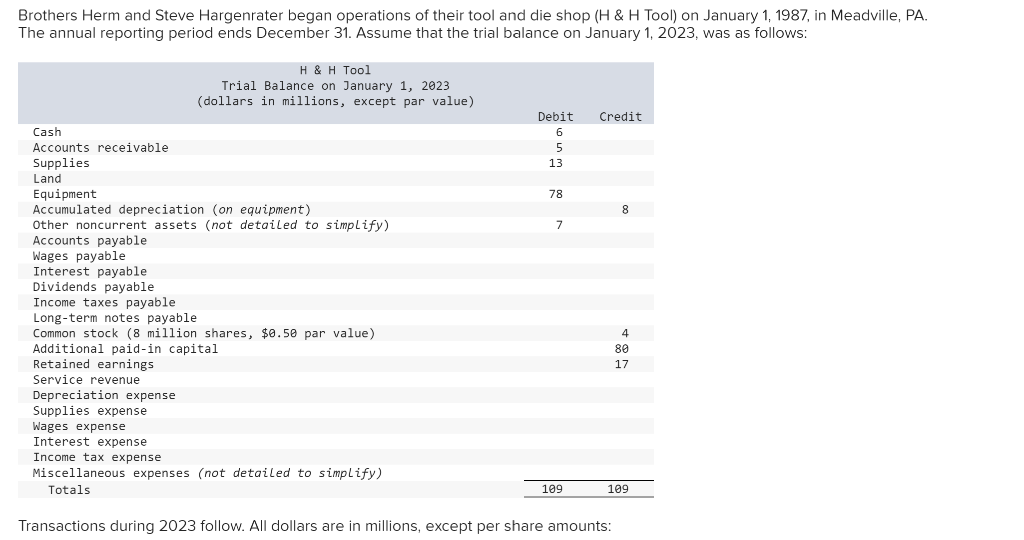

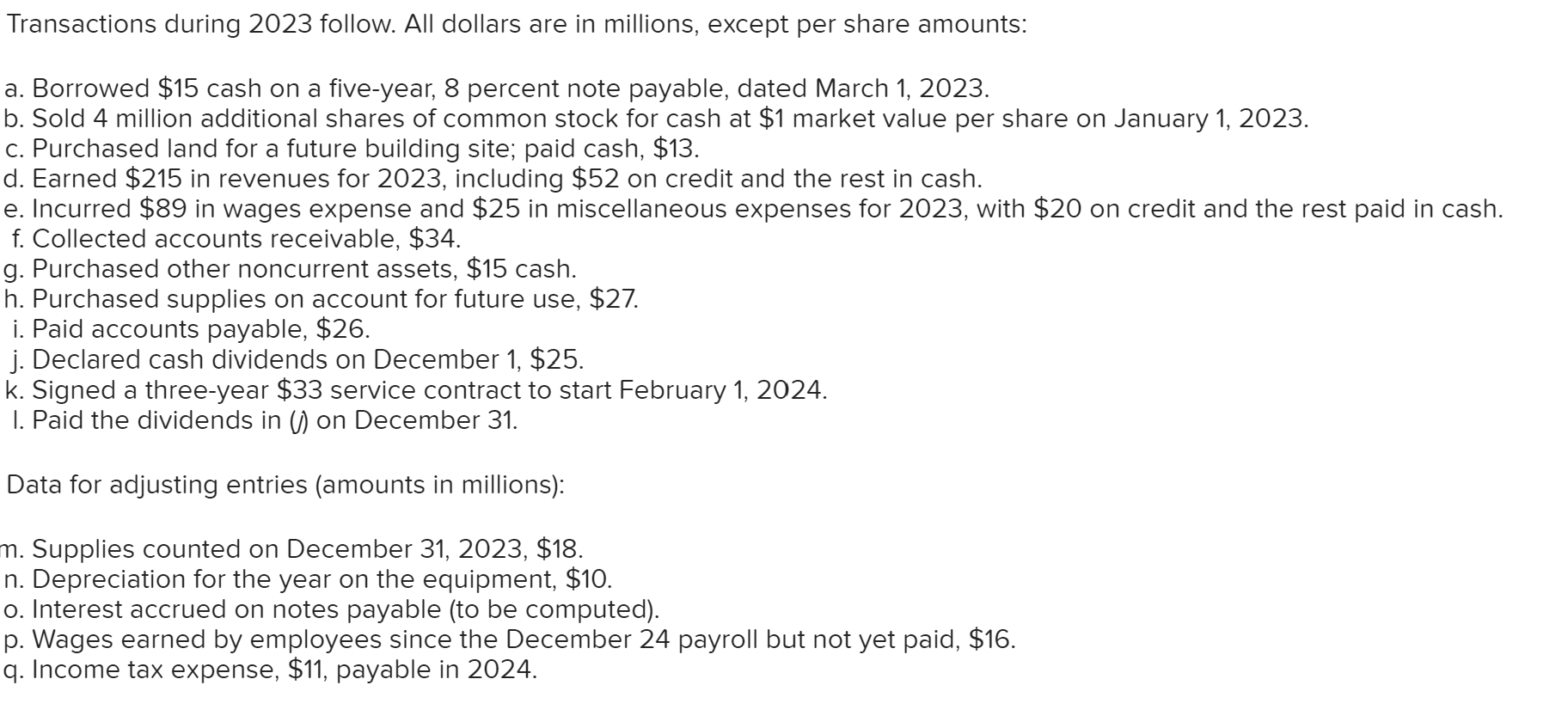

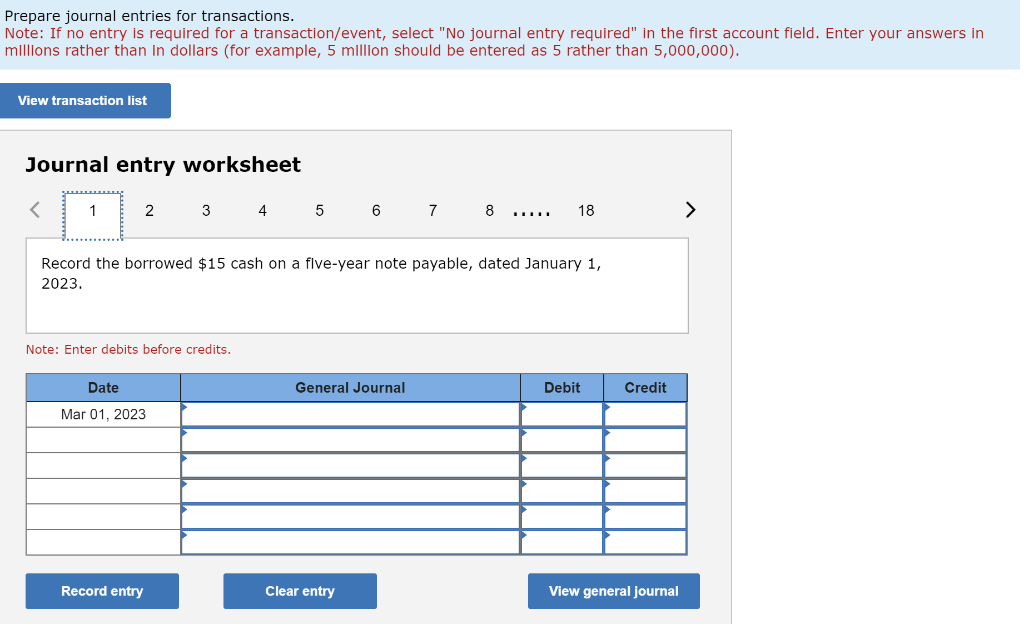

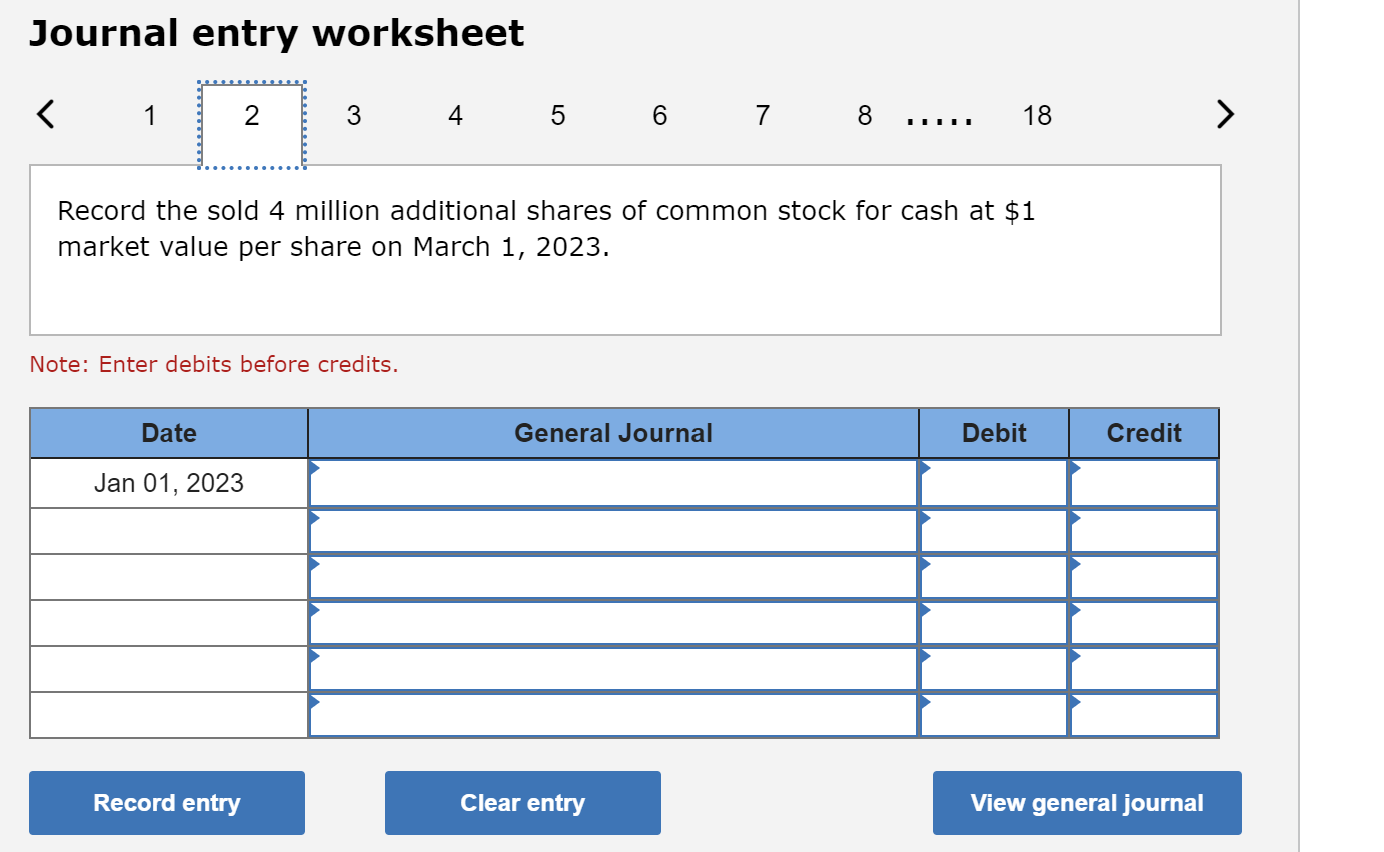

