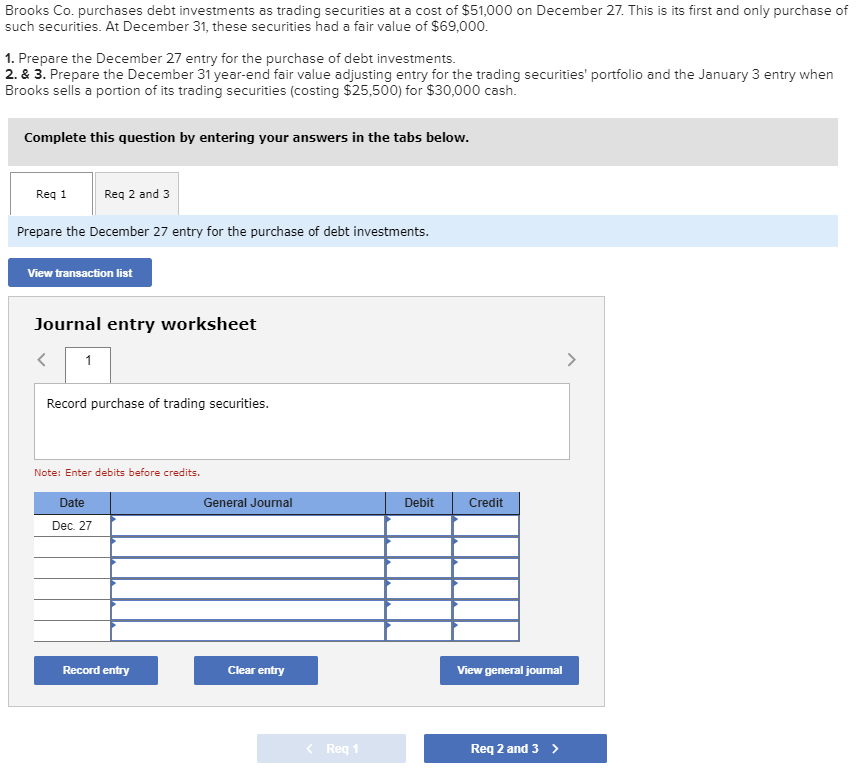

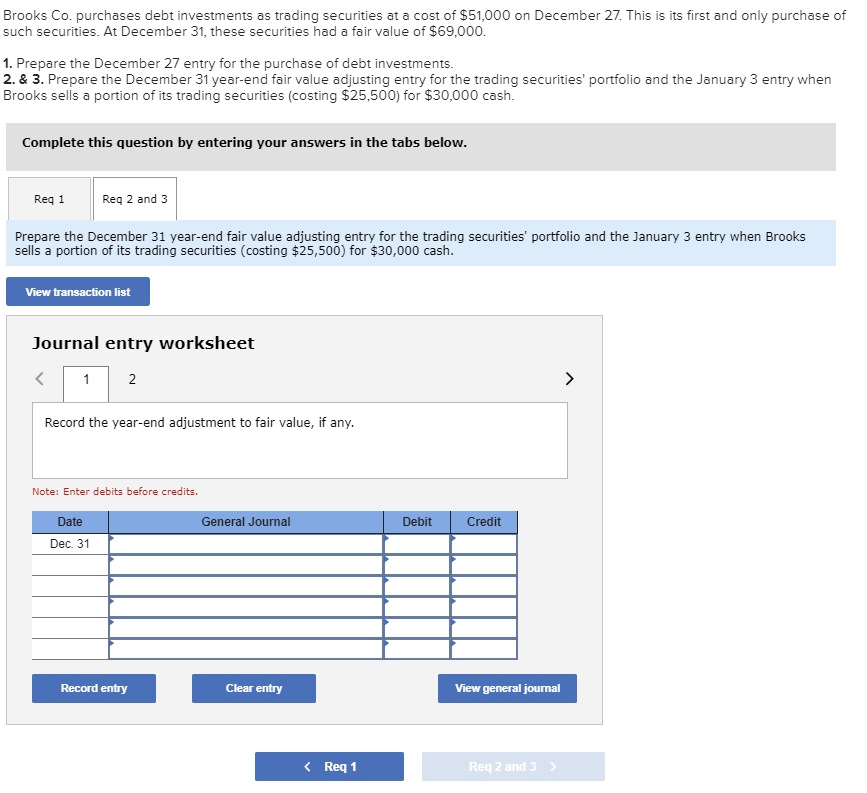

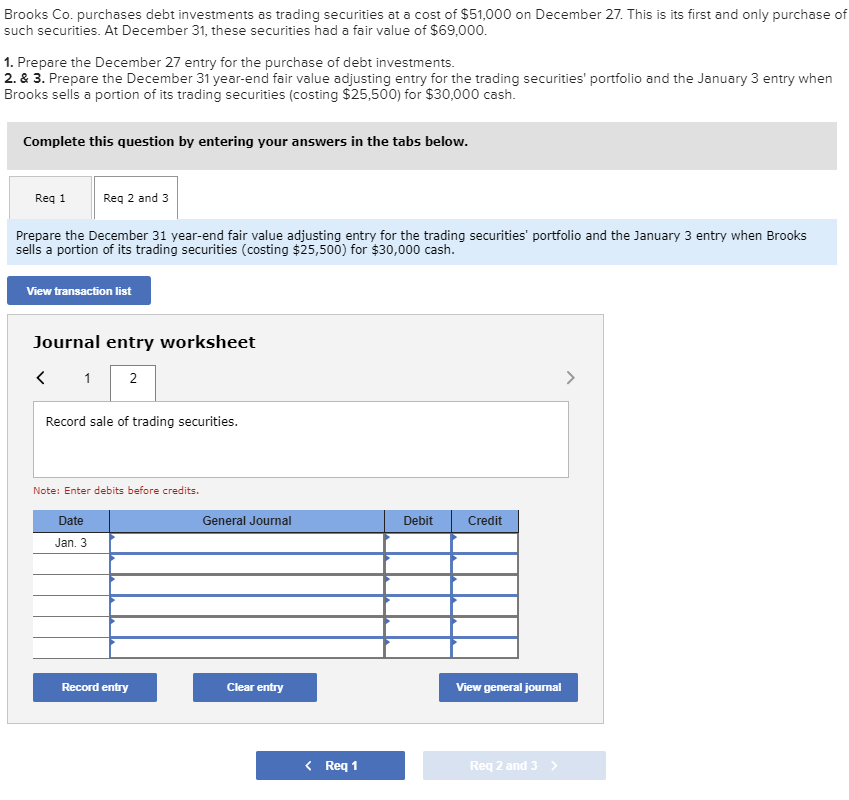

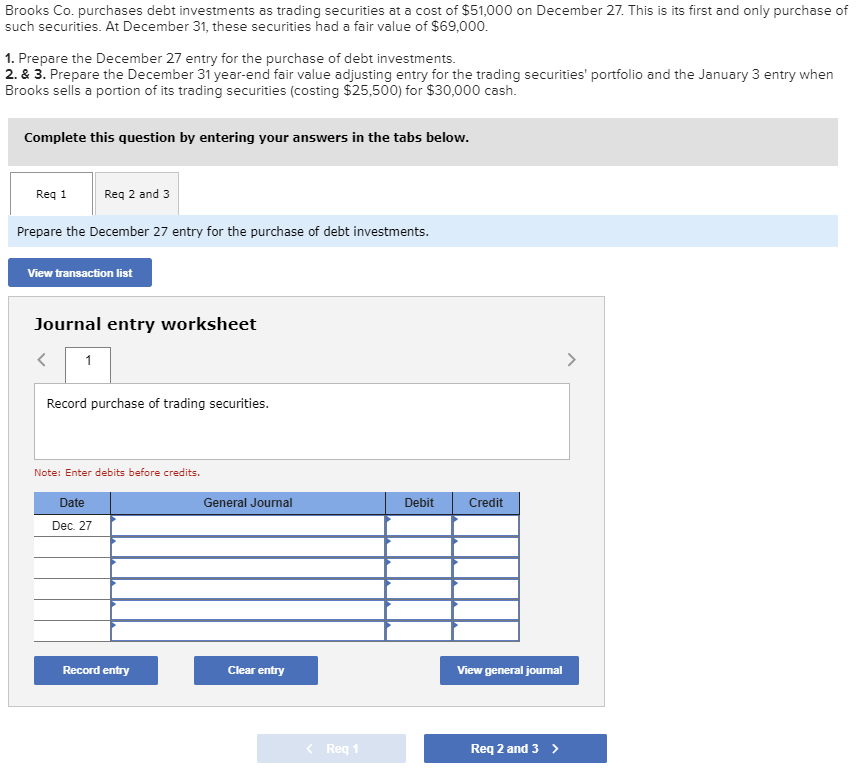

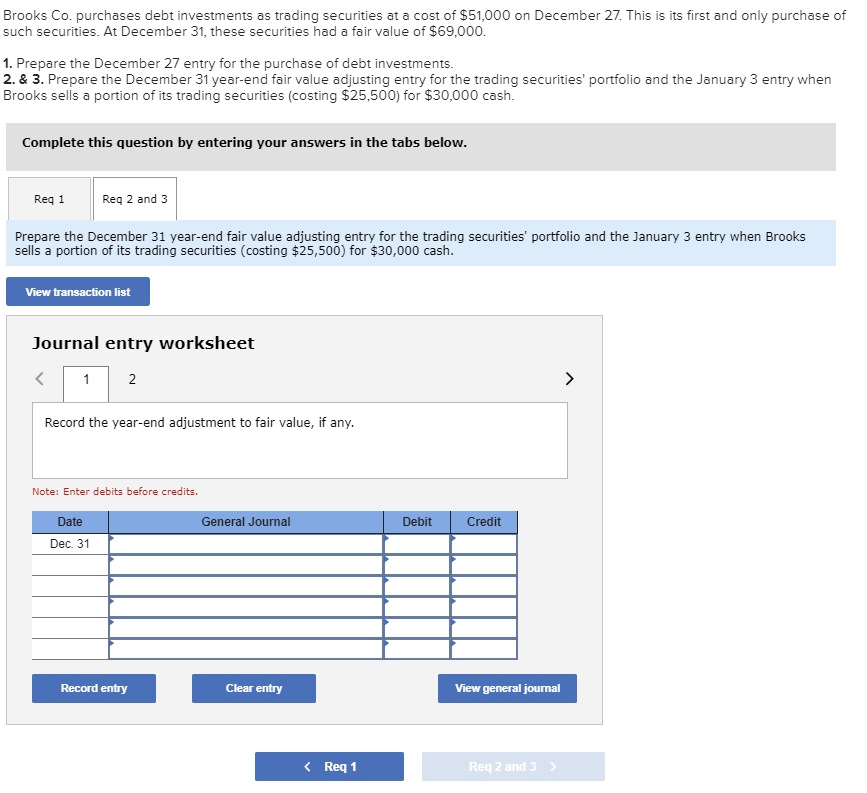

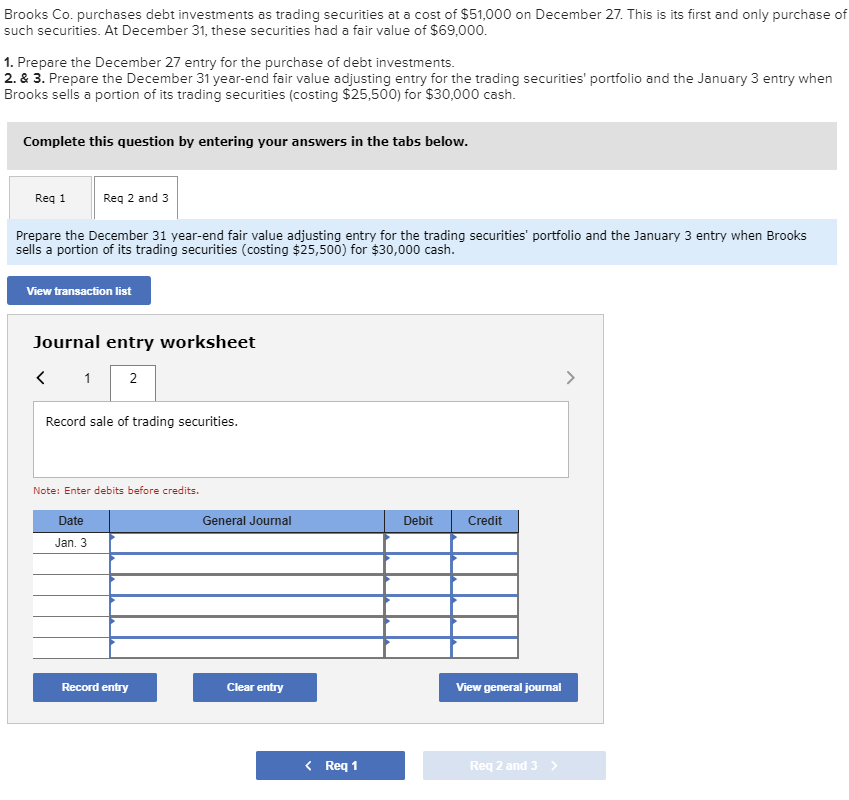

Brooks Co. purchases debt investments as trading securities at a cost of $51,000 on December 27. This is its first and only purchase of such securities. At December 31, these securities had a fair value of $69,000. 1. Prepare the December 27 entry for the purchase of debt investments. 2. & 3. Prepare the December 31 year-end fair value adjusting entry for the trading securities' portfolio and the January 3 entry when Brooks sells a portion