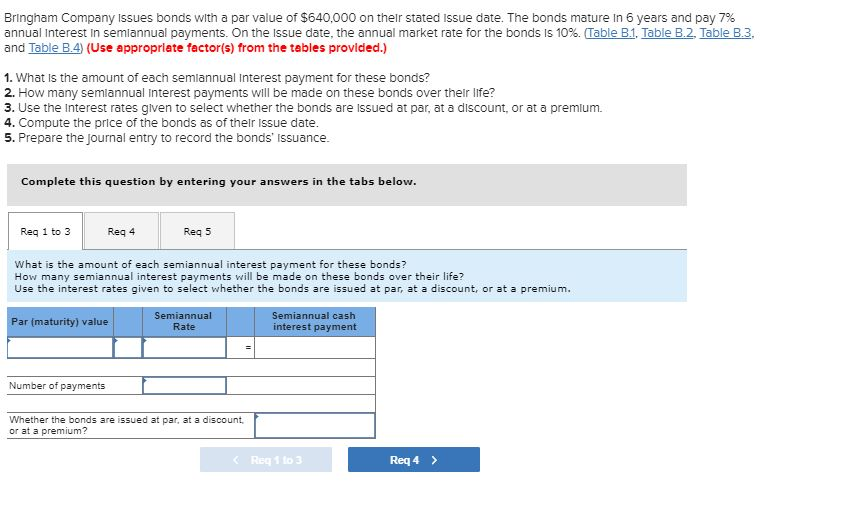

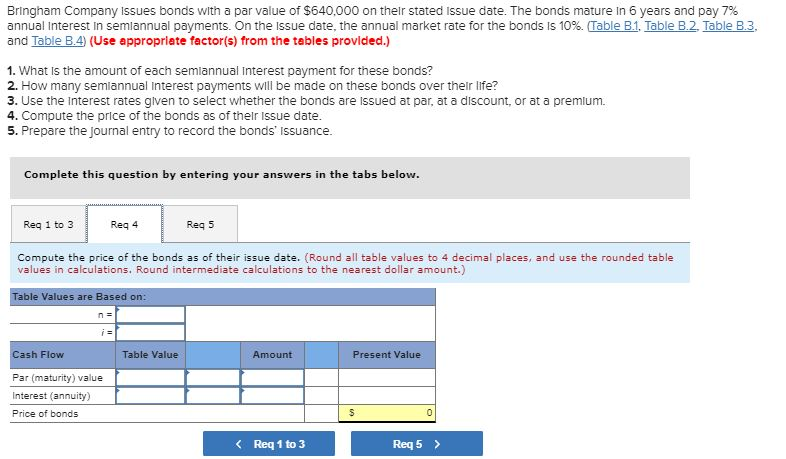

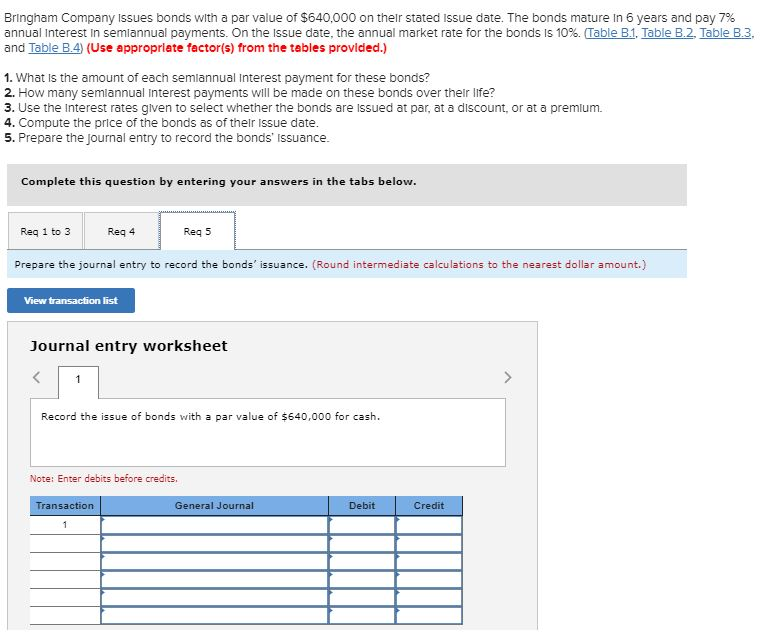

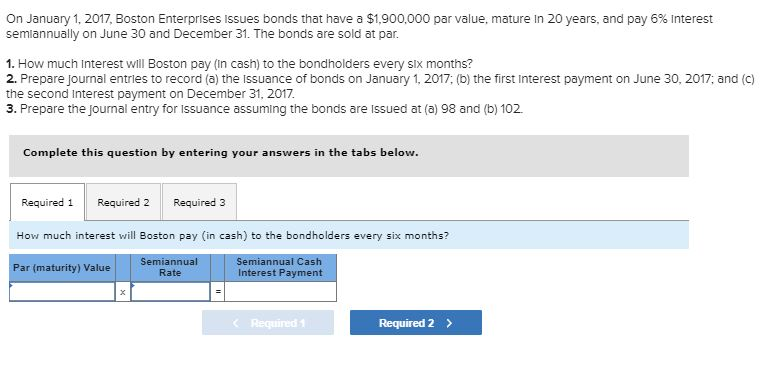

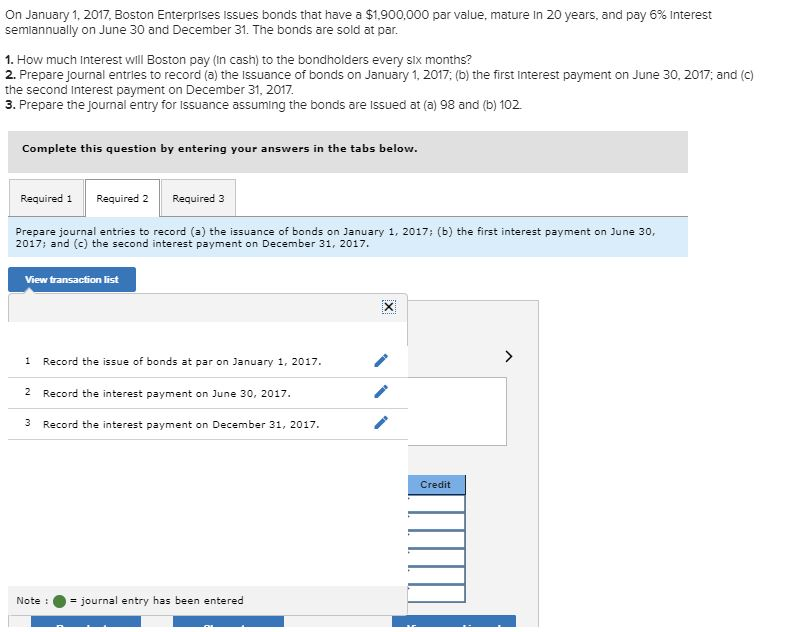

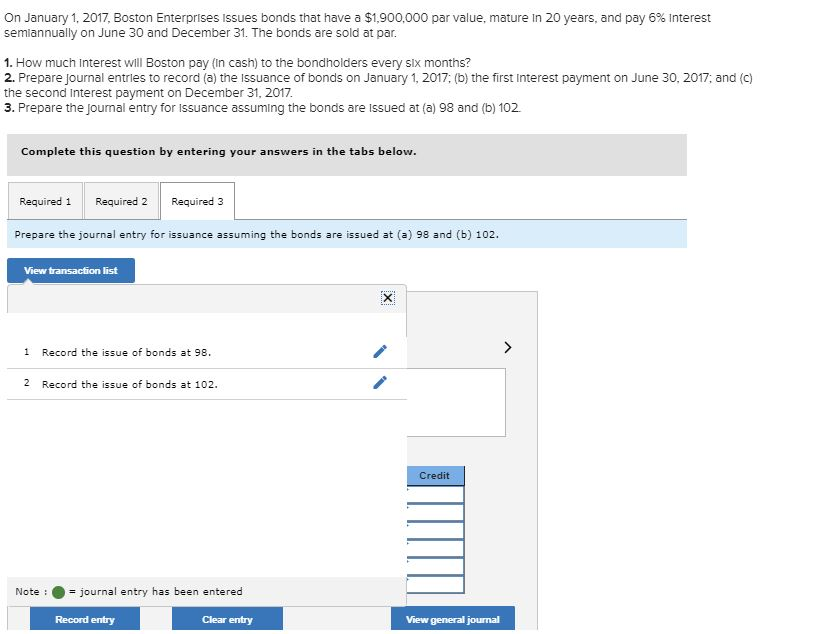

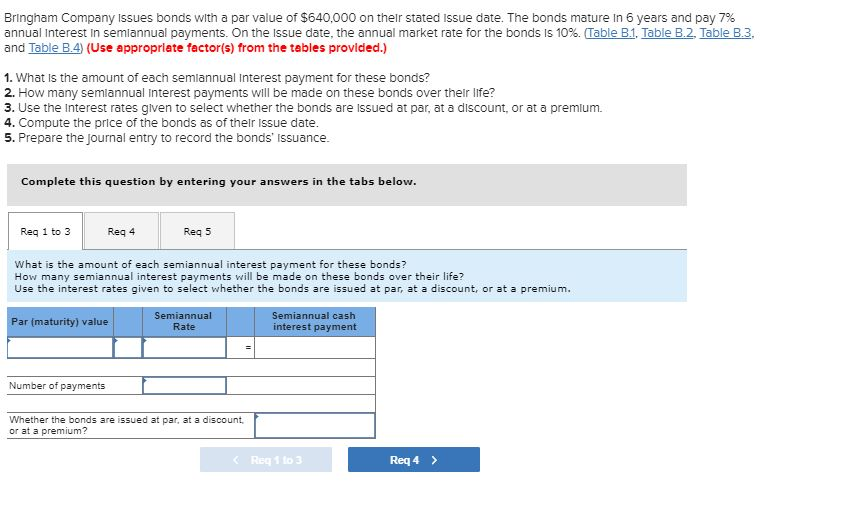

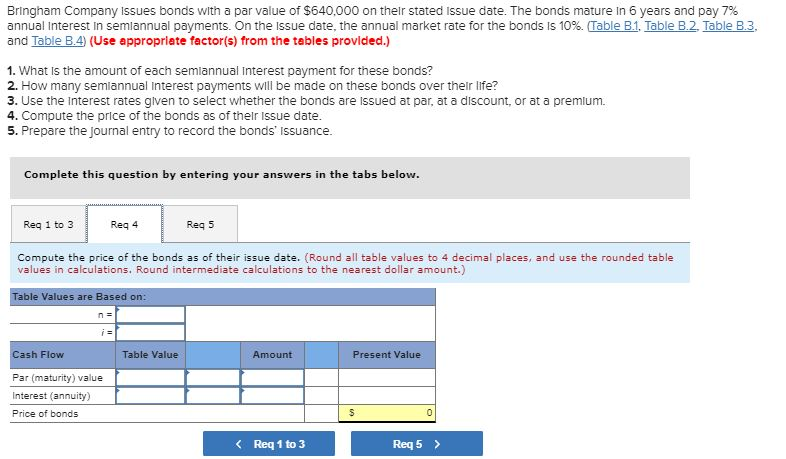

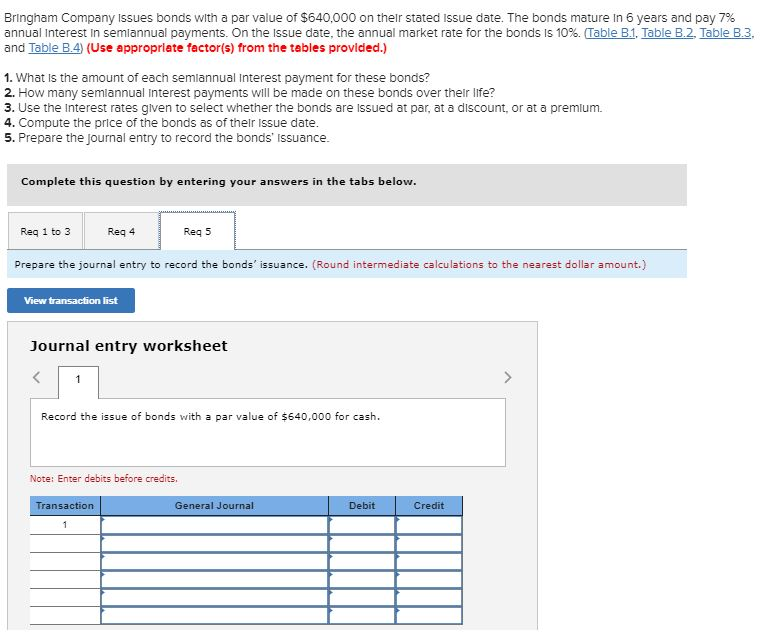

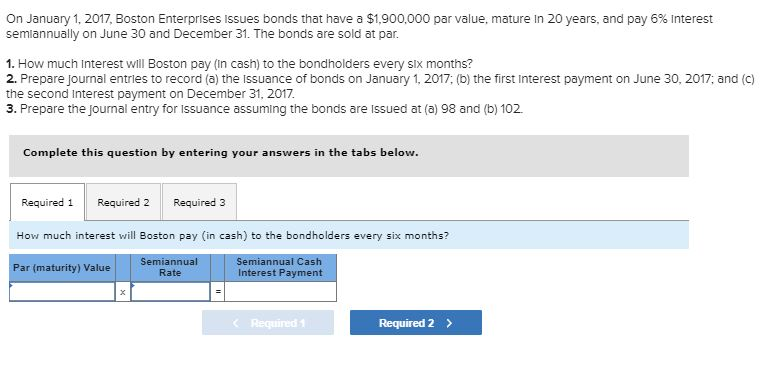

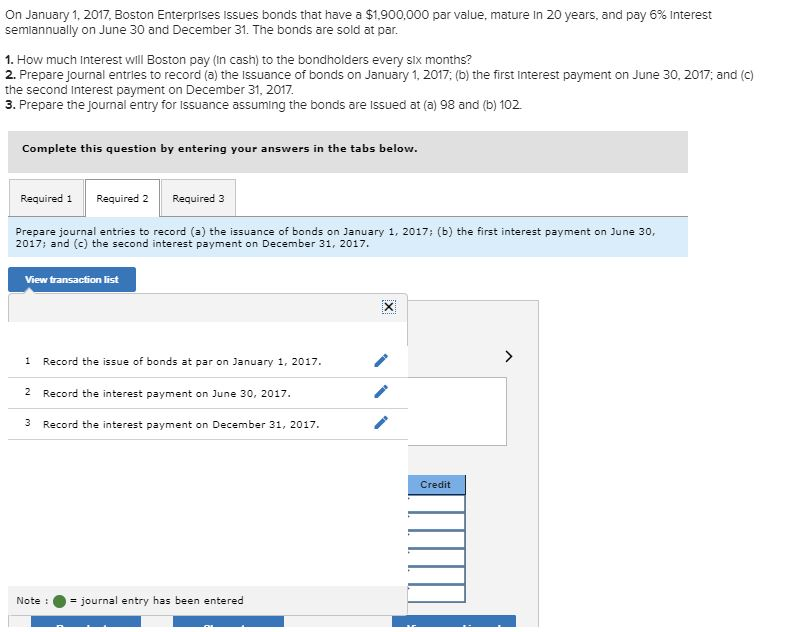

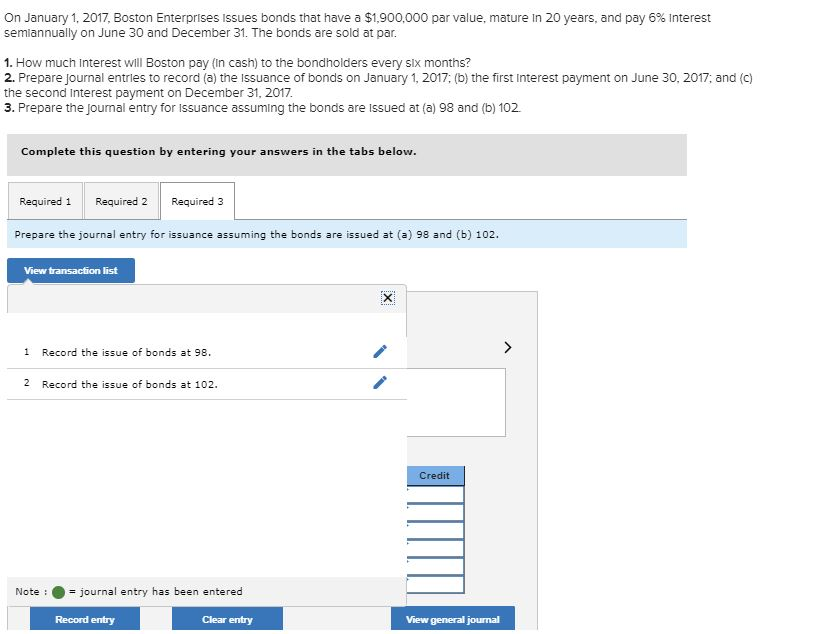

Bringham Company issues bonds with a par value of $640,000 on their stated issue date. The bonds m ature in 6 years and pay 7% annual interest in semiannual payments. On the issue date, the annual market rate for the bonds is 10%. Table B1, Table B.2, Table B3. and Table B.4 (Use appropriete factor(s) from the tables provided.) 1. What Is the amount of each semlannual Interest payment for these bonds? 2. How many semiannual Interest payments will be made on these bonds over their life? 3. Use the Interest rates given to select whether the bonds are Issued at par, at a discount, or at a premlum 4. Compute the price of the bonds