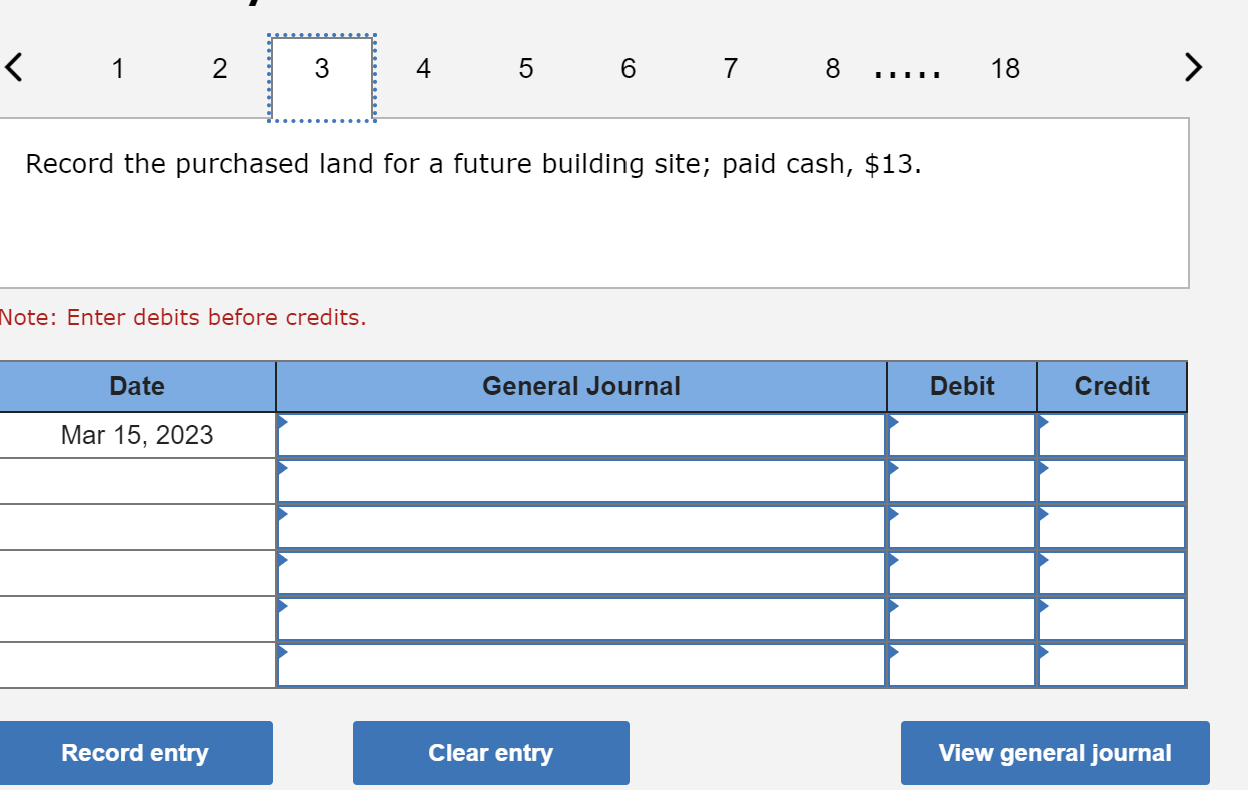

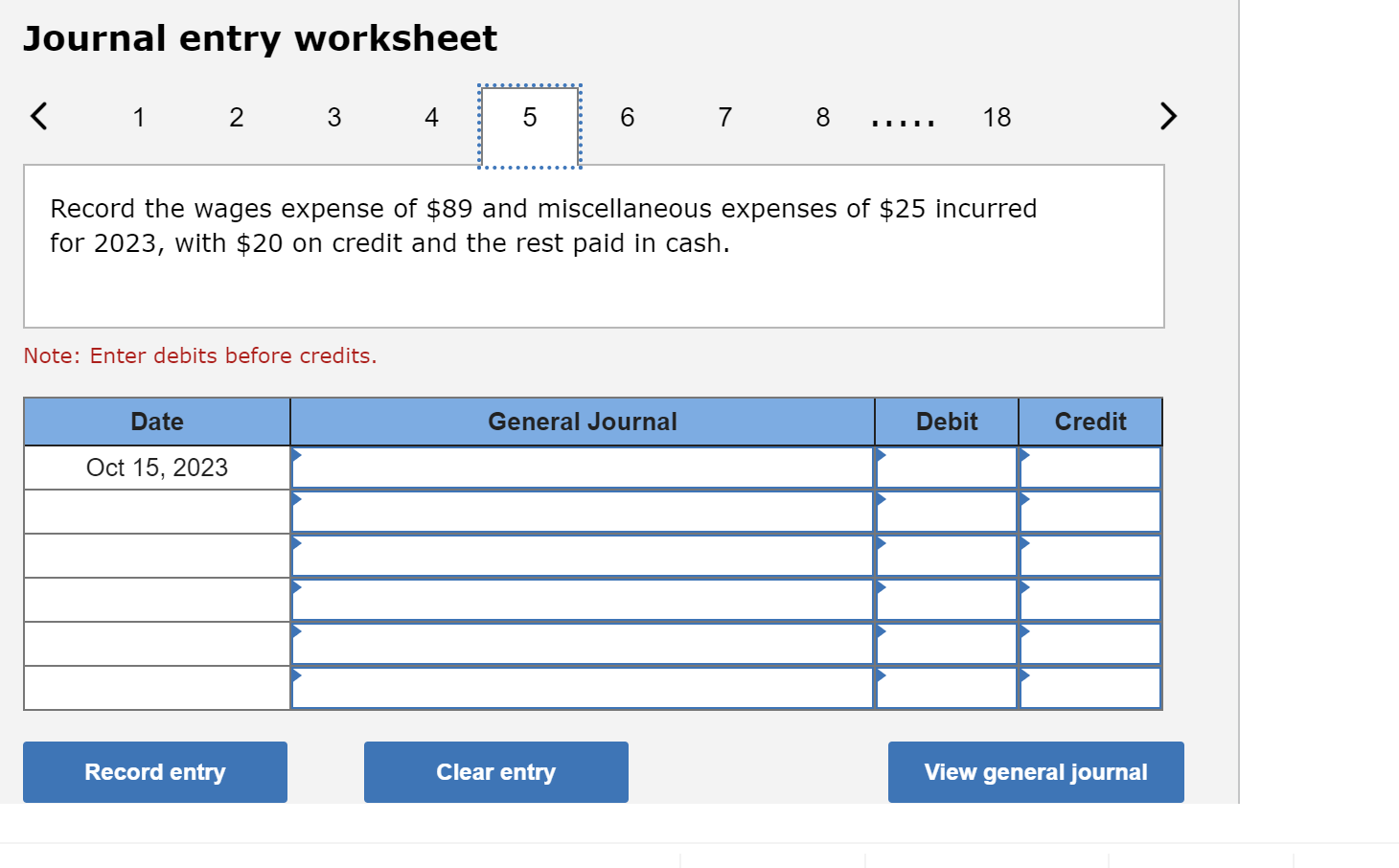

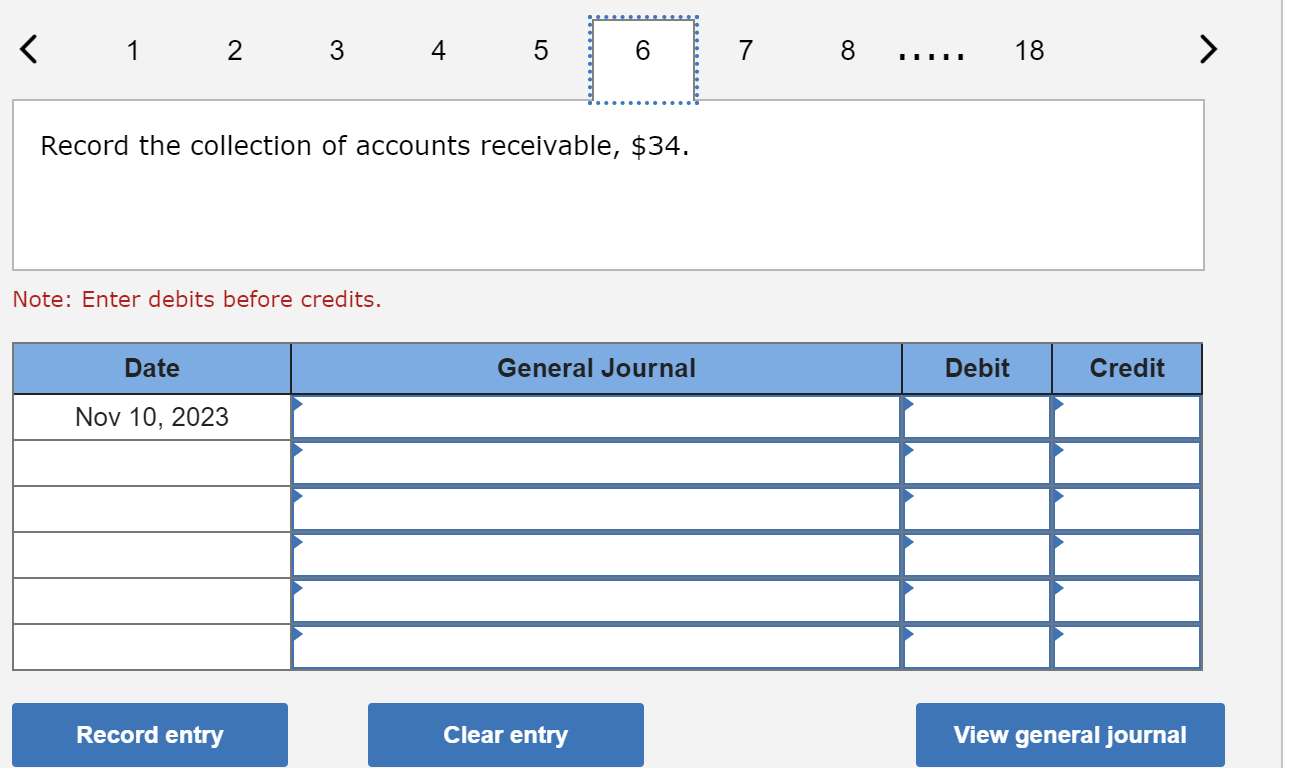

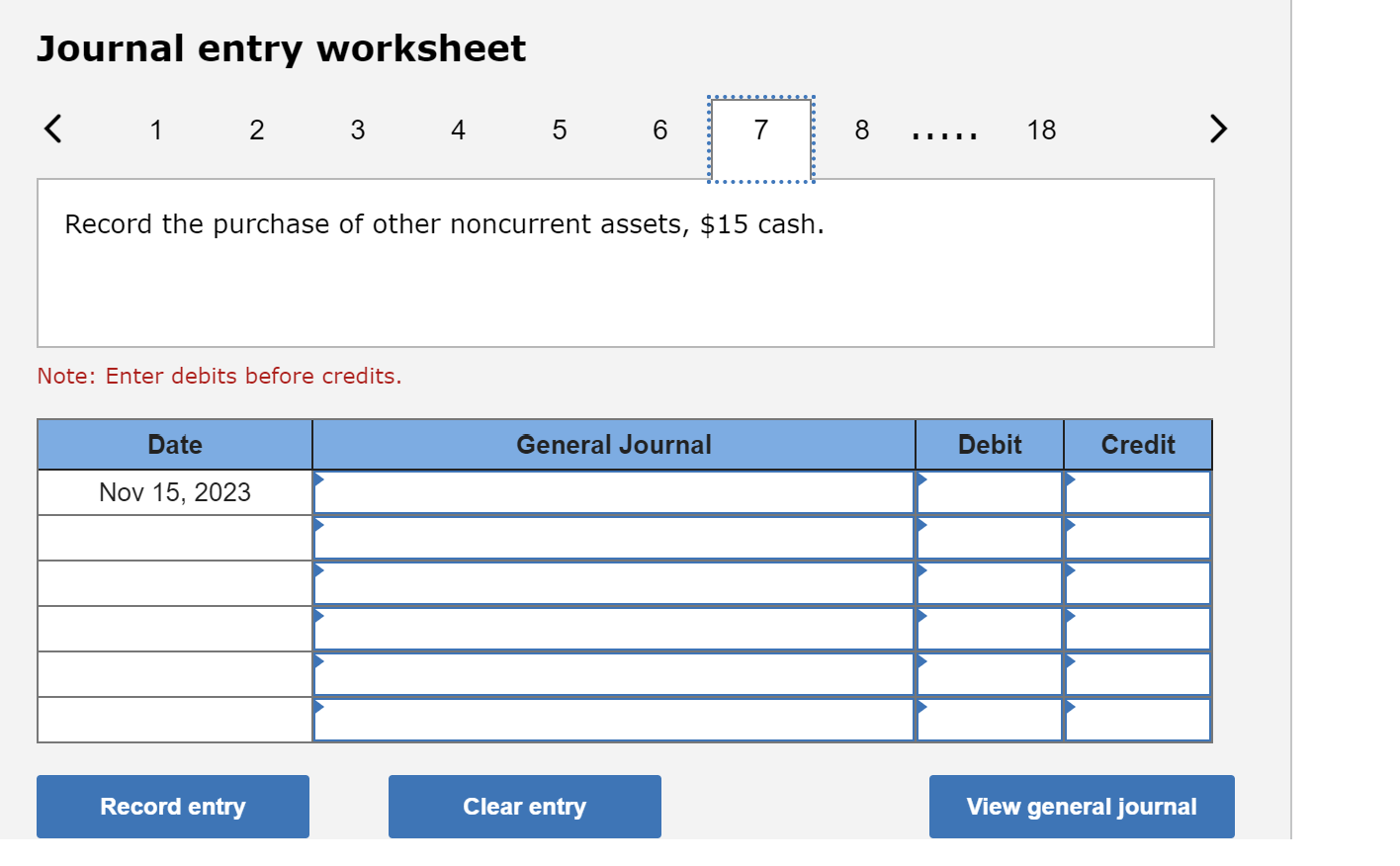