of its trading securities (costing $25,500) for $30,000 cash. Complete this question by entering your answers in the tabs below. Req 1 Reg 2 and 3 Prepare the December 27 entry for the purchase of debt investments. View transaction list Journal entry worksheet Record purchase of trading securities. Note: Enter debits before credits. General Journal Debit Credit Date Dec. 27 Record entry Clear entry View general journal Brooks Co. purchases debt investments as trading securities at a cost of $51,000 on December 27. This is its first and only purchase of such securities. At December 31, these securities had a fair value of $69,000. 1. Prepare the December 27 entry for the purchase of debt investments. 2. & 3. Prepare the December 31 year-end fair value adjusting entry for the trading securities' portfolio and the January 3 entry when Brooks sells a portion of its trading securities (costing $25,500) for $30,000 cash. Complete this question by entering your answers in the tabs below. Req1 Reg 2 and 3 Prepare the December 31 year-end fair value adjusting entry for the trading securities' portfolio and the January 3 entry when Brooks sells a portion of its trading securities (costing $25,500) for $30,000 cash. View transaction list Journal entry worksheet Brooks Co. purchases debt investments as trading securities at a cost of $51,000 on December 27. This is its first and only purchase of such securities. At December 31, these securities had a fair value of $69,000. 1. Prepare the December 27 entry for the purchase of debt investments. 2. & 3. Prepare the December 31 year-end fair value adjusting entry for the trading securities' portfolio and the January 3 entry when Brooks sells a portion of its trading securities (costing $25,500) for $30,000 cash. Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 Prepare the December 31 year-end fair value adjusting entry for the trading securities' portfolio and the January 3 entry when Brooks sells a portion of its trading securities (costing $25,500) for $30,000 cash. View transaction list Journal entry worksheet