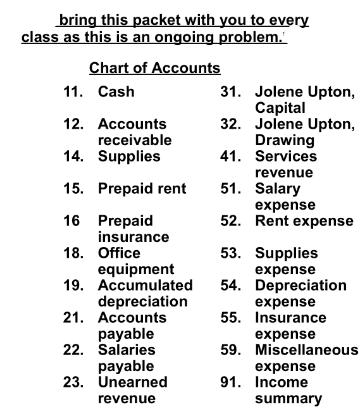

bring this packet with you to every class as this is an ongoing problem. Chart of Accounts 11. Cash 31. Jolene Upton, Capital 12.

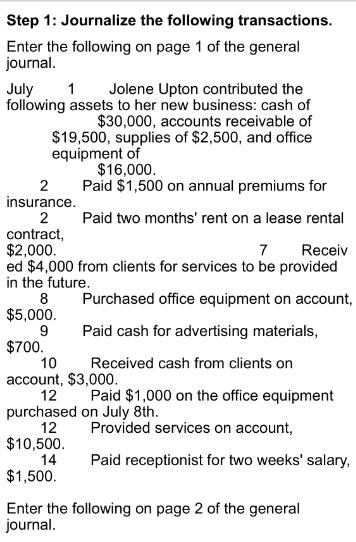

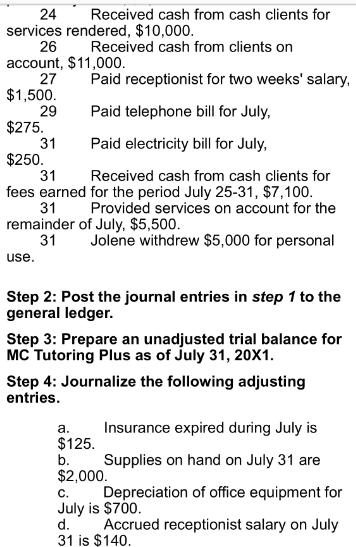

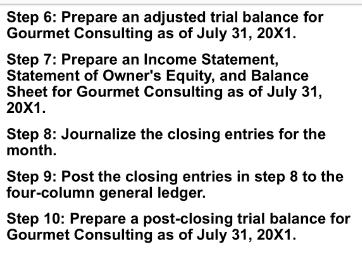

bring this packet with you to every class as this is an ongoing problem. Chart of Accounts 11. Cash 31. Jolene Upton, Capital 12. Accounts receivable 14. Supplies 15. Prepaid rent 16 Prepaid insurance 18. Office equipment 32. Jolene Upton, Drawing 41. Services revenue 51. Salary expense 52. Rent expense 53. Supplies expense 19. Accumulated 54. Depreciation depreciation 21. Accounts payable 22. Salaries payable 23. Unearned revenue expense 55. Insurance expense 59. Miscellaneous expense 91. Income summary Step 1: Journalize the following transactions. Enter the following on page 1 of the general journal. July 1 Jolene Upton contributed the following assets to her new business: cash of $30,000, accounts receivable of $19,500, supplies of $2,500, and office equipment of $16,000. 2 Paid $1,500 on annual premiums for insurance. 2 contract, $2,000. Paid two months' rent on a lease rental 7 Receiv ed $4,000 from clients for services to be provided in the future. 8 $5,000. $700. Purchased office equipment on account, 9 Paid cash for advertising materials, 10 Received cash from clients on account, $3,000. 12 Paid $1,000 on the office equipment purchased on July 8th. 12 Provided services on account, $10,500. 14 $1,500. Paid receptionist for two weeks' salary, Enter the following on page 2 of the general journal. 24 Received cash from cash clients for services rendered, $10,000. 26 Received cash from clients on account, $11,000. Paid receptionist for two weeks' salary, 27 $1,500. 29 Paid telephone bill for July, $275. 31 Paid electricity bill for July, $250. 31 fees earned for the period July 25-31, $7,100. 31 Received cash from cash clients for Provided services on account for the Jolene withdrew $5,000 for personal remainder of July, $5,500. use. 31 Step 2: Post the journal entries in step 1 to the general ledger. Step 3: Prepare an unadjusted trial balance for MC Tutoring Plus as of July 31, 20X1. Step 4: Journalize the following adjusting entries. a. $125. Insurance expired during July is b. $2,000. Supplies on hand on July 31 are C. Depreciation of office equipment for July is $700. d. Accrued receptionist salary on July 31 is $140. Step 6: Prepare an adjusted trial balance for Gourmet Consulting as of July 31, 20X1. Step 7: Prepare an Income Statement, Statement of Owner's Equity, and Balance Sheet for Gourmet Consulting as of July 31, 20X1. Step 8: Journalize the closing entries for the month. Step 9: Post the closing entries in step 8 to the four-column general ledger. Step 10: Prepare a post-closing trial balance for Gourmet Consulting as of July 31, 20X1.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

It seems that youve provided images with instructions for an accounting practice exercise which involves journalizing transactions posting to the ledger and preparing financial statements for a fictio...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started