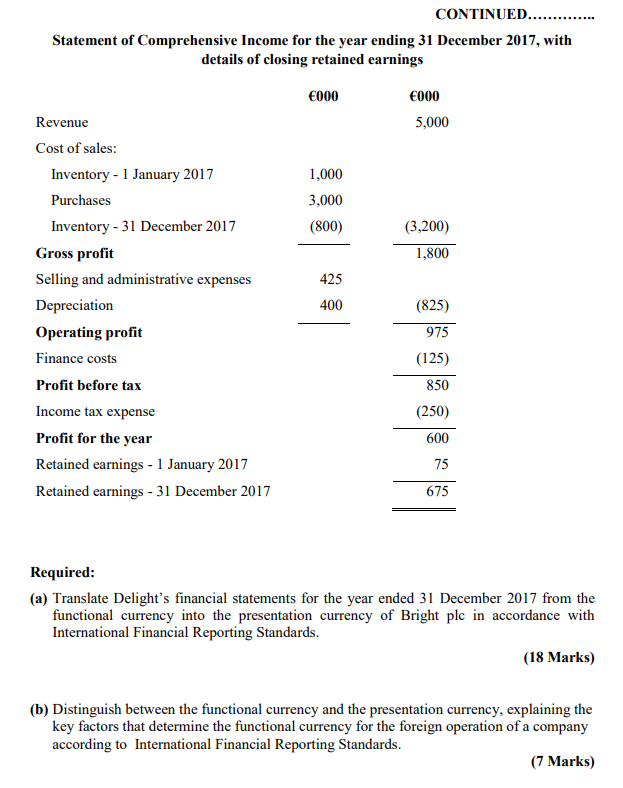

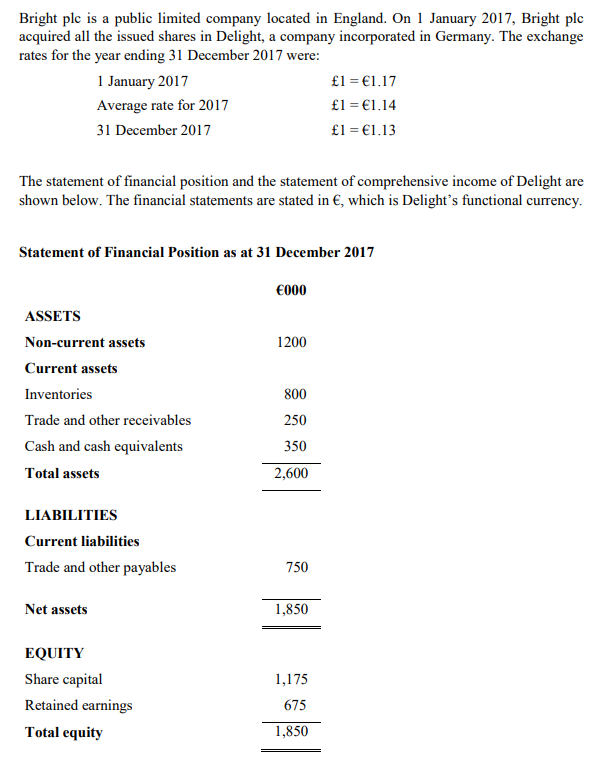

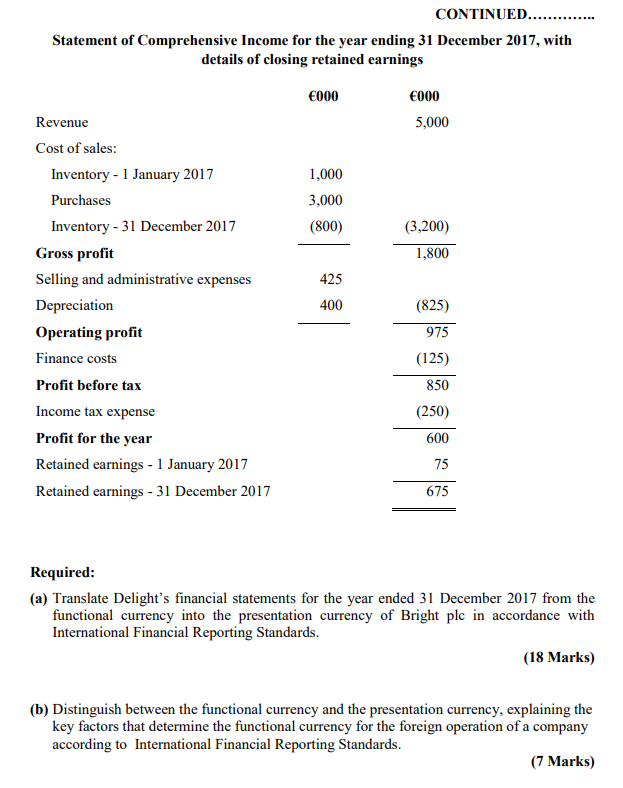

Bright plc is a public limited company located in England. On 1 January 2017, Bright plc acquired all the issued shares in Delight, a company incorporated in Germany. The exchange rates for the year ending 31 December 2017 were: 1 January 2017 1 = 1.17 Average rate for 2017 1 = 1.14 31 December 2017 1 = 1.13 The statement of financial position and the statement of comprehensive income of Delight are shown below. The financial statements are stated in , which is Delight's functional currency. Statement of Financial Position as at 31 December 2017 000 1200 ASSETS Non-current assets Current assets Inventories Trade and other receivables Cash and cash equivalents Total assets 800 250 350 2,600 LIABILITIES Current liabilities Trade and other payables 750 Net assets 1,850 1,175 EQUITY Share capital Retained earnings Total equity 675 1,850 CONTINUED...... Statement of Comprehensive Income for the year ending 31 December 2017, with details of closing retained earnings 000 000 5,000 1,000 3,000 (800) (3,200) 1,800 425 Revenue Cost of sales: Inventory - 1 January 2017 Purchases Inventory - 31 December 2017 Gross profit Selling and administrative expenses Depreciation Operating profit Finance costs Profit before tax Income tax expense Profit for the year Retained earnings - 1 January 2017 Retained earnings - 31 December 2017 400 (825) 975 (125) 850 (250) 600 75 675 Required: (a) Translate Delight's financial statements for the year ended 31 December 2017 from the functional currency into the presentation currency of Bright plc in accordance with International Financial Reporting Standards. (18 Marks) (b) Distinguish between the functional currency and the presentation currency, explaining the key factors that determine the functional currency for the foreign operation of a company