as of thelr Issue date. 5. Prepare the Journal entry to record the bonds' Issuance. Complete this question by entering your answers in the tabs below Req 1 to 3 Req 4 Req 5 What is the amount of each semiannual interest payment for these bonds? How many semiannual interest payments will be made on these bonds over their life? Use the interest rates given to select whether the bonds are issued at par, at a discount, or at a premium Semiannual Rate Semiannual cash interest payment Par (maturity) value Number of payments Whether the bonds are issued at par, at a discount or at a premium? Reg 1 to 3 Req 4 > Bringham Company issues bonds with a par value of $640,000 on their stated issue date. The bonds mature in 6 years and pay 7% annual interest in semiannual payments. On the Issue date, the annual market rate for the bonds is 10%. Table B1, Table B 2, Table B 3, and Table B.4 (Use appropriete factor(s) from the tables provided.) 1. What Is the amount of each semlannual Interest payment for these bonds? 2. How many semlannual Interest payments will be made on these bonds over their life? 3. Use the Interest rates glven to select whether the bonds are Issued at par, at a discount, or at a premlum 4. Compute the price of the bonds as of thelr Issue date. 5. Prepare the Journal entry to record the bonds' Issuance. Complete this question by entering your answers in the tabs below Req 1 to 3Req 4 Req 5 Compute the price of the bonds as of their issue date. (Round all table values to 4 decimal places, and use the rounded table values in calculations. Round intermediate calculations to the nearest dollar amount.) Table Values are Based on Table Value ash Flow Par (maturity) value Interest (annuity) Price of bonds Amount Present Value K Req 1 to 3 Req 5 > Bringham Company issues bonds with a par value of $640,000 on their stated issue date. The bonds mature in 6 years and pay 7% annual interest in semiannual payments. On the issue date, the annual market rate for the bonds is 10%. TableBI, TableB2 Table B3. and Table B.4) (Use eppropriete factor(s) from the tebles provicded.) 1. What is the amount of each semlannual Interest payment for these bonds? 