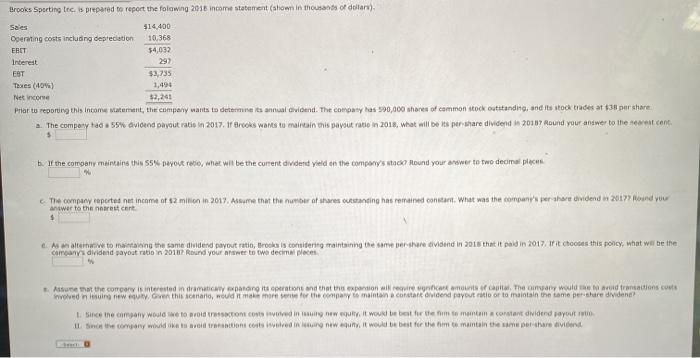

Brooks Sporting tec. is prepared to report the flowing 2016 income statement (shown in thousands of dollars) Sales $14.400 Operating costs including depreciation 10.368 EBIT 34,032 Interest EST $3,735 Taxes (40%) 1,494 Net incorre $2,241 Prior to reporting this income Matement, the company wants to determinats annual dividend. The company has 590,000 shares of common stock outstanding and its stock trades at per share a. The company had 55% dvidend payout ratie in 2017. If Brooks wants to maintain this payoutatie in 2018, what will be its per share dividend 20187 Round your answer to the rest cont $ b. If the company maintains thin s5 payout ratio, what will be the content dividend yield on the company's stoso Round your answer to two decima place The company apertos et income of 82 million in 2017. Assume that the number of rescutanding has remained constant. What was the commerce dividend w 2017? Pound you Anterneto mang the same dividend payout ratio, Brooksis content maintaining the same pershare divided in 2013 that it paid in 2017. If it chooses this policy, what will be the caman dividend payout rabo in 2017 Round your answer to two decimal places Asume at the company is interested in dramatica parang its operations and that the expansion will revient montera. They would torud tractions couts volved in ning new even this scenario, out more sense for the way to maintain a dividend payout or to maintain the same pershare dividend Le company wolowe to avoid TOM CONS Introdin nung nguy it would be best for them to mantem constant dividend payout the company wide ratione conting unit best for them to maintain the phare divided Brooks Sporting tec. is prepared to report the flowing 2016 income statement (shown in thousands of dollars) Sales $14.400 Operating costs including depreciation 10.368 EBIT 34,032 Interest EST $3,735 Taxes (40%) 1,494 Net incorre $2,241 Prior to reporting this income Matement, the company wants to determinats annual dividend. The company has 590,000 shares of common stock outstanding and its stock trades at per share a. The company had 55% dvidend payout ratie in 2017. If Brooks wants to maintain this payoutatie in 2018, what will be its per share dividend 20187 Round your answer to the rest cont $ b. If the company maintains thin s5 payout ratio, what will be the content dividend yield on the company's stoso Round your answer to two decima place The company apertos et income of 82 million in 2017. Assume that the number of rescutanding has remained constant. What was the commerce dividend w 2017? Pound you Anterneto mang the same dividend payout ratio, Brooksis content maintaining the same pershare divided in 2013 that it paid in 2017. If it chooses this policy, what will be the caman dividend payout rabo in 2017 Round your answer to two decimal places Asume at the company is interested in dramatica parang its operations and that the expansion will revient montera. They would torud tractions couts volved in ning new even this scenario, out more sense for the way to maintain a dividend payout or to maintain the same pershare dividend Le company wolowe to avoid TOM CONS Introdin nung nguy it would be best for them to mantem constant dividend payout the company wide ratione conting unit best for them to maintain the phare divided