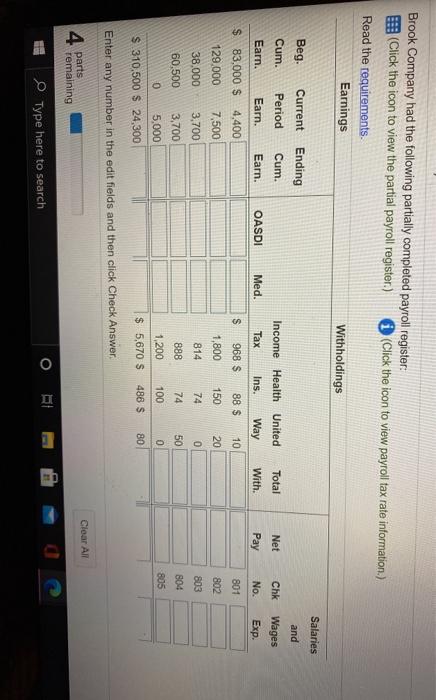

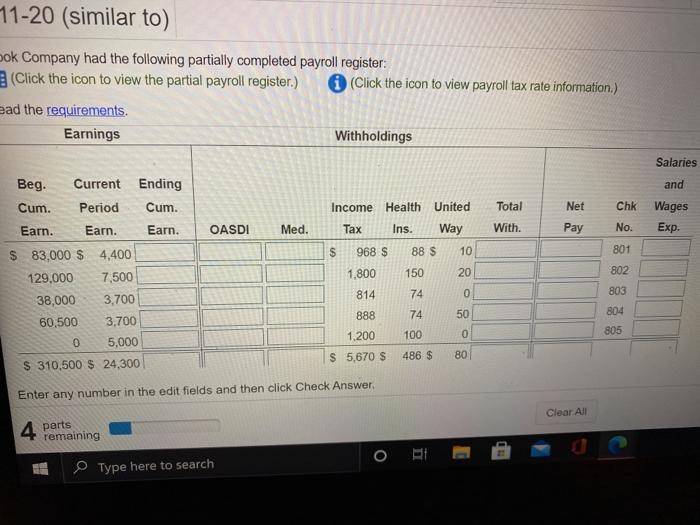

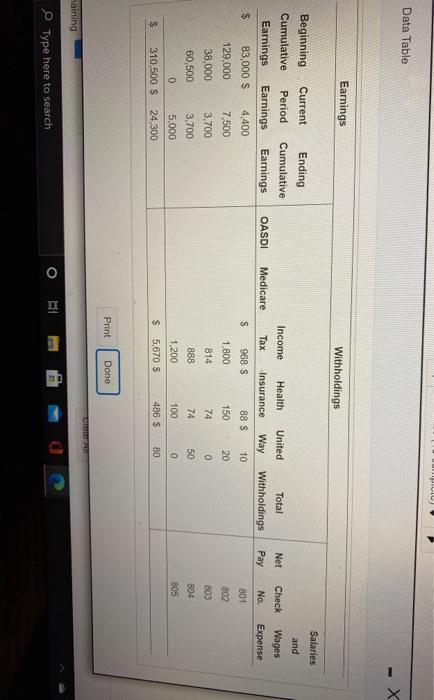

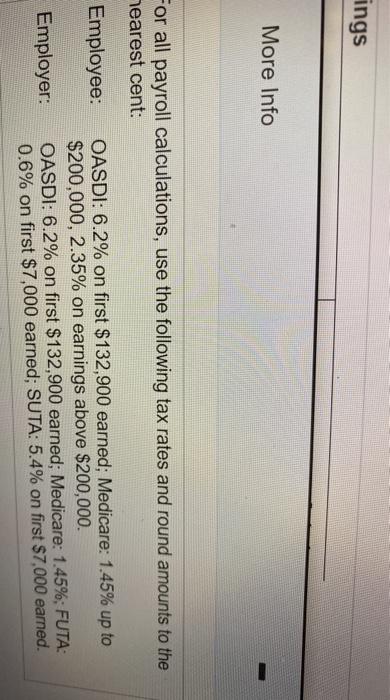

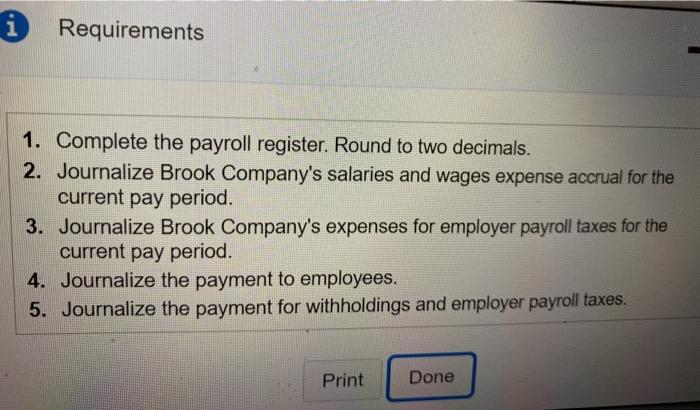

Brook Company had the following partially completed payroll register: (Click the icon to view the partial payroll register.) (Click the icon to view payroll tax rate information.) Read the requirements Earnings Withholdings Salaries Current Beg. Cum. and Ending Cum. Period Total Net Chk Earn. Earn. Earn. OASDI Wages Exp. Med. With Pay Income Health United Tax Ins. Way 968 $ 88 $ 10 1,800 150 20 No. $ 83,000 $ 4.400 $ 801 129.000 7,500 802 814 74 0 803 74 50 38.000 3,700 60.500 3,700 5,000 $ 310,500 $ 24,300 888 1,200 804 805 100 0 $ 5,670 S 488 S 80 Enter any number in the edit fields and then click Check Answer Clear All 4 parts remaining O Type here to search 11-20 (similar to) bok Company had the following partially completed payroll register: (Click the icon to view the partial payroll register.) (Click the icon to view payroll tax rate information.) ead the requirements. Earnings Withholdings Salaries and Income Health United Total Net Chk Wages OASDI Med. With. Pay No. Exp. 801 Beg. Current Ending Cum. Period Cum. Earn. Earn. Earn. $ 83,000 $4,400 129.000 7,500 38,000 3,700 60,500 3,700 0 5,000 $ 310,500 $ 24,300 Tax Ins. Way S 968 $ 88 $ 10 1,800 150 