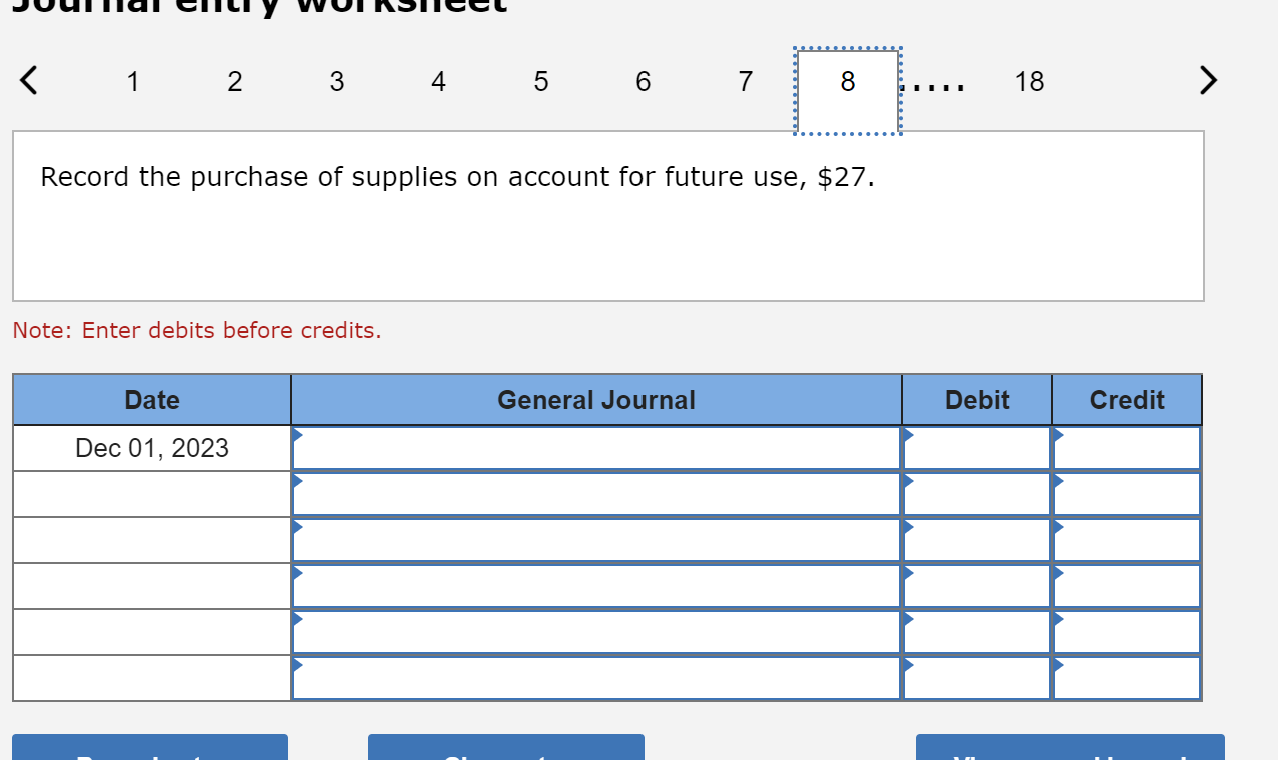

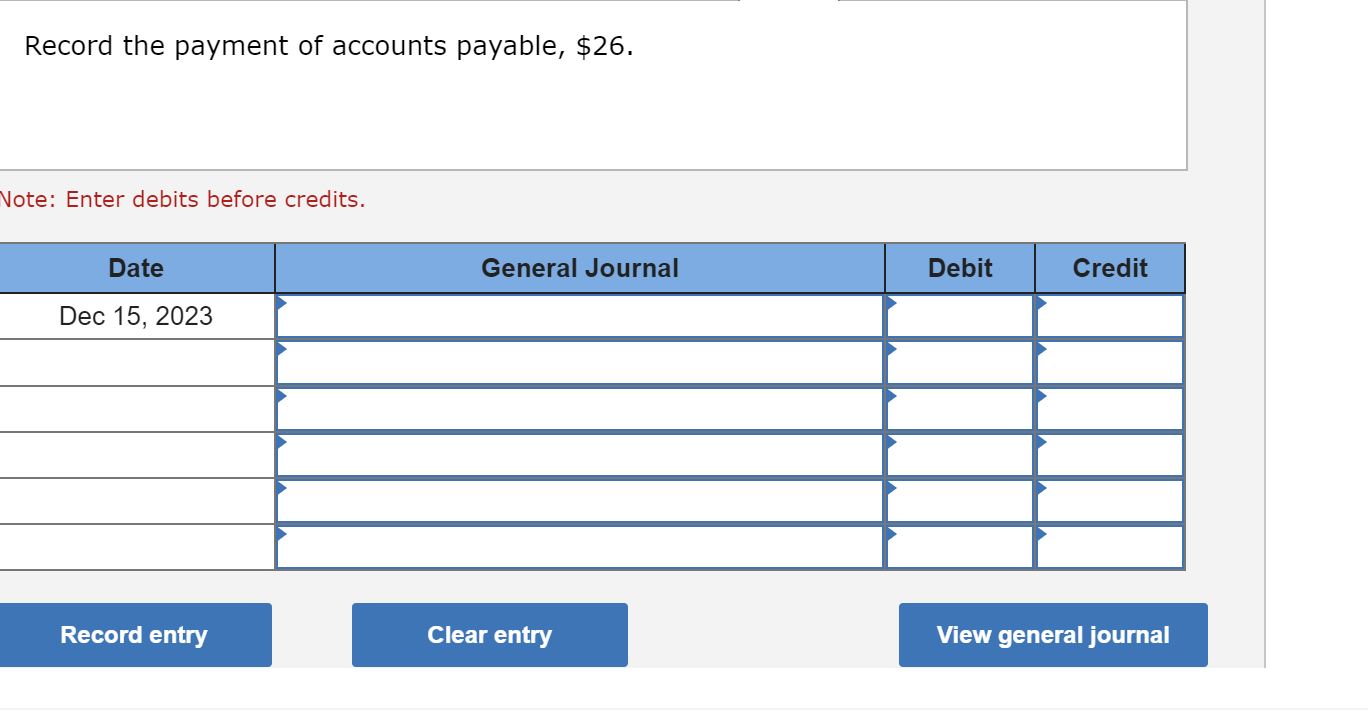

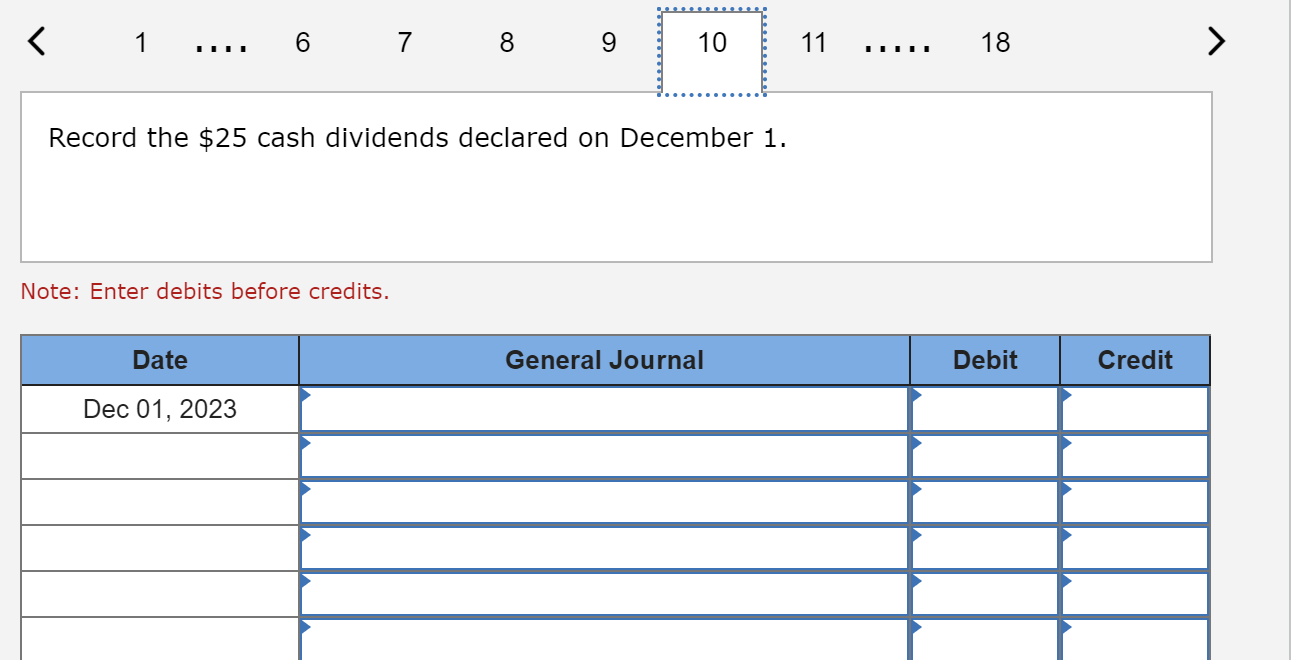

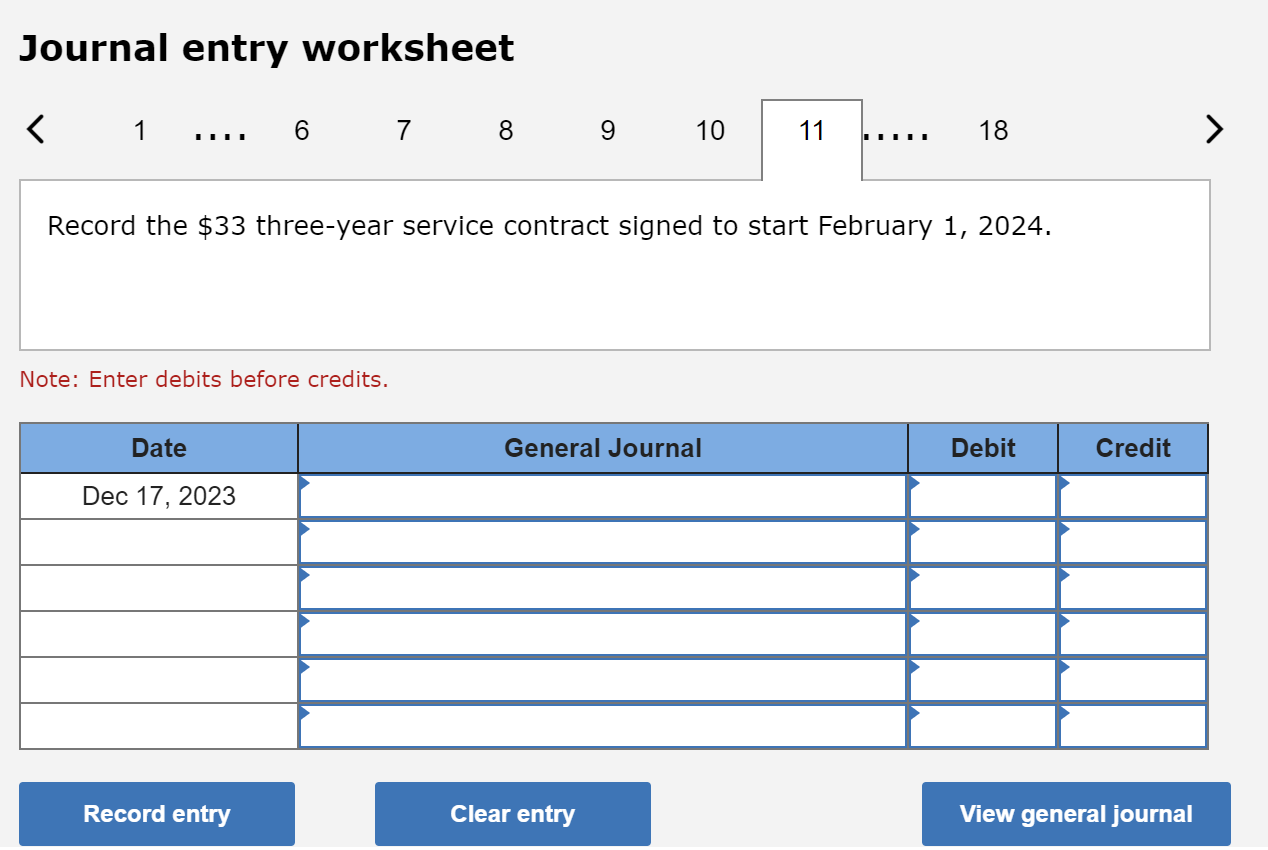