2. How many semlannual Interest payments will be made on these bonds over their lfe? 3. Use the Interest rates given to select whether the bonds are issued at par, at a discount, or at a premlum. 4. Compute the price of the bonds as of thelr Issue date. 5. Prepare the journal entry to record the bonds' Issuance. Complete this question by entering your answers in the tabs below Req 1 to 3Req 4 Req 5 Prepare the journal entry to record the bonds' issuance. (Round intermediate calculations to the nearest dollar amount.) View transaction list Journal entry worksheet Record the issue of bonds with a par value of $640,000 for cash. Note: Enter debits before credits Transaction General Journal Debit Credit On January 1, 2017, Boston Enterprises issues bonds that have a $1,900 semlannually on June 30 and December 31. The bonds are sold at par. par value, mature n 20 years, and pay 6% interest 1. How much Interest will Boston pay (In cash) to the bondholders every six months? 2. Prepare journal entries to record (a) the issuance of bonds on January 1, 2017, (b) the first interest payment on June 30, 2017, and (c) the second Interest payment on December 31, 2017 3. Prepare the journal entry for Issuance assuming the bonds are Issued at (a) 98 and (b) 102 Complete this question by entering your answers in the tabs below Required 1Required 2Required 3 How much interest will Boston pay (in cash) to the bondholders every six months? Par (maturity) Value Semiannual Rate Semiannual Cash Interest Payment Required 2> On January 1, 2017, Boston Enterprises issues bonds that have a $1.900,000 par value, mature in 20 years, and pay 6% Interest semlannually on June 30 and December 31. The bonds are sold at par. 1. How much Interest will Boston pay (in cash) to the bondholders every six months? 2. Prepare journal entries to record (a) the Issuance of bonds on January 1, 2017: (b) the first interest payment on June 30, 2017, and (c) the second Interest payment on December 31, 2017. 3. Prepare the journal entry for issuance assuming the bonds are Issued at (a) 98 and (b) 102 Complete this question by entering your answers in the tabs below. Required 1 Requied 2 Required 3 Prepare journal entries to record (a) the issuance of bonds on January 1, 2017: (b) the first interest payment on June 30, 2017; and (c) the second interest payment on December 31, 2017. View transaction list 1 Record the issue of bonds at par on January 1, 2017 2 Record the interest payment on June 30, 2017. 3 Record the interest payment on December 31, 2017 Credit Note: journal entry has been entered On January 1, 2017, Boston Enterprises issues bonds that have a $1,900,000 par value, mature in 20 years, and pay 6% Interest semlannually on June 30 and December 31. The bonds are sold at par. 1. How much Interest will Boston pay (in cash) to the bondholders every six months? 2. Prepare Journal entries to record (a) the issuance of bonds on January 1, 2017, (b) the first Interest payment on June 30, 2017, and (c) the second Interest payment on December 31, 2017. 3. Prepare the joumal entry for Issuance assuming the bonds are issued at (a) 98 and (b) 102. Complete this question by entering your answers in the tabs below Required 1 Required 2Required 3 Prepare the journal entry for issuance assuming the bonds are issued at (a) 98 and (b) 102. n list 1 Record the issue of bonds at 98 2 Record the issue of bonds at 102. Credit Note: journal entry has been entered Record entry Clear entry View general journal