20 814 74 0 802 803 804 805 888 74 50 1,200 100 0 $ 5,670 S 486 $ 80 Enter any number in the edit fields and then click Check Answer Clear All 4 parts remaining o E Type here to search Data Table X Earnings Withholdings Salaries Net OASDI and Wages Expense Total Withholdings Check No. Medicare Pay $ Beginning Current Ending Cumulative Period Cumulative Earnings Earnings Earnings S 83,000 $ 4,400 129.000 7,500 38,000 3,700 60,500 3,700 0 5,000 $ 310,500 $ 24,300 801 802 Income Health United Tax Insurance Way 968 S 88 S 10 1,800 150 20 814 74 0 888 74 50 1,200 100 0 $ 5,670 S 486 $ 80 803 804 805 Print Done Done maining Type here to search o ings More Info For all payroll calculations, use the following tax rates and round amounts to the hearest cent: Employee: OASDI: 6.2% on first $132,900 earned; Medicare: 1.45% up to $200,000, 2.35% on earnings above $200,000. OASDI: 6.2% on first $132,900 earned; Medicare: 1.45%; FUTA: 0.6% on first $7,000 earned; SUTA: 5.4% on first $7,000 earned. Employer: i Requirements 1. Complete the payroll register. Round to two decimals. 2. Journalize Brook Company's salaries and wages expense accrual for the current pay period. 3. Journalize Brook Company's expenses for employer payroll taxes for the current pay period. 4. Journalize the payment to employees. 5. Journalize the payment for withholdings and employer payroll taxes. Print Done