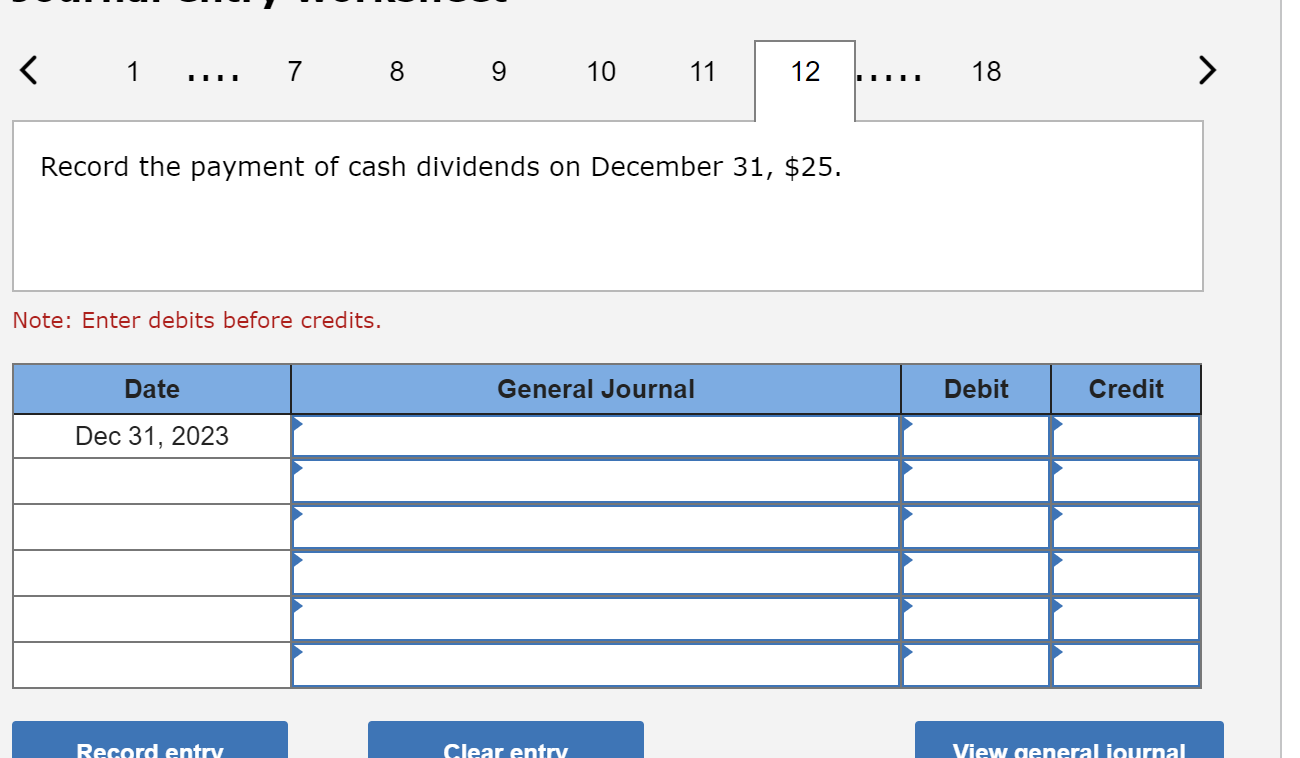

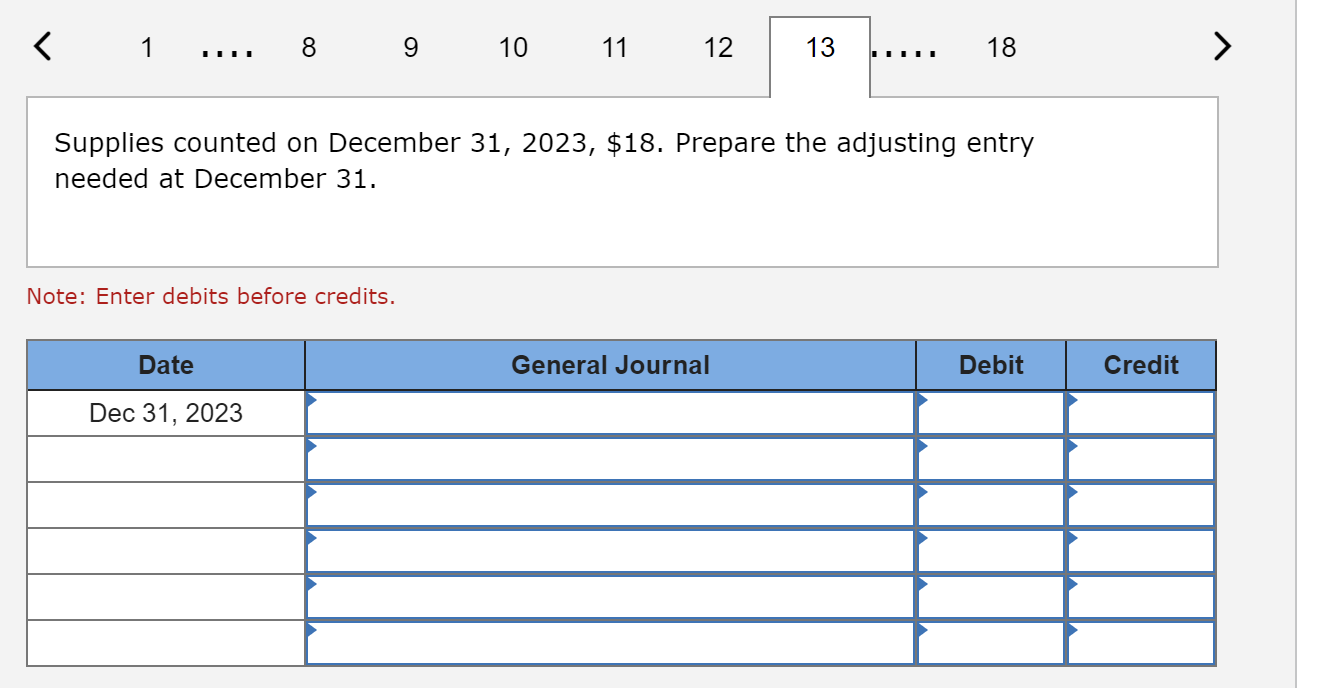

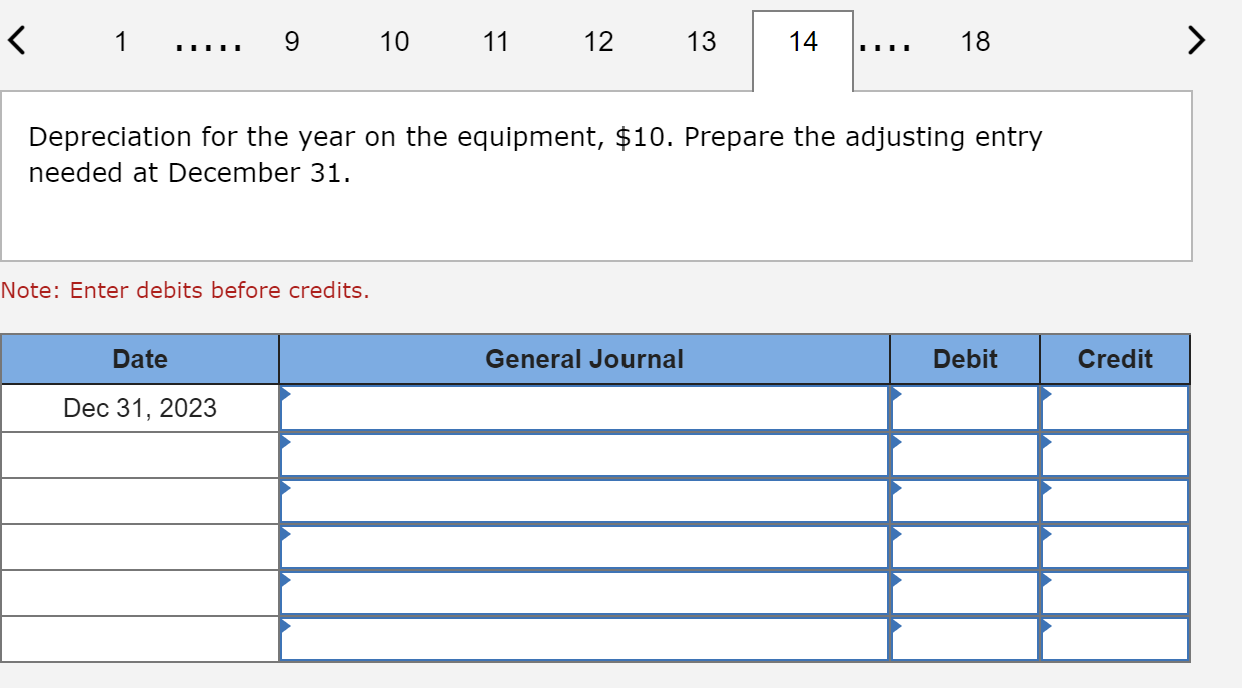

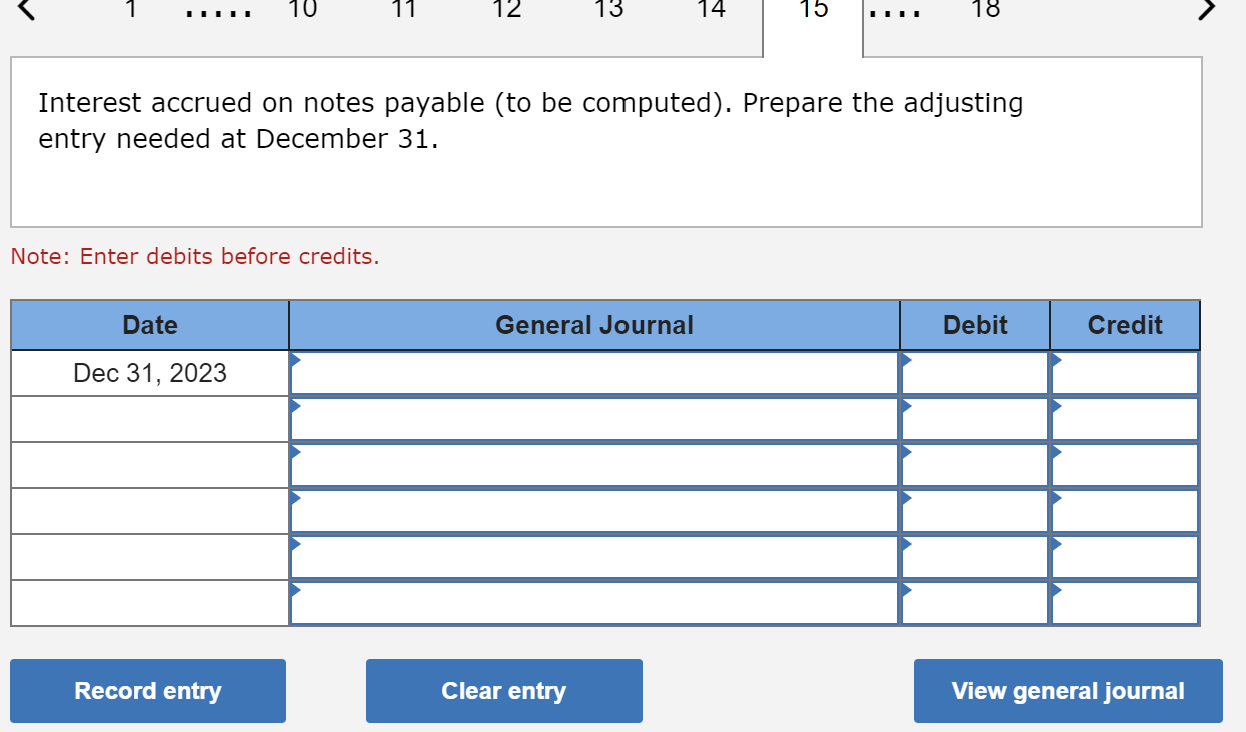

