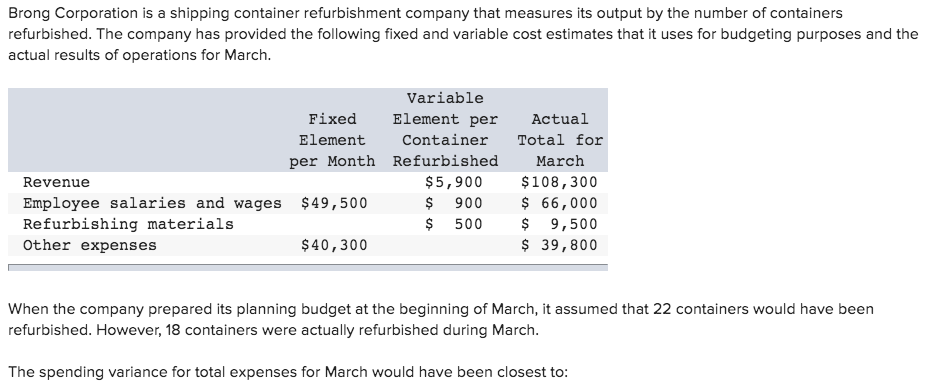

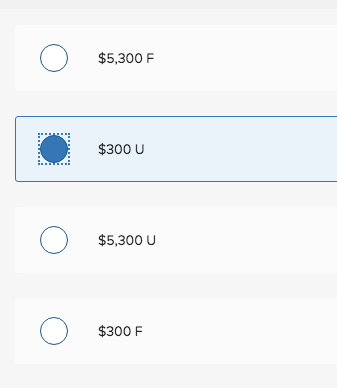

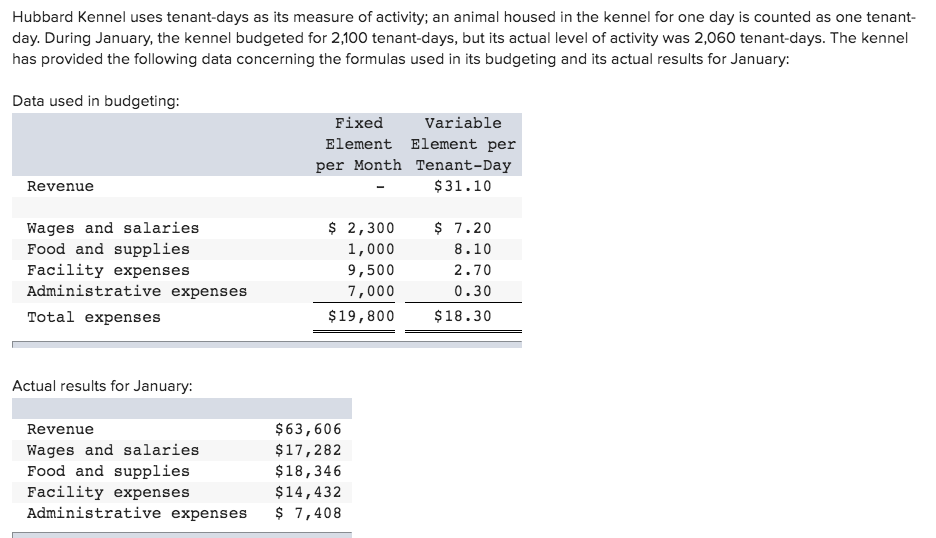

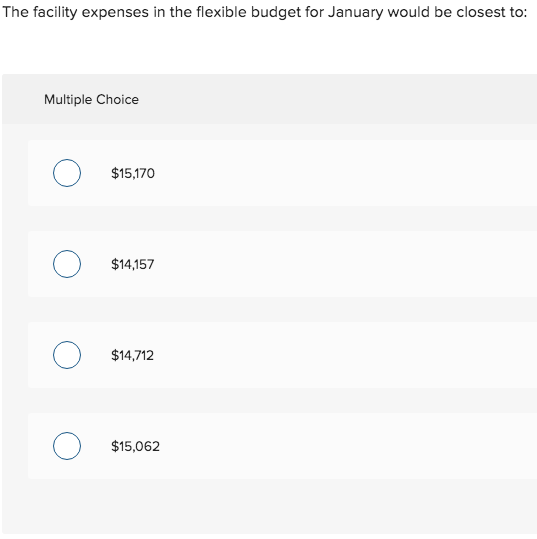

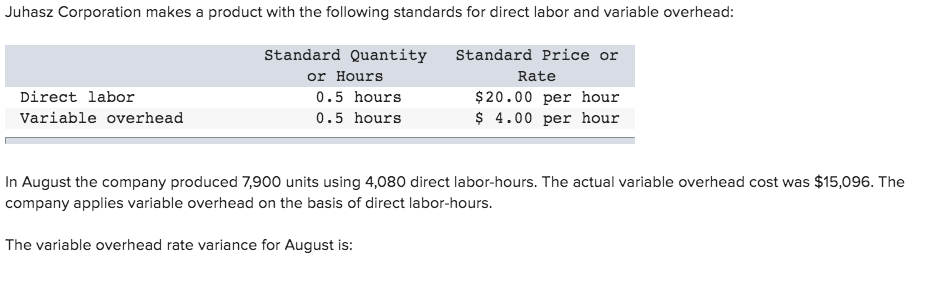

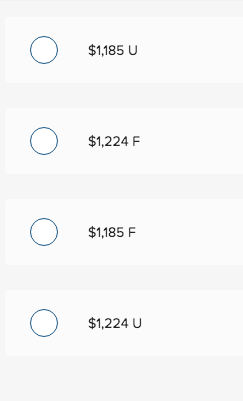

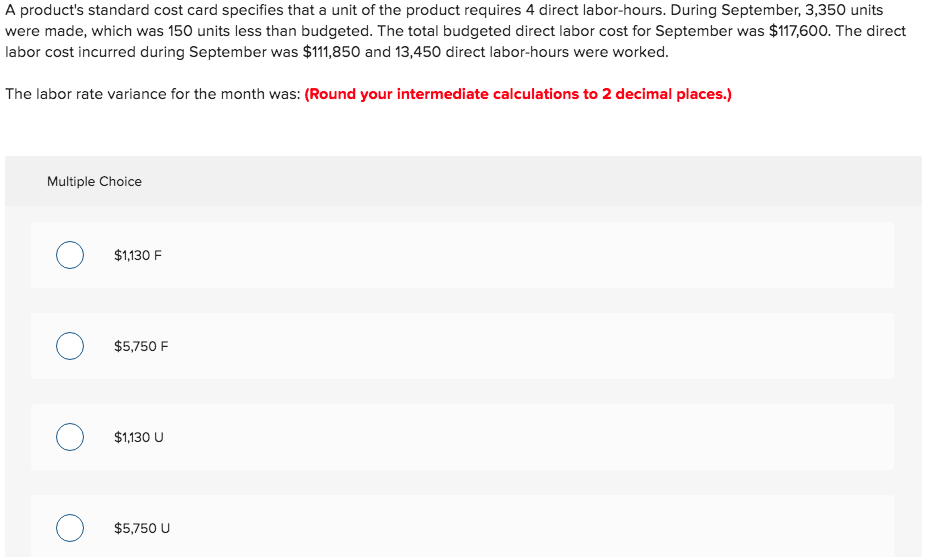

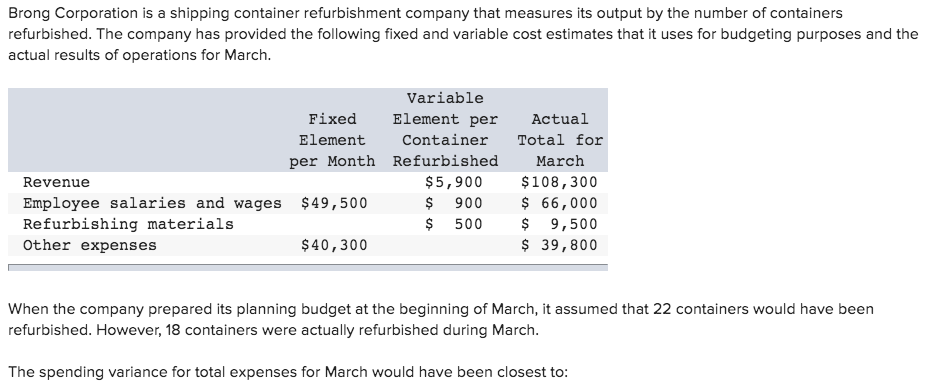

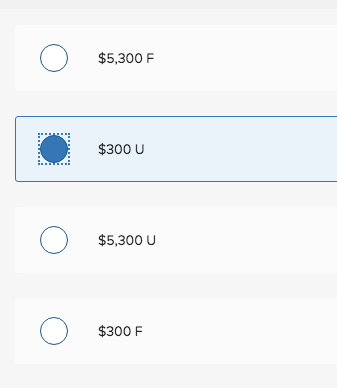

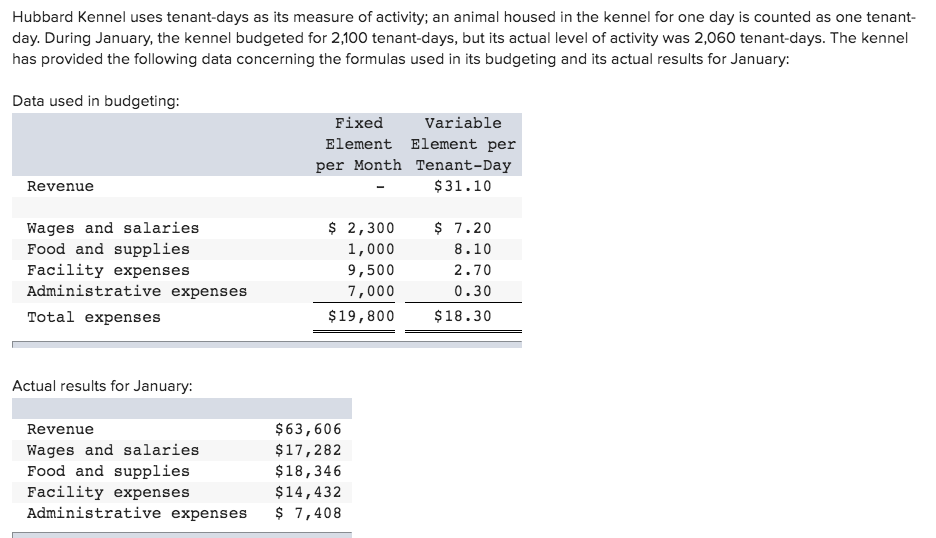

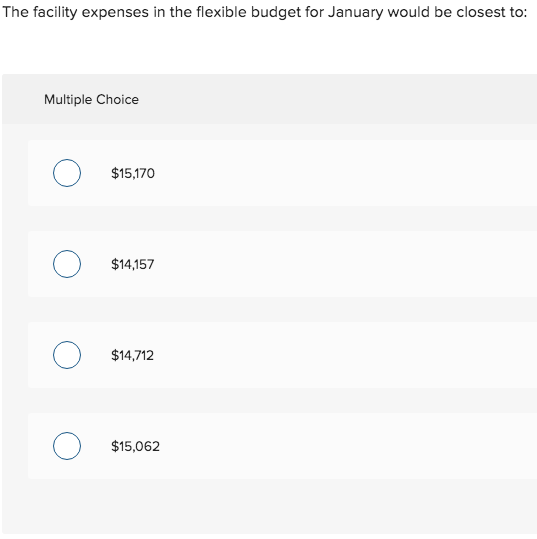

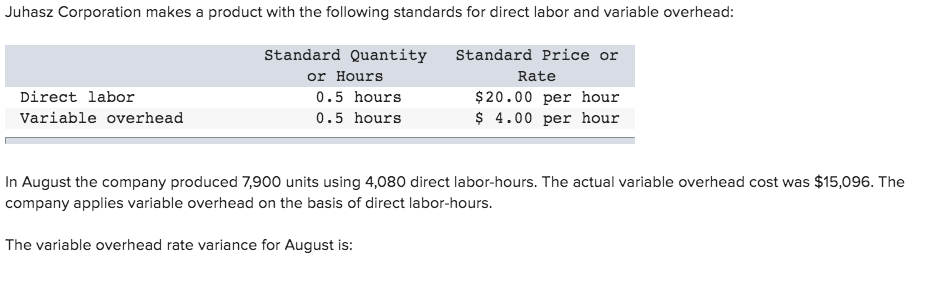

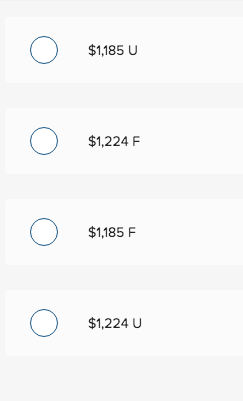

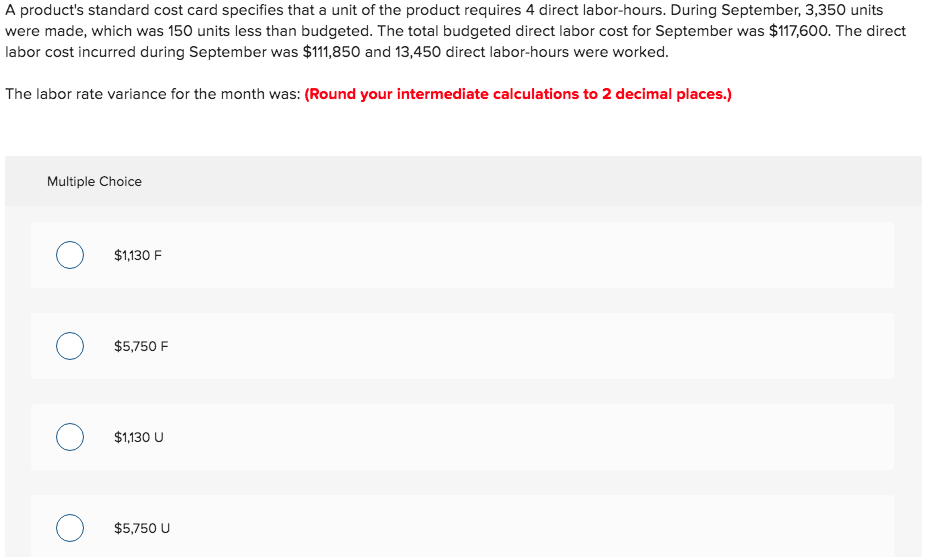

Brong Corporation is a shipping container refurbishment company that measures its output by the number of containers refurbished. The company has provided the following fixed and variable cost estimates that it uses for budgeting purposes and the