Answered step by step

Verified Expert Solution

Question

1 Approved Answer

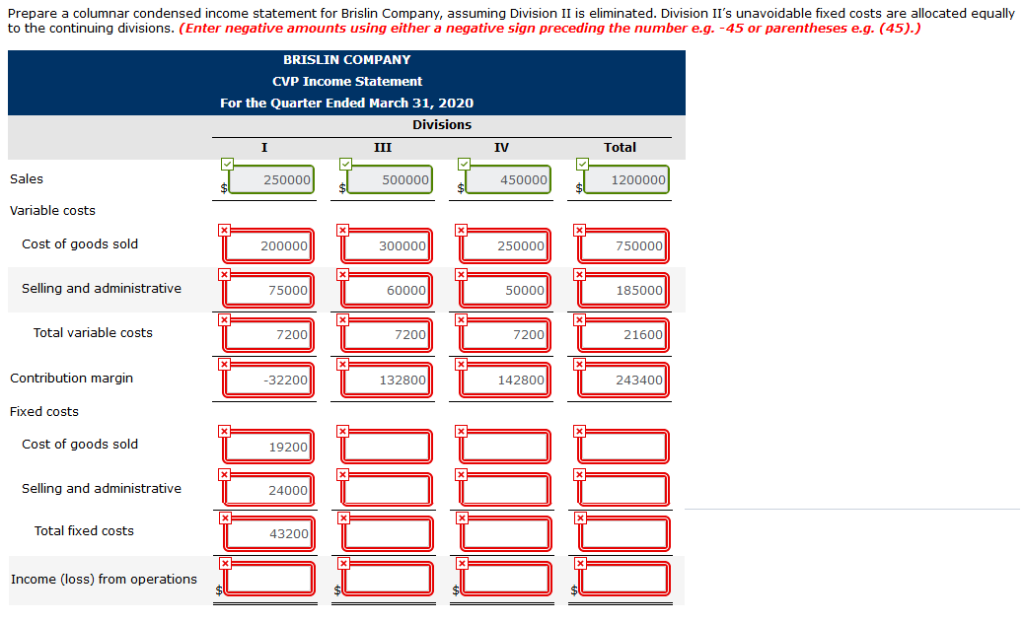

Brislin Company has four operating divisions. During the first quarter of 2020, the company reported aggregate income from operations of $213,000 and the following divisional

Brislin Company has four operating divisions. During the first quarter of 2020, the company reported aggregate income from operations of $213,000 and the following divisional results.

| Division | |||||||||

| I | II | III | IV | ||||||

| Sales | $250,000 | $200,000 | $500,000 | $450,000 | |||||

| Cost of goods sold | 200,000 | 192,000 | 300,000 | 250,000 | |||||

| Selling and administrative expenses | 75,000 | 60,000 | 60,000 | 50,000 | |||||

| Income (loss) from operations | $ (25,000) | $ (52,000) | $140,000 | $150,000 | |||||

Analysis reveals the following percentages of variable costs in each division.

| I | II | III | IV | ||||||||||

| Cost of goods sold | 70 | % | 90 | % | 80 | % | 75 | % | |||||

| Selling and administrative expenses | 40 | 60 | 50 | 60 |

Discontinuance of any division would save 50% of the fixed costs and expenses for that division. Top management is very concerned about the unprofitable divisions (I and II). Consensus is that one or both of the divisions should be discontinued.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started