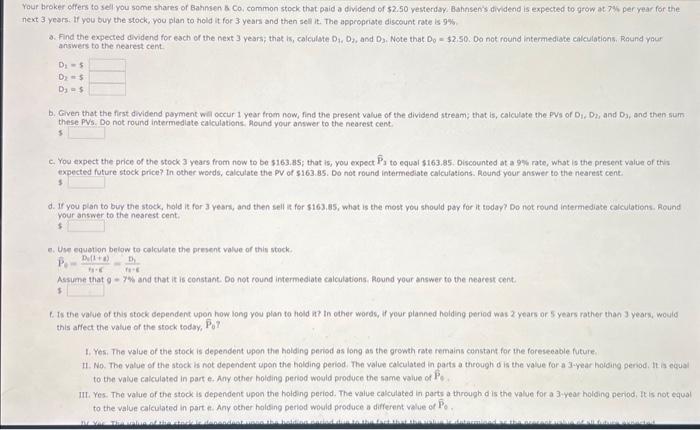

broker dfens to sel you some shares of Bahnsen 8 . Co, common stock that paid a dividend of $2.50 vesterday. Bahnsen's dividend is expected to grow at 7% per year for the at 3 yesrs. If you buy the stock, you plan to hold it for 3 years and then sell it. The appropriate discount rate is 9%. a. Find the expected dividend for esch of the next 3 years; that is, calculate D1,D2, and D3. Note that D0=$2,50,00 not round intermediate calculations. Round yaur answers to the nearest cent. D1=5D2=5D2=5 b. Given that the first dividend payment wa occur 1 year from now, find the present value of the dividend stream; that is, Caiculate the PVs of D1, D2, and D3, and then sum these Dis. no not round intermedlate calculations. Alound your answer to the nearest cent. 5 C. You expect the price of the stock 3 years from now to be 5163.65 ; that is, you expect P3 to equal $163.85. Discounted at a 9% rate, what is the present value of this exnected futare stock price? In other words, calculate the PV of \$163.85. Do not round intermediate calculations. Reund your answer to the nearest cent. 3 your answer to the nearest cent. 5 e. Use equetion below to calculate the present valve of this stock. Aseame that g=7% and that it is constant. Do not round intermediate calculations, Round your answer to the nearest cent. 5 6. Is the value of this stock Gependent upon how long you plan to hold n t in other words, if vour planned holding period was 2 years or 5 years rather than 3 years, would this affect the value of the stock today, P^0 ? 1. Yos. The value of the stock is dependent upen the holding perisd as long as the growth rate remains constant for the foreseeable future. 11. No. The value of the stock is not dependent upon the holding period. The value calculated in garts a through d is the value for a 3 -year holding geriod. it is equal to the value calculated in part e. Any other holding period would produce the same value of P4 III. Yes. The value of the stock is dependent upon the holding period. The value calculated in parts a through dis the value for a 3 year holding period, it is not equal to the value calculated in part e. Any other holding period would produce a different value of P0