actual results of operations for March. Variable Fixed Element per Element Container per Month Refurbished Revenue $5,900 Employee salaries and wages $49,500 $ 900 Refurbishing materials $ 500 Other expenses $ 40,300 Actual Total for March $108,300 $ 66,000 $ 9,500 $ 39,800 When the company prepared its planning budget at the beginning of March, it assumed that 22 containers would have been refurbished. However, 18 containers were actually refurbished during March. The spending variance for total expenses for March would have been closest to: $5,300 F $300 U $5,300 U $300 F Hubbard Kennel uses tenant-days as its measure of activity; an animal housed in the kennel for one day is counted as one tenant- day. During January, the kennel budgeted for 2,100 tenant-days, but its actual level of activity was 2,060 tenant-days. The kennel has provided the following data concerning the formulas used in its budgeting and its actual results for January: Data used in budgeting: Fixed Variable Element Element per per Month Tenant-Day $31.10 Revenue Wages and salaries Food and supplies Facility expenses Administrative expenses Total expenses $ 2,300 1,000 9,500 7,000 $19,800 $ 7.20 8.10 2.70 0.30 $18.30 Actual results for January: Revenue Wages and salaries Food and supplies Facility expenses Administrative expenses $63,606 $17,282 $18,346 $14,432 $ 7,408 The facility expenses in the flexible budget for January would be closest to: Multiple Choice $15,170 $14,157 $14,712 $15,062 Juhasz Corporation makes a product with the following standards for direct labor and variable overhead: Standard Quantity or Hours 0.5 hours 0.5 hours Standard Price or Rate $ 20.00 per hour $ 4.00 per hour Direct labor Variable overhead In August the company produced 7,900 units using 4,080 direct labor-hours. The actual variable overhead cost was $15,096. The company applies variable overhead on the basis of direct labor-hours. The variable overhead rate variance for August is: $1,1850 $1,224E $1,185 $1,224 U A product's standard cost card specifies that a unit of the product requires 4 direct labor-hours. During September, 3,350 units were made, which was 150 units less than budgeted. The total budgeted direct labor cost for September was $117,600. The direct labor cost incurred during September was $111,850 and 13,450 direct labor-hours were worked. The labor rate variance for the month was: (Round your intermediate calculations to 2 decimal places.) Multiple Choice 0 $1,130 F 0 $5,750 F 0 $1,130 U 0 $5,750 U