Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Uni Fassion Company has two product lines: T-shirts and Sweatshirts. The Company's simple costing system has two direct cost categories (materials and labor) and

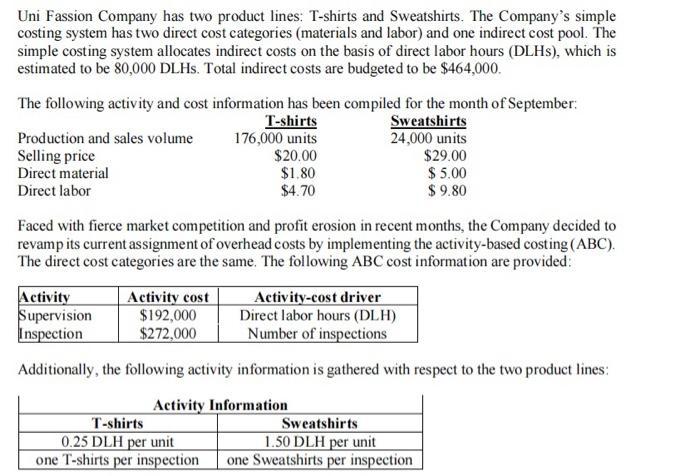

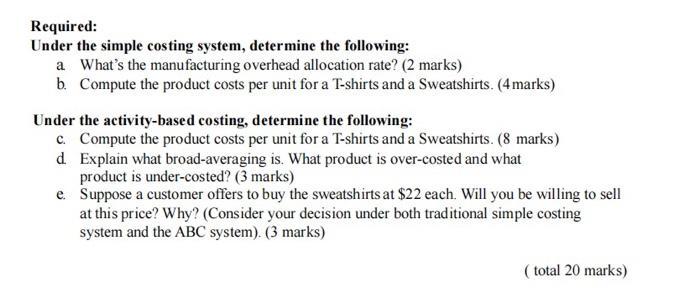

Uni Fassion Company has two product lines: T-shirts and Sweatshirts. The Company's simple costing system has two direct cost categories (materials and labor) and one indirect cost pool. The simple costing system allocates indirect costs on the basis of direct labor hours (DLHs), which is estimated to be 80,000 DLHs. Total indirect costs are budgeted to be $464,000. The following activity and cost information has been compiled for the month of September: T-shirts Sweatshirts Production and sales volume Selling price Direct material Direct labor 176,000 units $20.00 $1,80 $4.70 Faced with fierce market competition and profit erosion in recent months, the Company decided to revamp its current assignment of overhead costs by implementing the activity-based costing (ABC). The direct cost categories are the same. The following ABC cost information are provided: Activity cost $192,000 $272,000 Activity Supervision Inspection Activity-cost driver Direct labor hours (DLH) Number of inspections Additionally, the following activity information is gathered with respect to the two product lines: 24,000 units $29.00 $5.00 $9.80 Activity Information T-shirts 0.25 DLH per unit one T-shirts per inspection Sweatshirts 1.50 DLH per unit one Sweatshirts per inspection Required: Under the simple costing system, determine the following: a What's the manufacturing overhead allocation rate? (2 marks) b. Compute the product costs per unit for a T-shirts and a Sweatshirts. (4 marks) Under the activity-based costing, determine the following: c. Compute the product costs per unit for a T-shirts and a Sweatshirts. (8 marks) Explain what broad-averaging is. What product is over-costed and what product is under-costed? (3 marks) d. e. Suppose a customer offers to buy the sweatshirts at $22 each. Will you be willing to sell at this price? Why? (Consider your decision under both traditional simple costing system and the ABC system). (3 marks) (total 20 marks)

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a The manufacturing overhead allocation rate under the simple costing system is 580 per direct labor hour 464000 80000 DLH b The product costs per uni...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started