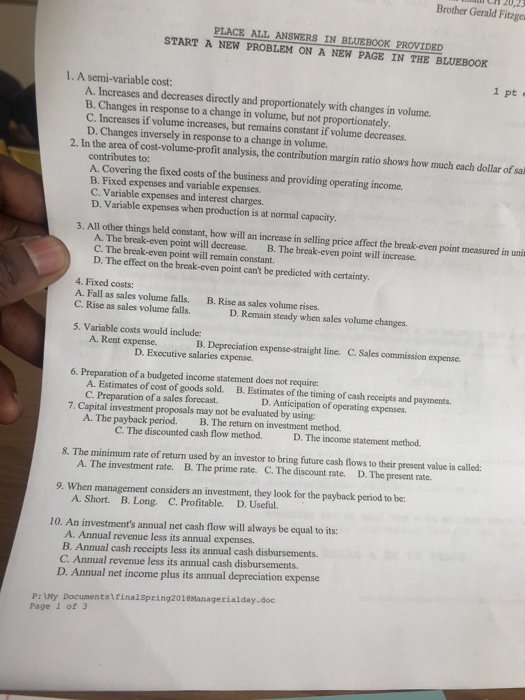

Brother Gerald Fitzge PLACE ALL ANSWERS IN BLUEBOOK PROVIDED START A NEW PROBLEM ON A NEW PAGE IN THE BLUEBOOK 1. A semi-variable cost: ?pto A. Increases and decreases directly and proportionately with changes in volume. B. Changes in response to a change in volume, but not proportionately C. Increases if volume increases, but remains constant if volume decreases. D. Changes inversely in response to a change in volume. 2. In the area of cost-volume-profit analysis, the contribution margin ratio shows how much each dollar of sal contributes to: A. Covering the fixed costs of the business and providing operating income. B. Fixed expenses and variable expenses. C. Variable expenses and interest charges. D. Variable expenses when production is at normal capacity things held constant, how will an increase in selling price affect the break-even point measured in unis A. The break-even point will decrease. B. The break-even point will increase C. The break-even point will remain constant D. The effect on the break-even point can't be predicted with certainty 4. Fixed costs: A. Fall as sales volume falls. C. Rise as sales volume falls. B. Rise as sales volume rises. D. Remain steady when sales volume changes 5. Variable costs would include A. Rent expense. B. Depreciation expense-straight line. C. Sales commission expense. D. Executive salaries expense. 6. Preparation of a budgeted income statement does not require: 7. Capital investment proposals may not be evaluated by using C. The discounted cash flow method A. Estimates of cost of goods sold.B. Estimates of the timing of cash receipts and payments. C. Preparation of a sales forecast. D. Anticipation of operating expenses A. The payback period. B. The return on investment method. D. The income statement method. 8. The minimum rate of return used by an investor to bring future cash flows to their present value is called: A. The investment rate. B. The prime rate. C. The discount rate. D. The present rate. 9. When management considers an investment, they look for the payback period to be: A. Short. B. Long. C. Profitable. D. Useful. 10. An investment's annual net cash flow will always be equal to its: A. Annual revenue less its annual expenses. B. Annual cash receipts less its annual cash disbursements C. Annual revenue less its annual cash disbursements. D. Annual net income plus its annual depreciation expense P: My Documentslfinalspring2018Managerialday.doc Page 1 of 3