Answered step by step

Verified Expert Solution

Question

1 Approved Answer

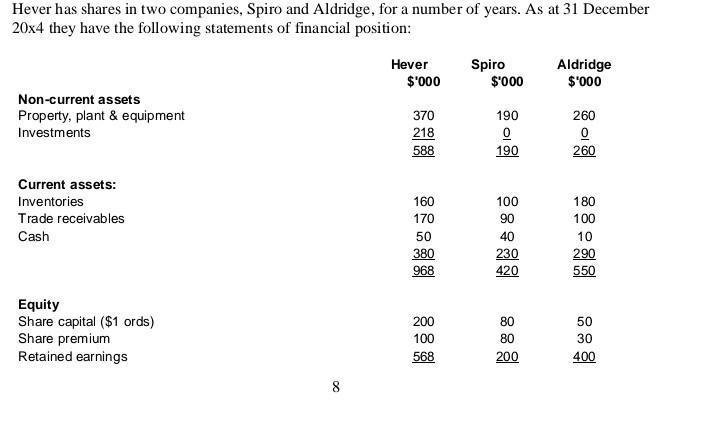

Hever has shares in two companies, Spiro and Aldridge, for a number of years. As at 31 December 20x4 they have the following statements

Hever has shares in two companies, Spiro and Aldridge, for a number of years. As at 31 December 20x4 they have the following statements of financial position: Non-current assets Property, plant & equipment Investments Current assets: Inventories Trade receivables Cash Equity Share capital ($1 ords) Share premium Retained earnings 8 Hever $'000 370 218 588 160 170 50 380 968 200 100 568 Spiro $'000 190 0 190 100 90 40 230 420 80 80 200 Aldridge $'000 260 0 260 180 100 10 290 550 50 30 400 Current liabilities Trade payables 868 100 968 360 Property, plant and equipment Inventories 60 420 480 70 550 You ascertain the following additional information: 1. The 'investments' in the statement of financial position comprise solely Haver's investment in Spiro ($128,000) and in Aldridge ($90,000). 2. The 48,000 shares in Spiro were acquired when Spiro's retained earnings balance stood at $20,000. The 15,000 shares in Aldridge were acquired when that company had a retained earnings balance of $150,000 3. when Hever acquired its shares in Spiro the fair value of Spiro's net assets equaled their book values with the following exceptions: $'000 50 higher 20 lower (sold during 20x4)

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started