Answered step by step

Verified Expert Solution

Question

1 Approved Answer

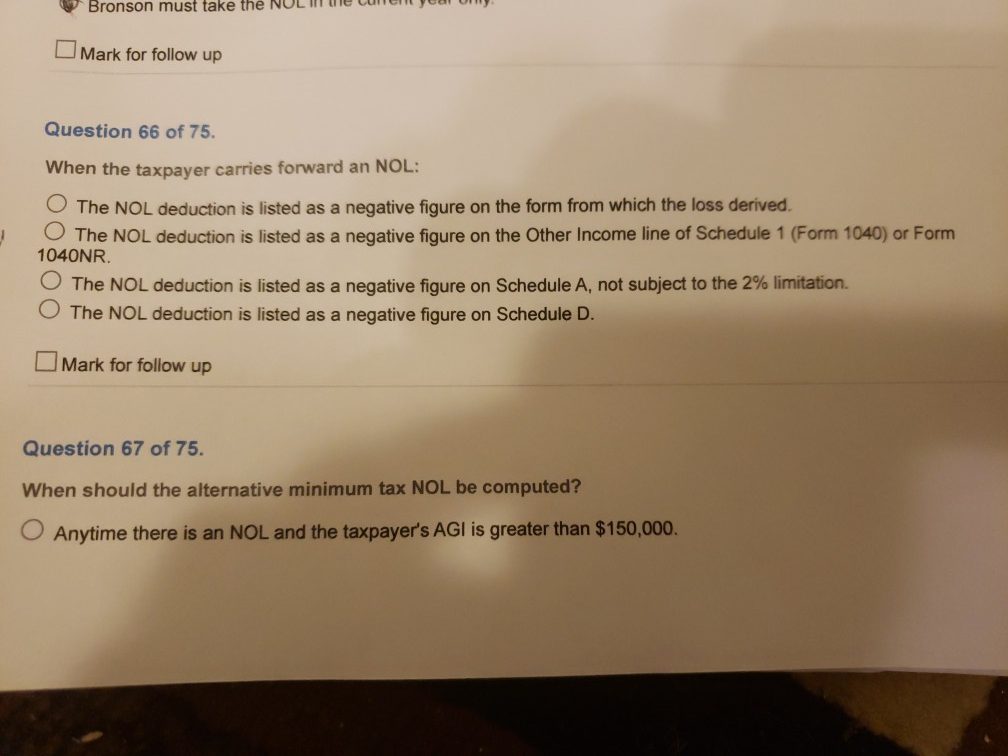

Bronson must take the NUL II e Curent year Uny Mark for follow up Question 66 of 75. When the taxpayer carries forward an NOL:

Bronson must take the NUL II e Curent year Uny Mark for follow up Question 66 of 75. When the taxpayer carries forward an NOL: The NOL deduction is listed as a negative figure on the form from which the loss derived. The NOL deduction is listed as a negative figure on the Other Income line of Schedule 1 (Form 1040) or Form 1040NR. The NOL deduction is listed as a negative figure on Schedule A, not subject to the 2% limitation. The NOL deduction is listed as a negative figure on Schedule D. Mark for follow up Question 67 of 75. When should the alternative minimum tax NOL be computed? Anytime there is an NOL and the taxpayer's AGI is greater than $150.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started