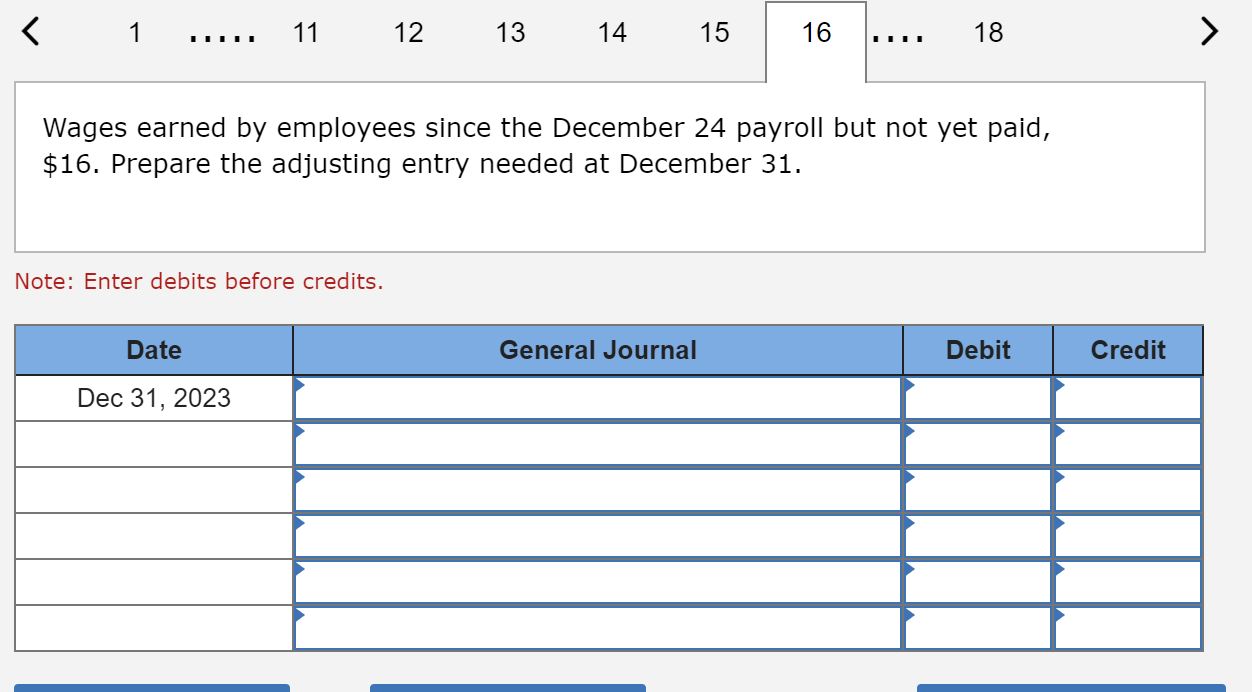

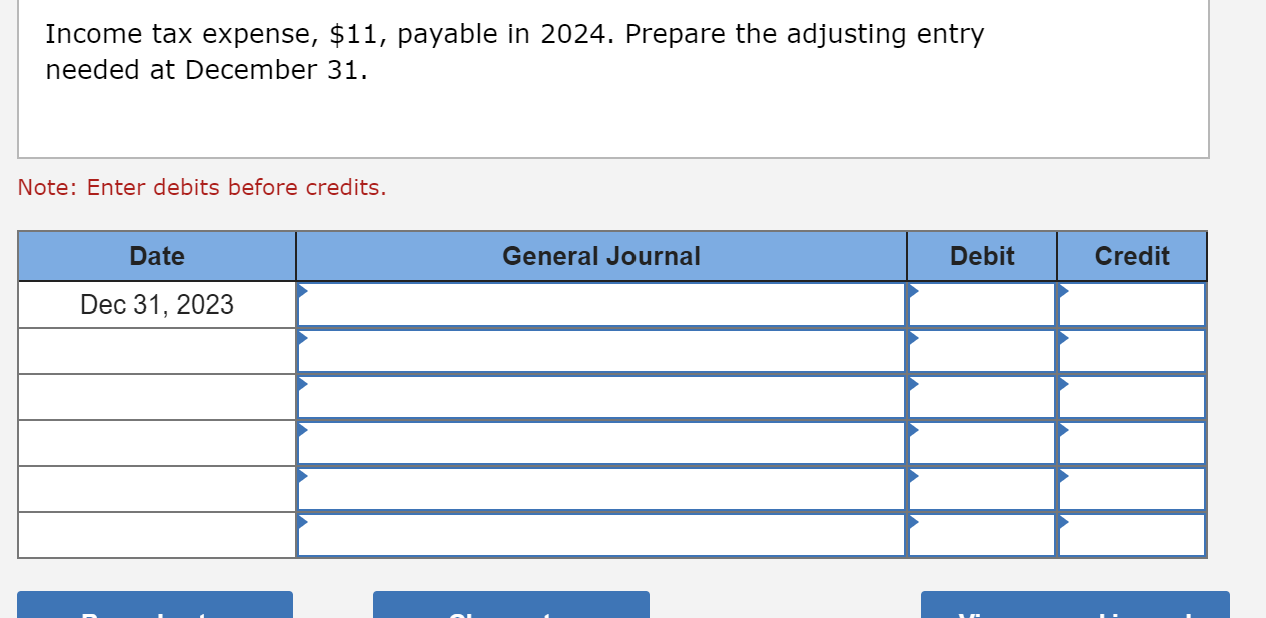

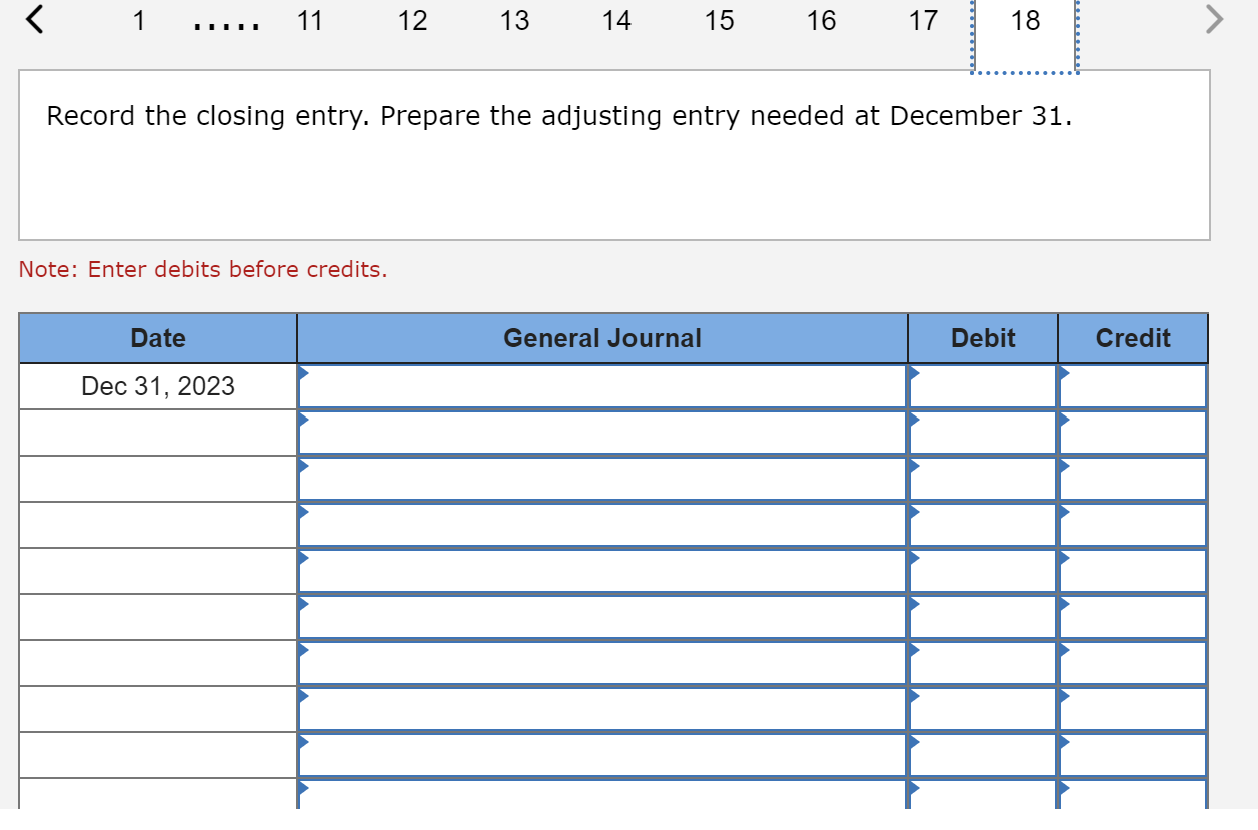

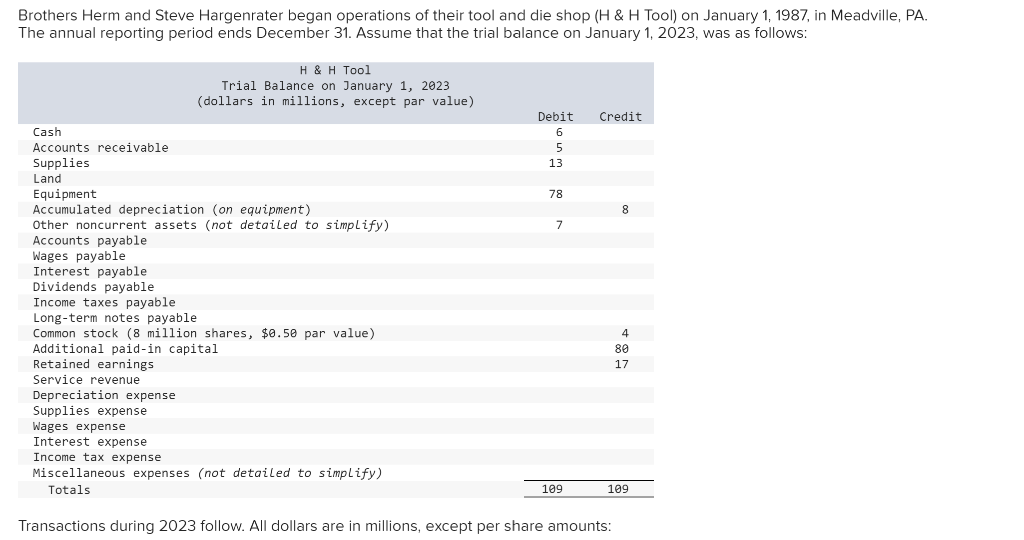

