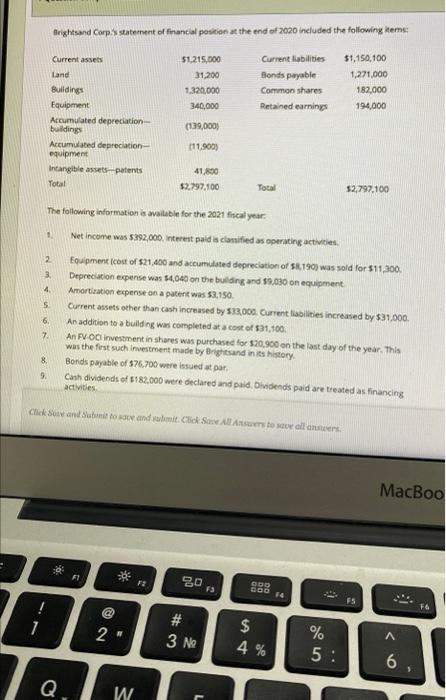

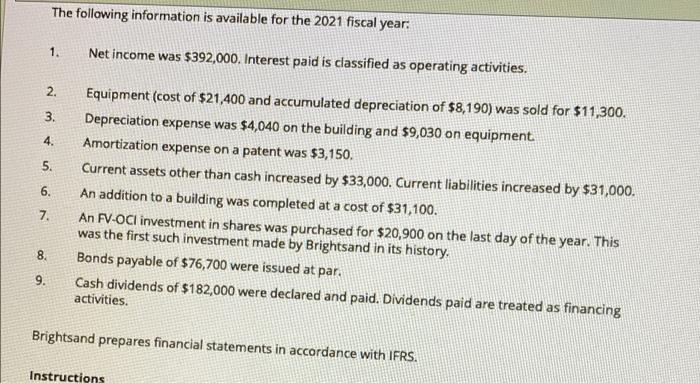

Brightsand Corp.statement of financial position at the end of 2020 included the following items: Current abilities $1215.000 31,200 1,320,000 Bonds payable Common shares Retained earnings $1,150, 100 1,271,000 182,000 194,000 340,000 Current assets Land Buildings Equipment Accumulated depreciation buildings Accumulated depreciation- equipment Intangible assets patents (139,000) 111.900) Total 41,800 52.797,100 Total 52.797.100 The following information is available for the 2021 fiscal year: 1 2 3. 4 5 Net Income was 5392,000, interest paid is classified as operating activities Equipment cost of $21.400 and accumulated depreciation of Sk. 190) was sold for $11.300 Deprecation expense was 54,040 on the building and $9.030 on equipment Amortization expense on a patent was 53.150. Current assets other than cash increased by 533,000 Current des increased by $31.000. An addition to a building was completed at a cost of $31.100 An PVC investment in shares was purchased for $20.900 on the last day of the year. This was the first such Investment made by rights and in its history, Bonds payable of $76.700 were issued a par Canh dividends of 5182,000 were declared and paid Dividends paid are treated as financing activities 6. 7. 8. 5. Click Save and submit to walk and submit. Click Save All Aners to save all answers, MacBoo FE 80 ODO 73 COOF ! N 2 3 Ne $ 4 % % 5: 6 1 W The following information is available for the 2021 fiscal year. 1. Net income was $392,000. Interest paid is classified as operating activities. 2. 3. 4. 5. 6. Equipment (cost of $21,400 and accumulated depreciation of $8,190) was sold for $11,300. Depreciation expense was $4,040 on the building and $9,030 on equipment Amortization expense on a patent was $3,150. Current assets other than cash increased by $33,000. Current liabilities increased by $31,000. An addition to a building was completed at a cost of $31,100. An FV-OCl investment in shares was purchased for $20,900 on the last day of the year. This was the first such investment made by Brightsand in its history, Bonds payable of $76,700 were issued at par. Cash dividends of $182,000 were declared and paid. Dividends paid are treated as financing activities. 7. 8. 9. Brightsand prepares financial statements in accordance with IFRS. Instructions