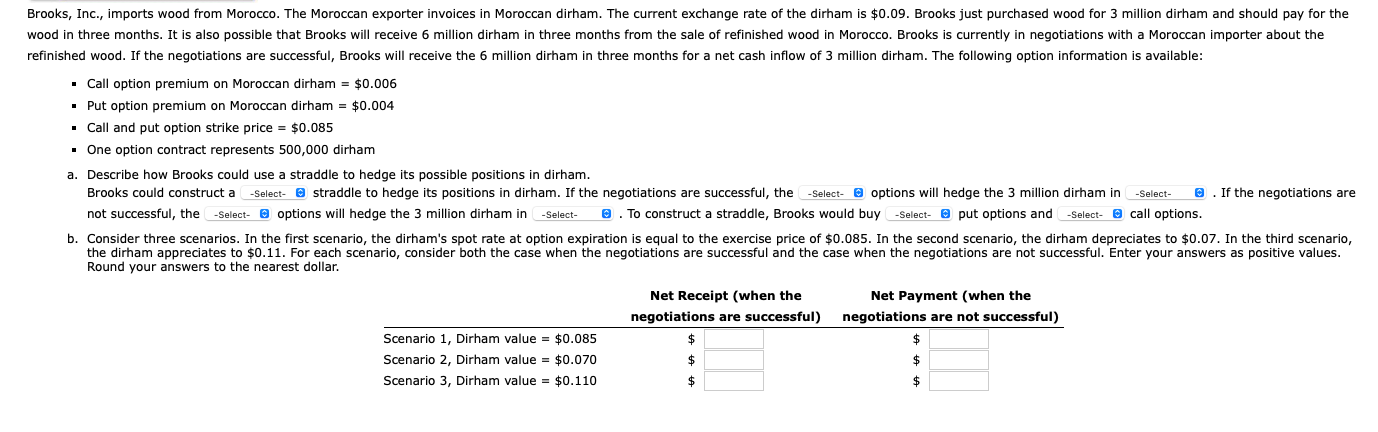

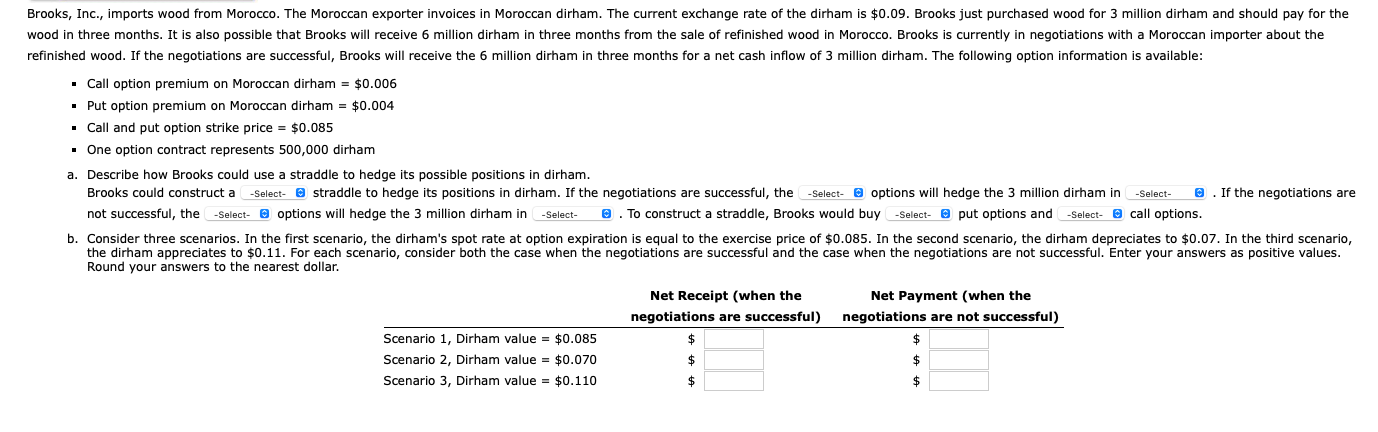

Brooks, Inc., imports wood from Morocco. The Moroccan exporter invoices in Moroccan dirham. The current exchange rate of the dirham is $0.09. Brooks just purchased wood for 3 million dirham and should pay for the wood in three months. It is also possible that Brooks will receive 6 million dirham in three months from the sale of refinished wood in Morocco. Brooks is currently in negotiations with a Moroccan importer about the refinished wood. If the negotiations are successful, Brooks will receive the 6 million dirham in three months for a net cash inflow of 3 million dirham. The following option information is available: Call option premium on Moroccan dirham = $0.006 Put option premium on Moroccan dirham = $0.004 Call and put option strike price = $0.085 One option contract represents 500,000 dirham a. Describe how Brooks could use a straddle to hedge its possible positions in dirham. Brooks could construct a -Select- straddle to hedge its positions in dirham. If the negotiations are successful, the -Select options will hedge the 3 million dirham in -Select- . If the negotiations are not successful, the -Select- options will hedge the 3 million dirham in -Select- . To construct a straddle, Brooks would buy -Select- put options and -Select- call options. b. Consider three scenarios. In the first scenario, the dirham's spot rate at option expiration is equal to the exercise price of $0.085. In the second scenario, the dirham depreciates to $0.07. In the third scenario, the dirham appreciates to $0.11. For each scenario, consider both the case when the negotiations are successful and the case when the negotiations are not successful. Enter your answers as positive values. Round your answers to the nearest dollar. Net Payment (when the negotiations are not successful) Scenario 1, Dirham value = $0.085 Scenario 2, Dirham value = $0.070 Scenario 3, Dirham value = $0.110 Net Receipt (when the negotiations are successful) $ $ $ $ Brooks, Inc., imports wood from Morocco. The Moroccan exporter invoices in Moroccan dirham. The current exchange rate of the dirham is $0.09. Brooks just purchased wood for 3 million dirham and should pay for the wood in three months. It is also possible that Brooks will receive 6 million dirham in three months from the sale of refinished wood in Morocco. Brooks is currently in negotiations with a Moroccan importer about the refinished wood. If the negotiations are successful, Brooks will receive the 6 million dirham in three months for a net cash inflow of 3 million dirham. The following option information is available: Call option premium on Moroccan dirham = $0.006 Put option premium on Moroccan dirham = $0.004 Call and put option strike price = $0.085 One option contract represents 500,000 dirham a. Describe how Brooks could use a straddle to hedge its possible positions in dirham. Brooks could construct a -Select- straddle to hedge its positions in dirham. If the negotiations are successful, the -Select options will hedge the 3 million dirham in -Select- . If the negotiations are not successful, the -Select- options will hedge the 3 million dirham in -Select- . To construct a straddle, Brooks would buy -Select- put options and -Select- call options. b. Consider three scenarios. In the first scenario, the dirham's spot rate at option expiration is equal to the exercise price of $0.085. In the second scenario, the dirham depreciates to $0.07. In the third scenario, the dirham appreciates to $0.11. For each scenario, consider both the case when the negotiations are successful and the case when the negotiations are not successful. Enter your answers as positive values. Round your answers to the nearest dollar. Net Payment (when the negotiations are not successful) Scenario 1, Dirham value = $0.085 Scenario 2, Dirham value = $0.070 Scenario 3, Dirham value = $0.110 Net Receipt (when the negotiations are successful) $ $ $ $