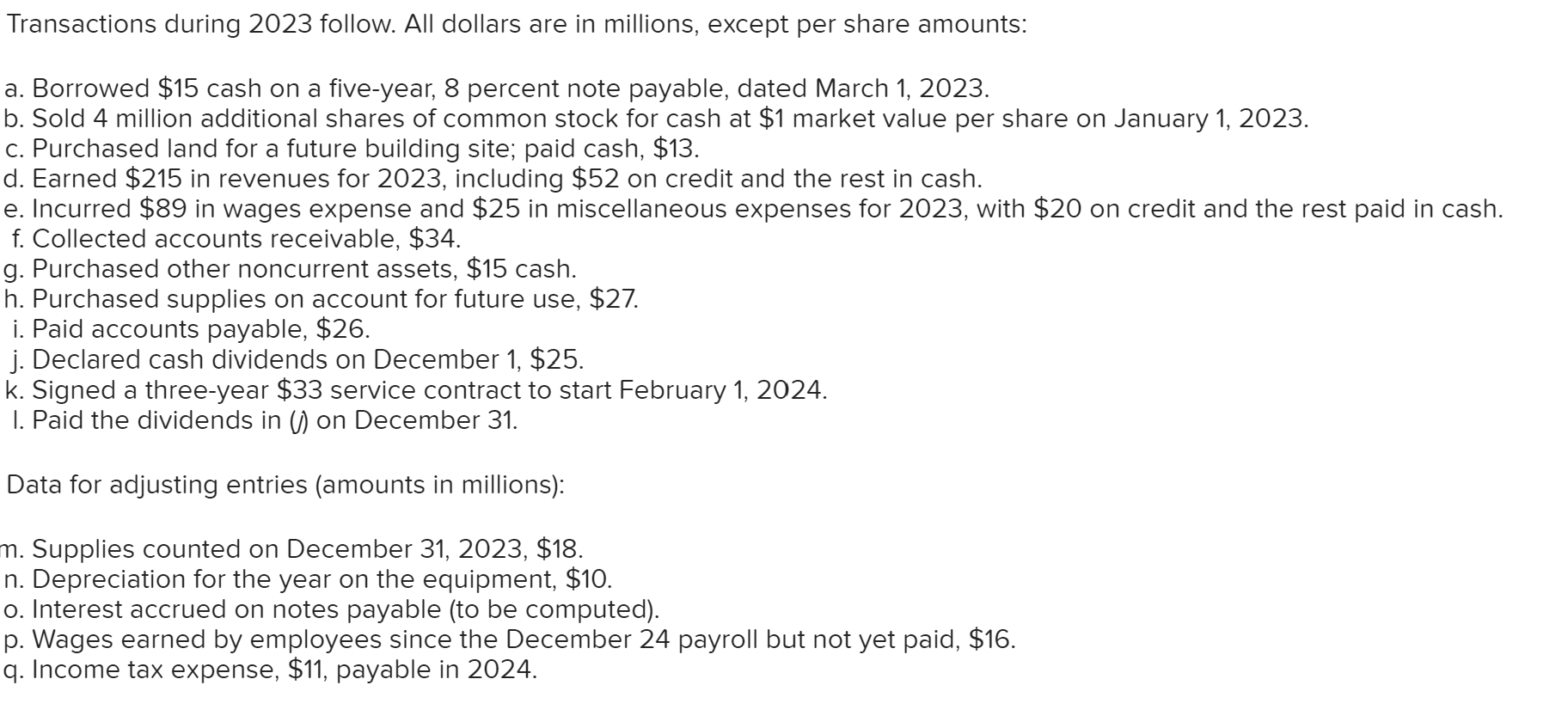

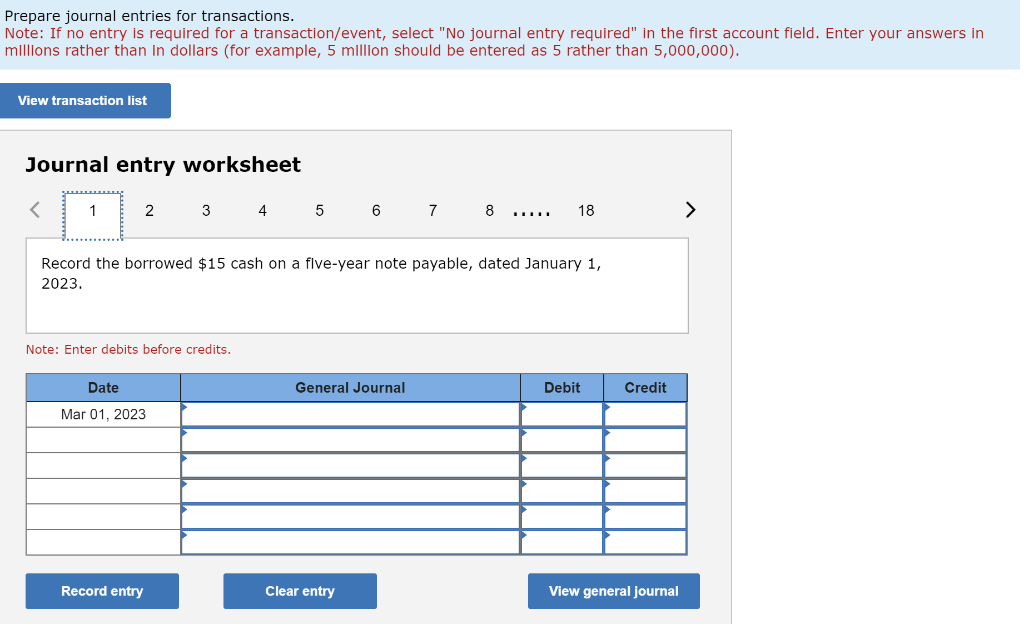

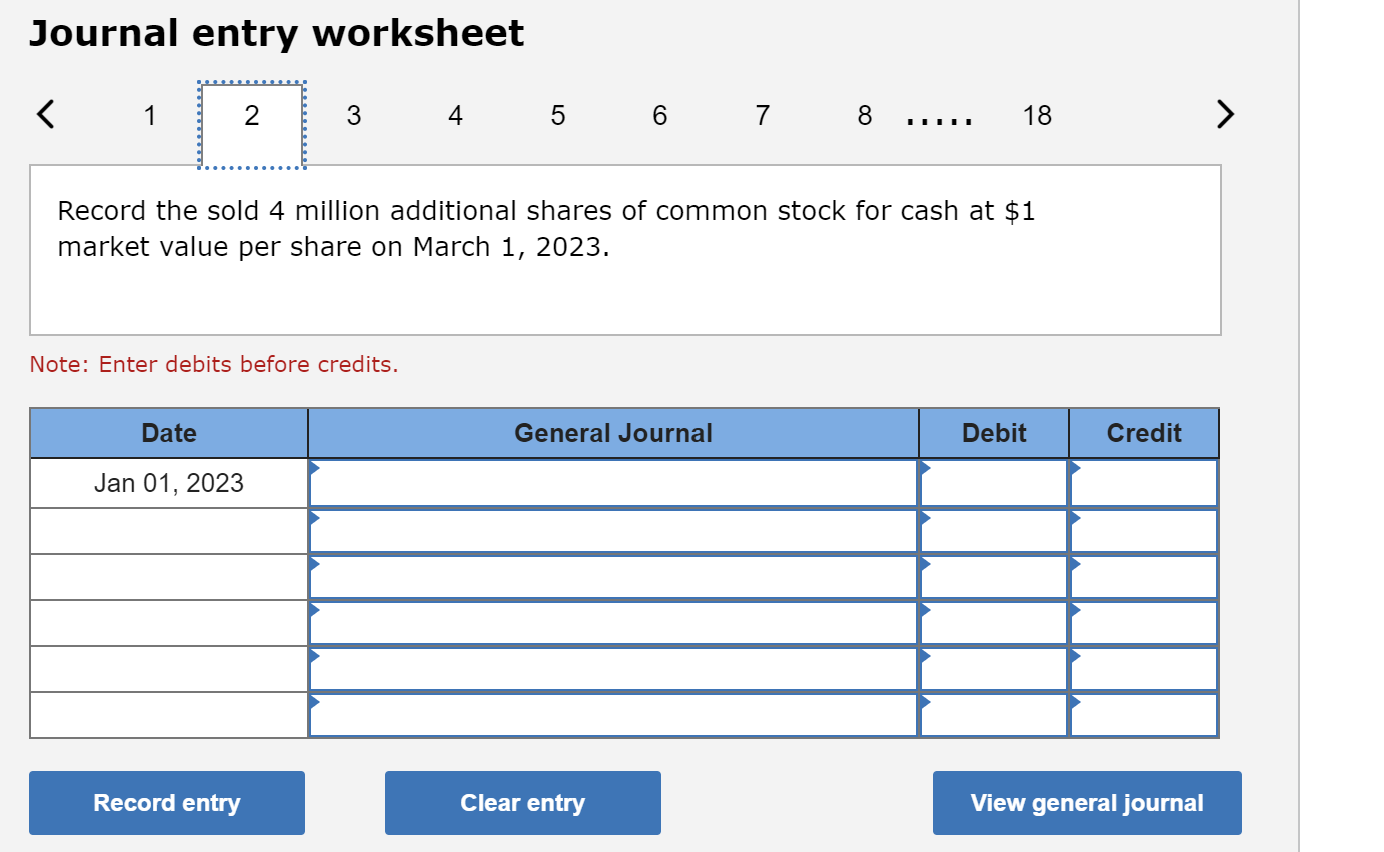

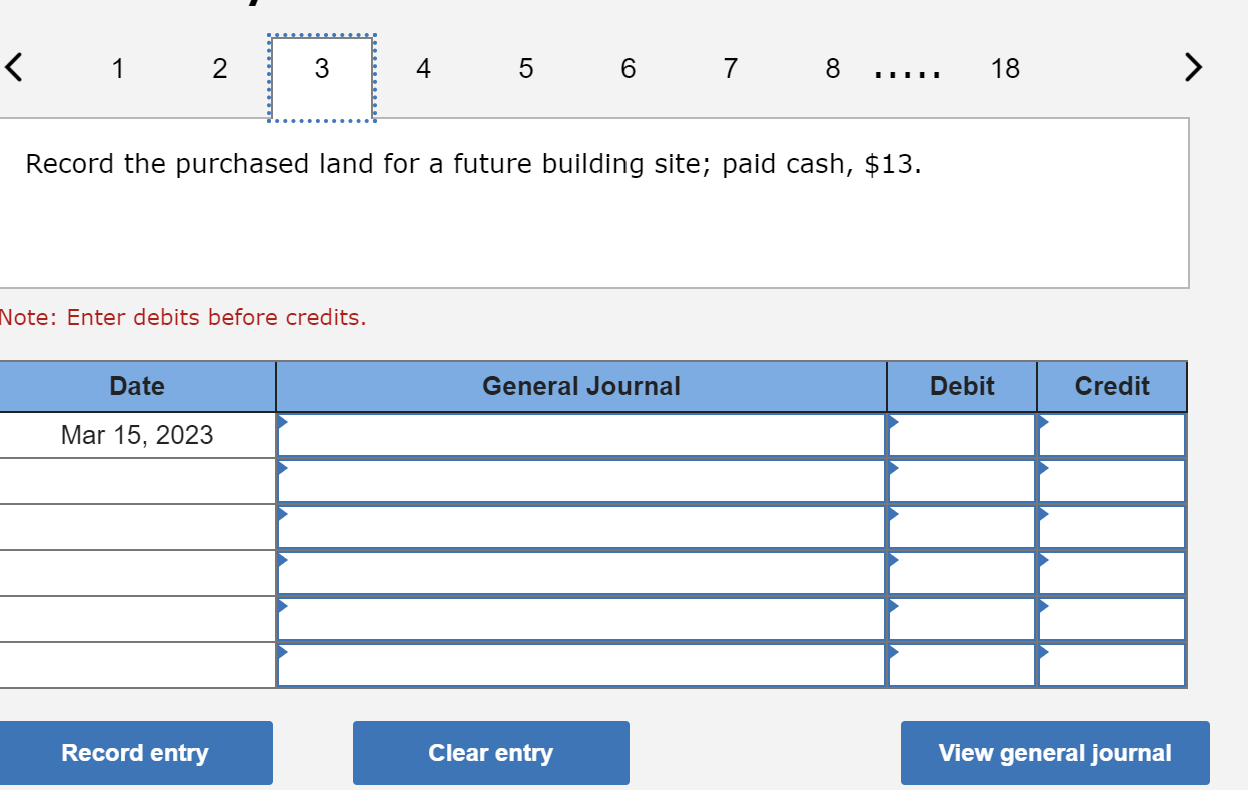

