Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bronto Company invested in 10,000 shares in Saurus Company, which it purchased in June 2012 for $1 per share, before Saurus went public. On

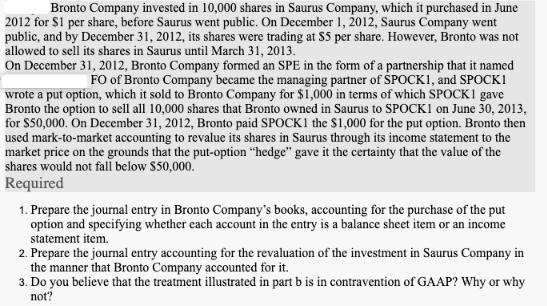

Bronto Company invested in 10,000 shares in Saurus Company, which it purchased in June 2012 for $1 per share, before Saurus went public. On December 1, 2012, Saurus Company went public, and by December 31, 2012, its shares were trading at $5 per share. However, Bronto was not allowed to sell its shares in Saurus until March 31, 2013. On December 31, 2012, Bronto Company formed an SPE in the form of a partnership that it named FO of Bronto Company became the managing partner of SPOCKI, and SPOCKI wrote a put option, which it sold to Bronto Company for $1,000 in terms of which SPOCKI gave Bronto the option to sell all 10,000 shares that Bronto owned in Saurus to SPOCKI on June 30, 2013, for $50,000. On December 31, 2012, Bronto paid SPOCK1 the $1,000 for the put option. Bronto then used mark-to-market accounting to revalue its shares in Saurus through its income statement to the market price on the grounds that the put-option "hedge" gave it the certainty that the value of the shares would not fall below $50,000. Required 1. Prepare the journal entry in Bronto Company's books, accounting for the purchase of the put option and specifying whether each account in the entry is a balance sheet item or an income statement item. 2. Prepare the journal entry accounting for the revaluation of the investment in Saurus Company in the manner that Bronto Company accounted for it. 3. Do you believe that the treatment illustrated in part b is in contravention of GAAP? Why or why not?

Step by Step Solution

★★★★★

3.56 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

The answer provided below has been developed in a clear stepbystep manner Sure I can help you with t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started