Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Brooklyn has been contributing to a traditional IRA for seven years (all deductible contributions) and has a total of $30,000 in the account. In 2023

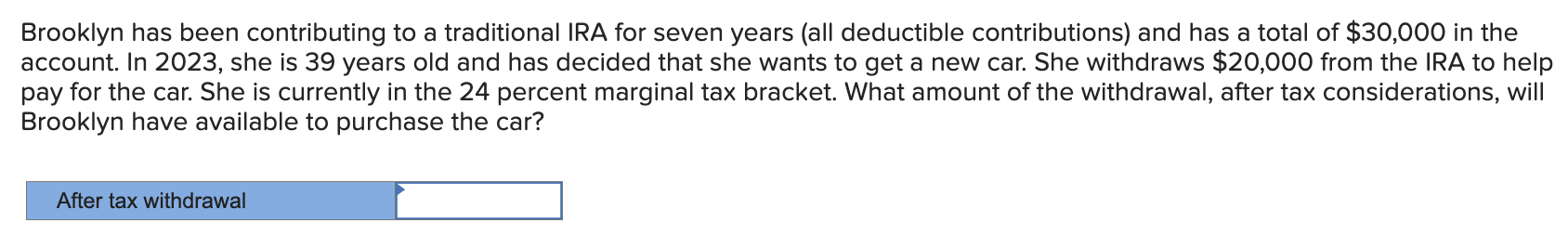

Brooklyn has been contributing to a traditional IRA for seven years (all deductible contributions) and has a total of $30,000 in the account. In 2023 , she is 39 years old and has decided that she wants to get a new car. She withdraws $20,000 from the IRA to help pay for the car. She is currently in the 24 percent marginal tax bracket. What amount of the withdrawal, after tax considerations, will Brooklyn have available to purchase the car

Brooklyn has been contributing to a traditional IRA for seven years (all deductible contributions) and has a total of $30,000 in the account. In 2023 , she is 39 years old and has decided that she wants to get a new car. She withdraws $20,000 from the IRA to help pay for the car. She is currently in the 24 percent marginal tax bracket. What amount of the withdrawal, after tax considerations, will Brooklyn have available to purchase the car Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started