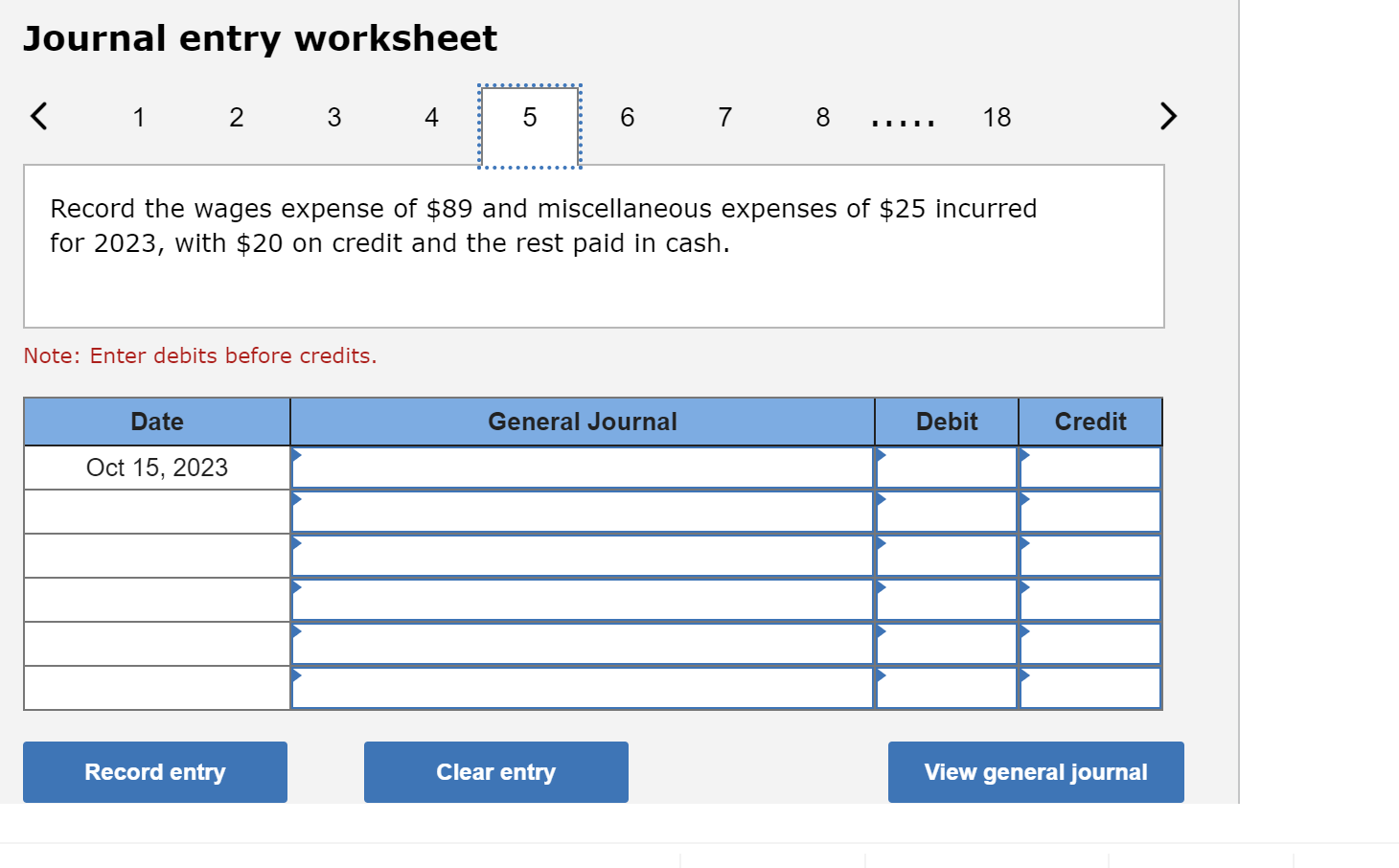

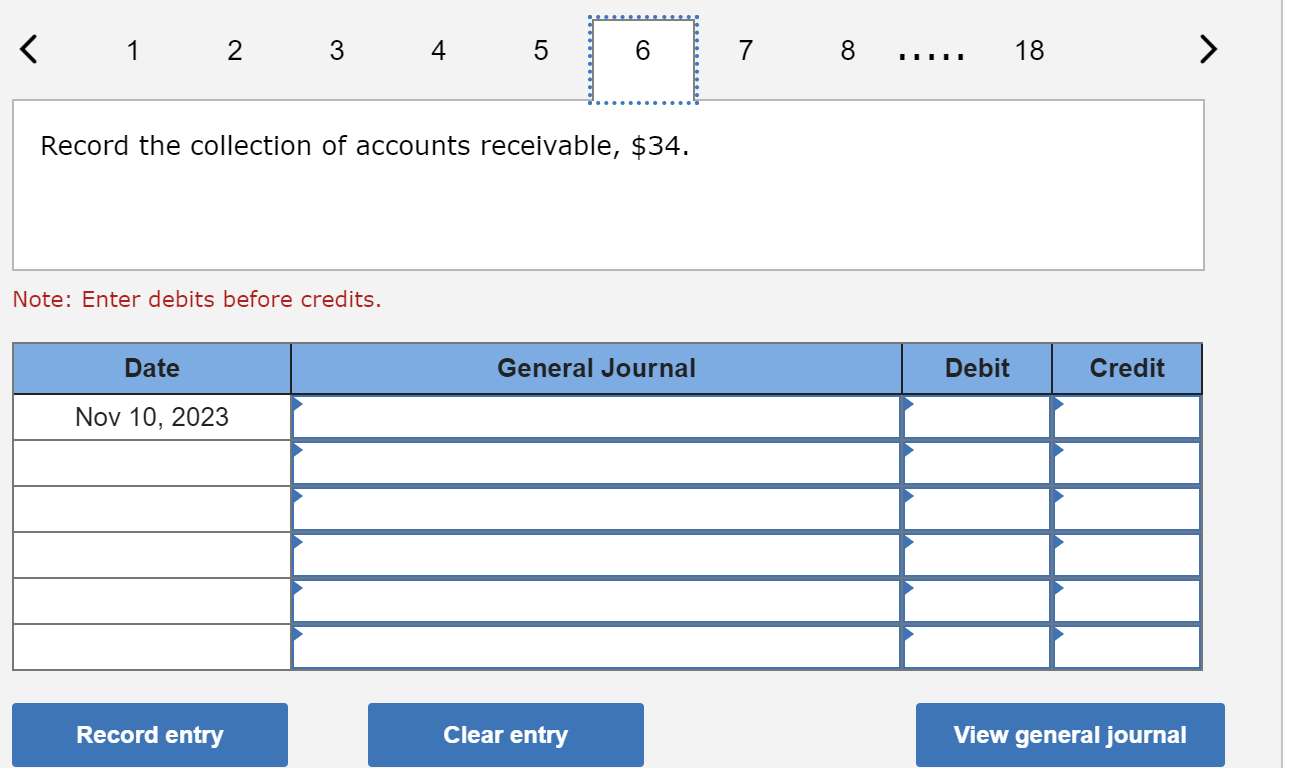

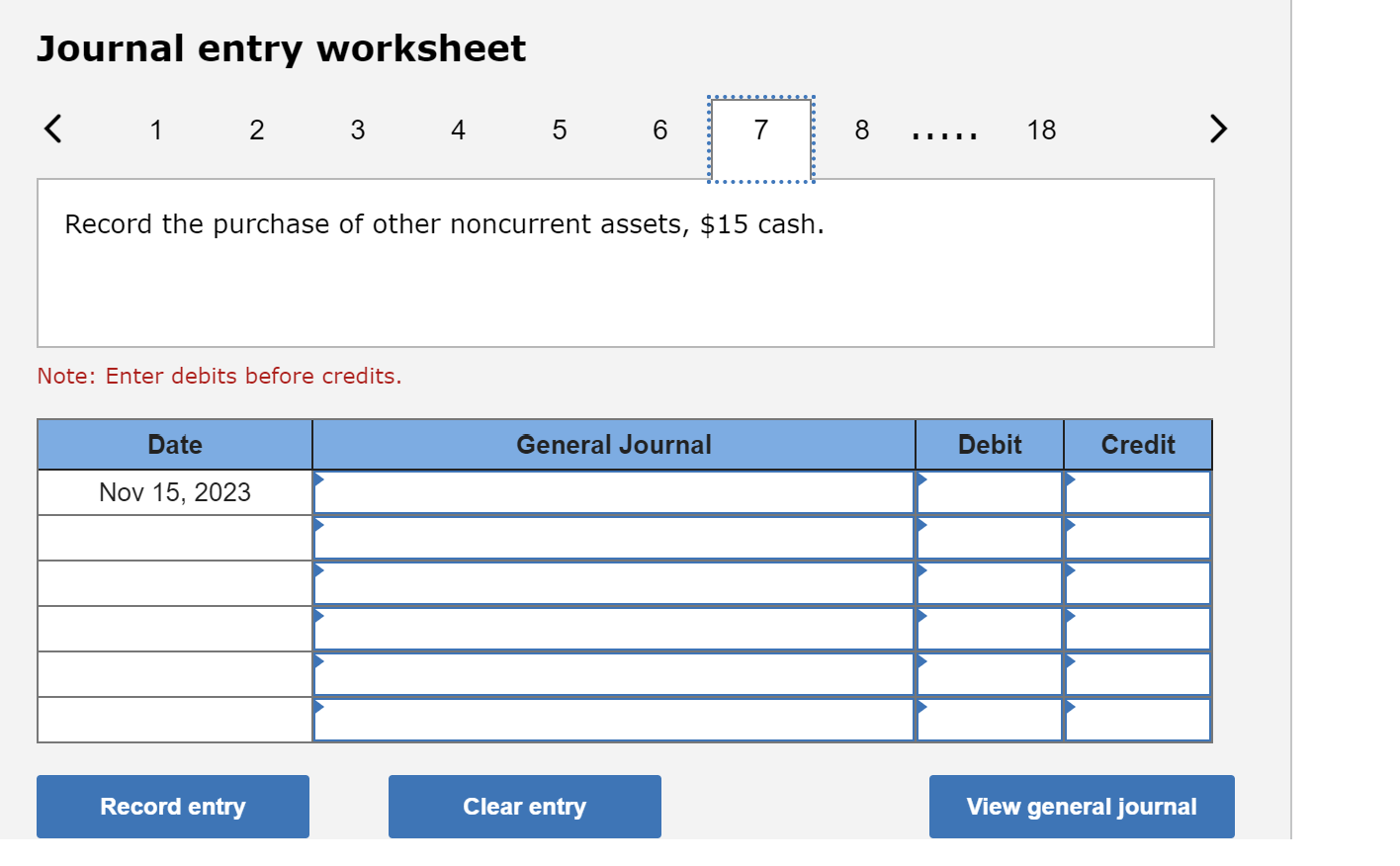

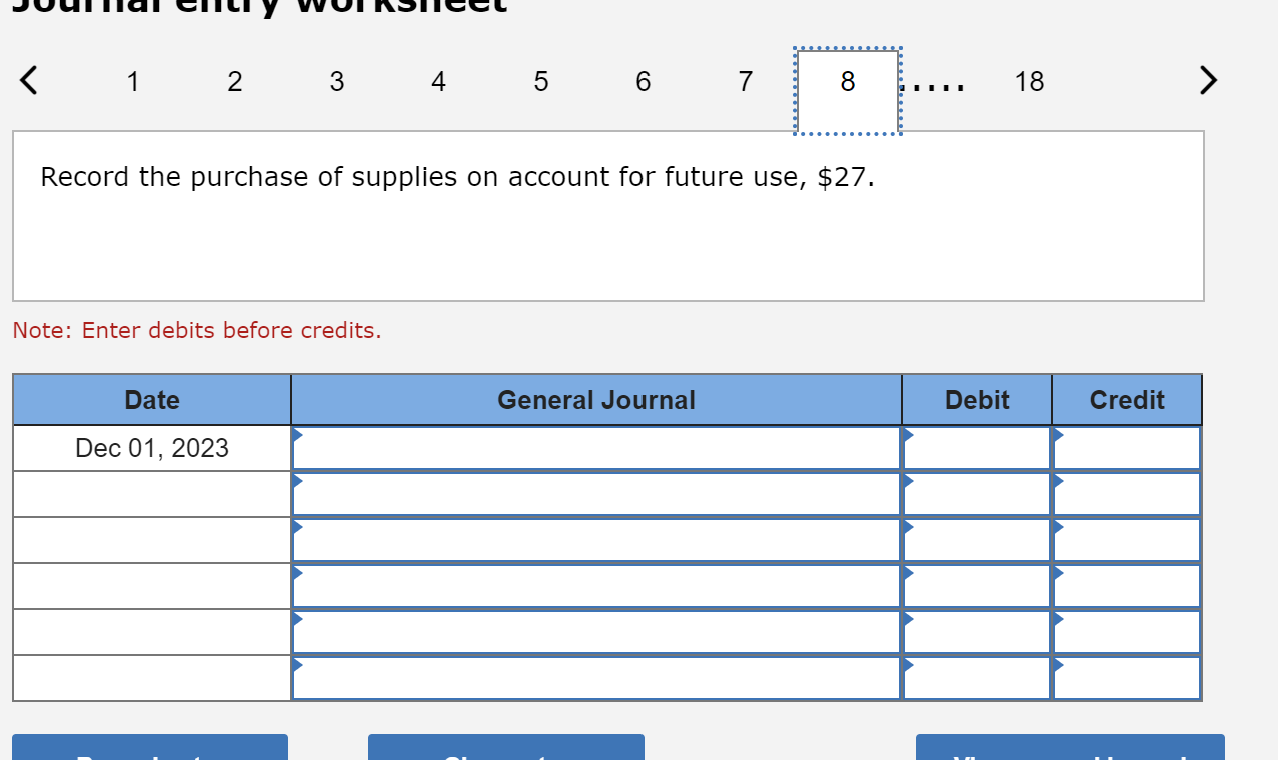