according to International Financial Reporting Standards. (7 Marks) Bright plc is a public limited company located in England. On 1 January 2017, Bright plc acquired all the issued shares in Delight, a company incorporated in Germany. The exchange rates for the year ending 31 December 2017 were: 1 January 2017 1 = 1.17 Average rate for 2017 1 = 1.14 31 December 2017 1 = 1.13 The statement of financial position and the statement of comprehensive income of Delight are shown below. The financial statements are stated in , which is Delight's functional currency. Statement of Financial Position as at 31 December 2017 000 1200 ASSETS Non-current assets Current assets Inventories Trade and other receivables Cash and cash equivalents Total assets 800 250 350 2,600 LIABILITIES Current liabilities Trade and other payables 750 Net assets 1,850 1,175 EQUITY Share capital Retained earnings Total equity 675 1,850 CONTINUED...... Statement of Comprehensive Income for the year ending 31 December 2017, with details of closing retained earnings 000 000 5,000 1,000 3,000 (800) (3,200) 1,800 425 Revenue Cost of sales: Inventory - 1 January 2017 Purchases Inventory - 31 December 2017 Gross profit Selling and administrative expenses Depreciation Operating profit Finance costs Profit before tax Income tax expense Profit for the year Retained earnings - 1 January 2017 Retained earnings - 31 December 2017 400 (825) 975 (125) 850 (250) 600 75 675 Required: (a) Translate Delight's financial statements for the year ended 31 December 2017 from the functional currency into the presentation currency of Bright plc in accordance with International Financial Reporting Standards. (18 Marks) (b) Distinguish between the functional currency and the presentation currency, explaining the key factors that determine the functional currency for the foreign operation of a company according to International Financial Reporting Standards. (7 Marks)