Question

Brock Florist Company sold their delivery truck after three years of service. If MACRS was used for the depreciation schedule, what is the after tax

Brock Florist Company sold their delivery truck after three years of service. If MACRS was used for the depreciation schedule, what is the after tax cash flow from the sale of the truck (continue to use 30% tax rate) if a. the sales price was $15,000? b. the sales price was $10,000? c. the sales price was $5,000?

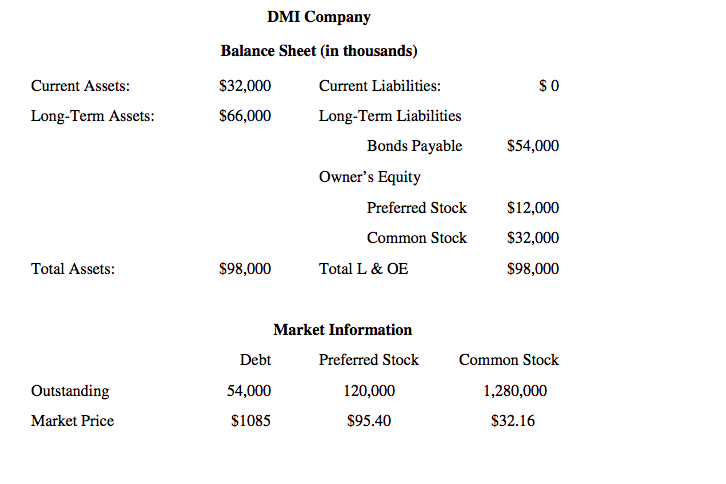

The CFO of DMI is trying to determine the companys WACC. Brad, a promising MBA, says that the company should use book value to assign the components percentage for the WACC. Angela, a long-time employee and experienced financial analyst, says the company should use market value to assign the components. The after-tax cost of debt is at 7%, the cost of preferred stock is at 11%, and the cost of equity is at 14%. Calculate the WACC using both the book value and market value approaches with the following information. Which do you think is better? Why?

DMI Company Balance Sheet (in thousands) $32,000 $66,000 Current Assets Current Liabilities S0 Long-Term Assets: Long-Term Liabilities Bonds Payable $54,000 Owner's Equity $12,000 $32,000 $98,000 Preferred Stock Common Stock Total Assets $98,000 Total L & OE Market Information Debt 54,000 $1085 Preferred Stock 120,000 $95.40 Common Stock Outstanding 1,280,000 Market Price $32.16 DMI Company Balance Sheet (in thousands) $32,000 $66,000 Current Assets Current Liabilities S0 Long-Term Assets: Long-Term Liabilities Bonds Payable $54,000 Owner's Equity $12,000 $32,000 $98,000 Preferred Stock Common Stock Total Assets $98,000 Total L & OE Market Information Debt 54,000 $1085 Preferred Stock 120,000 $95.40 Common Stock Outstanding 1,280,000 Market Price $32.16Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started