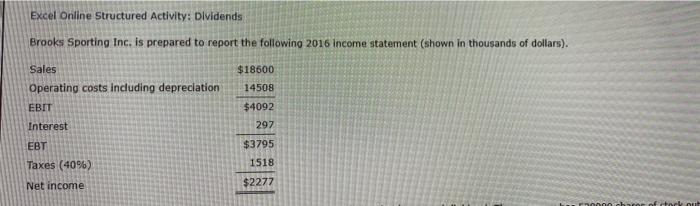

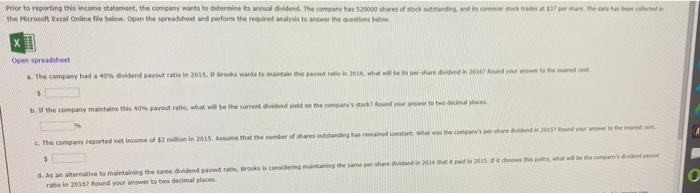

Brooks Sporting Inc is prepared tort the following 2016 homestament (shown in thousands of dollars) Sales S16000 Operating costs Indong depreciation 1450 LOTT 34092 297 $1795 Tas (404) 1510 Net Income $2277 Prior to rooting this income statement, the company wants to determine is dividend. The company has 520000 shares of stock outstanding and commenticks at 37 per share. The data has been collected the recente below. Open the spreadsheet and perform there analysis tower the questione Open het s. The comowny had con dividend payout rate in 2015. ok wants to maintain seront to 1, 2016, what will be taper share ordered 2067 Round Wur noser to the part ont in e company maintain the con pavot rate, what will be the current dividend ved on the company's stade round your answer to two decent ad pace. c. The company reported net inte of 12 million in 2015. Anume that the rumber of share outstanding that remained constant, what was the comes where dided w 2015 round your answer to rewet A. Matematis be maintaining the dividend parent rate, teks le condidering maintaining the same per share dividend in 2016 that it cand in 2015. u chooses the police what will be the crownsvidend parent ration 2017 Round you to two decimal aces me that the company is sed ning end of the compared to dedin W for the company to main contendevout of the same predvidene 1. Since the two transactions to be the moment constant de 11. Since the company to cover it was for them to matchar den Excel Online Structured Activity: Dividends Brooks Sporting Inc. is prepared to report the following 2016 income statement (shown in thousands of dollars). $18600 Sales Operating costs including depreciation EBIT 14508 $4092 Interest 297 EBT $3795 Taxes (40%) 1518 Net income $2277 Prior to reporting the income statement, the company wants to determines annual vided. The company has 520000 sharest stod och betalen the Microsoft Excel Online bow. Open the red perform them to the Orhet The company had 40 divenduti in 2015. to maintain the who b. W the company maintains the 40% prout ratio, what are the current intend vide on the The company reported at income of 12 in 2015, that the shares and has 5 d. Assume to maintain the divided but remember than 100 ratie in 2016 Round your awer to two decimal places Brooks Sporting Inc. is prepared to report the following 2016 income statement (shown in thousands of data) Sales Operating costs including depreciation EBIT Tnterest EBT Taxes (409 Net Income $13600 14508 $4092 297 $3795 1518 $2277 Prior to reporting this income statement, the company wants to determine its annual dividend. The company has 52000 shares of stock outstandes, and is common the trade 337 pet share the data acted the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to write outons belon Open spreadsheet The company had a 40% dividend payout ratio in 2015. of Brooks wants to maintain this outrat in 2016, we wisperare din 2016 5 . If the company maintains the 40% payout ratio, what will be the current vidend yield on the company's stock round your wer to the domes The company reported net income 2 million in 2015. Asume that the number of share outstanding has remained constare, what was the core has done in 2017 andre 5 d. As an alternative to maintaining the same dividend payout ratio, troos is considering manting the same share when ratio in 20167 Round your answer to two decimal places wwwanding its operation and that this will the main the same share