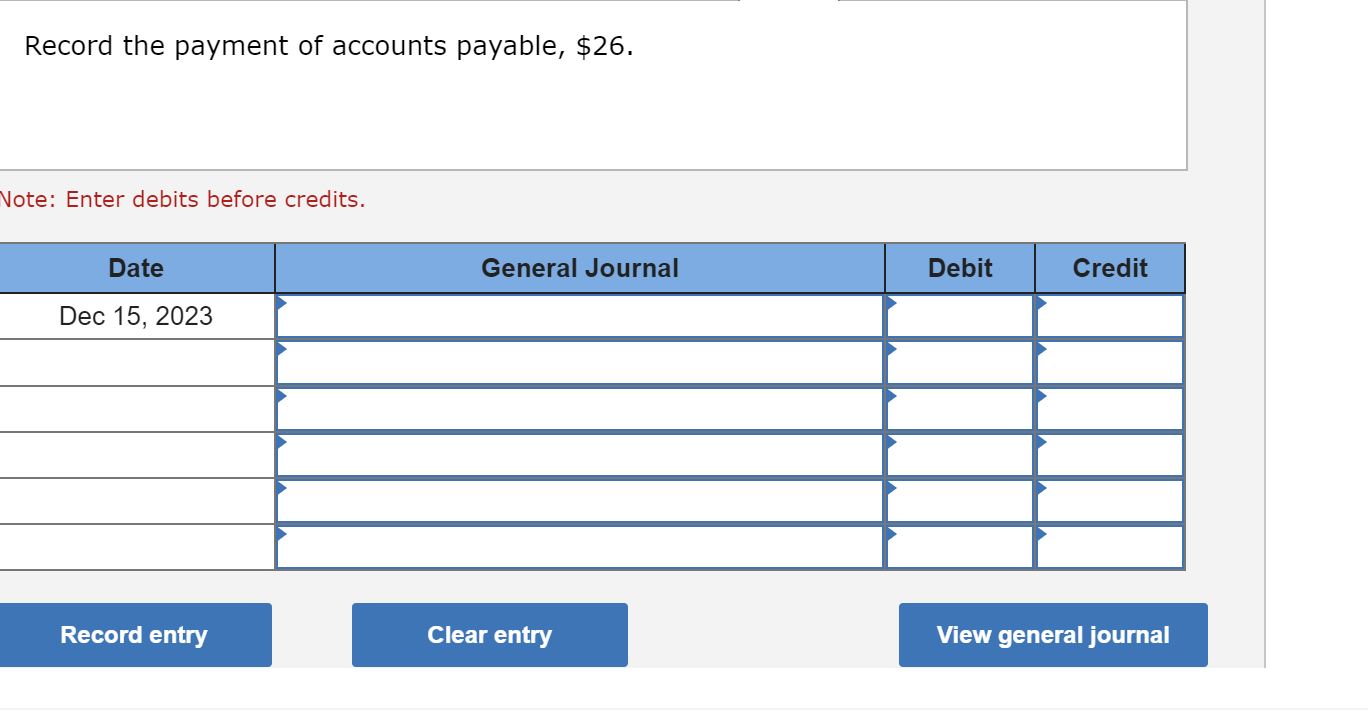

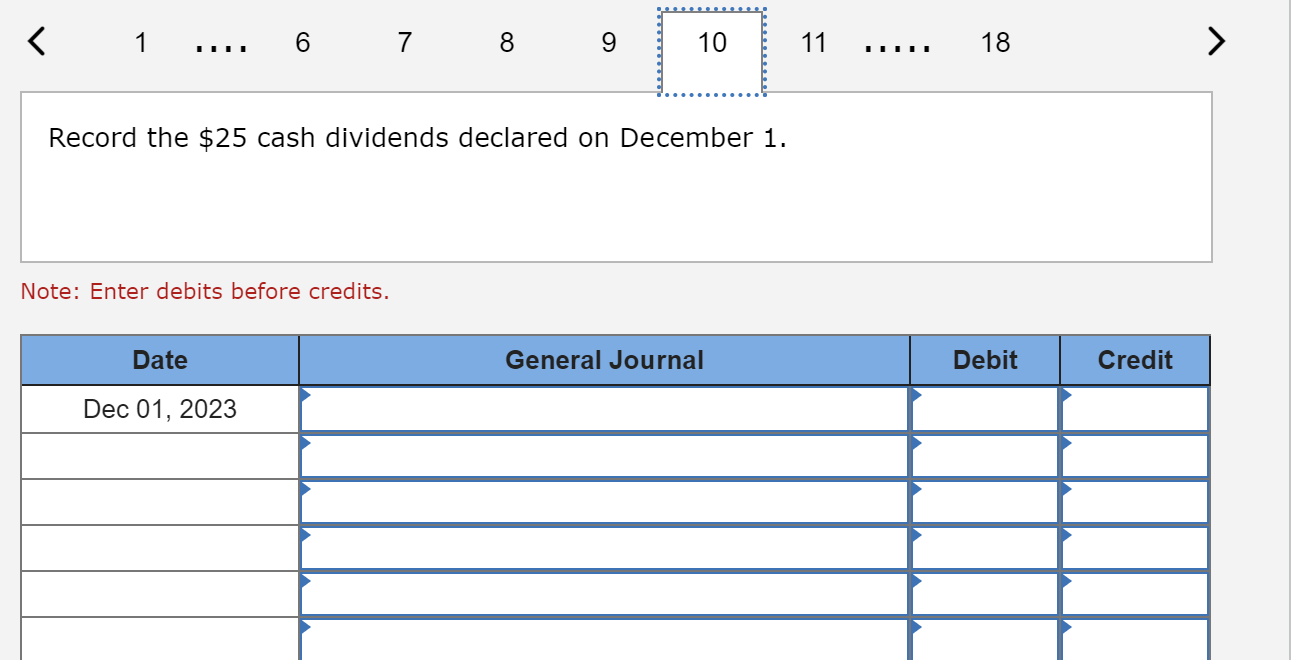

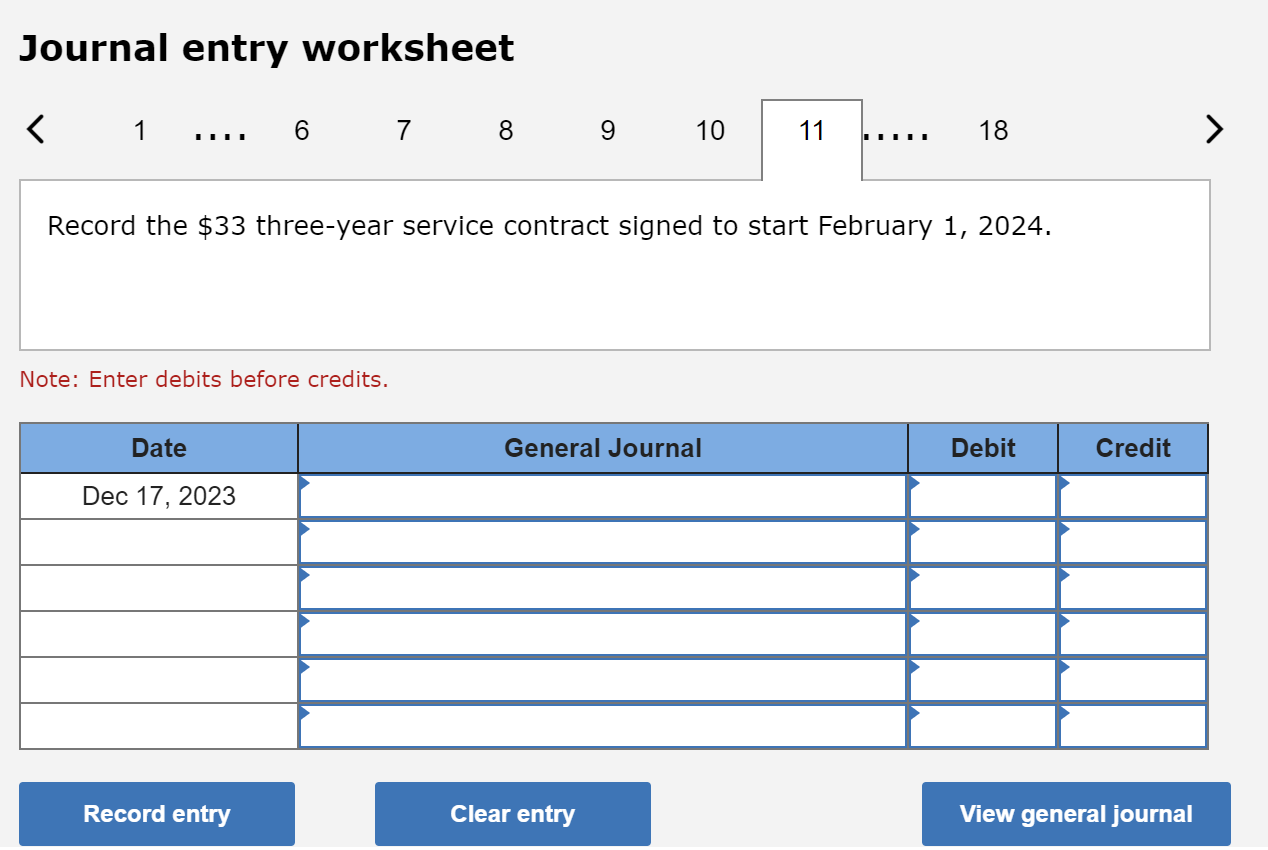

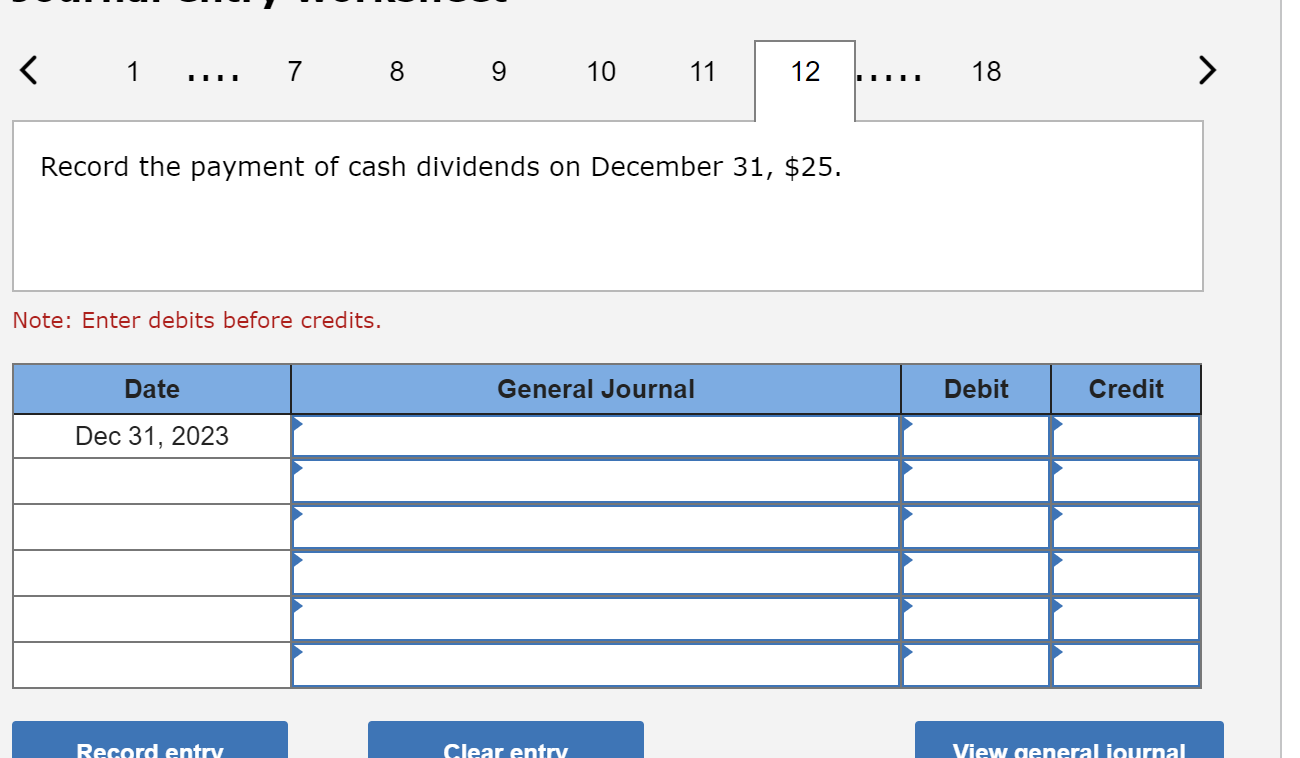

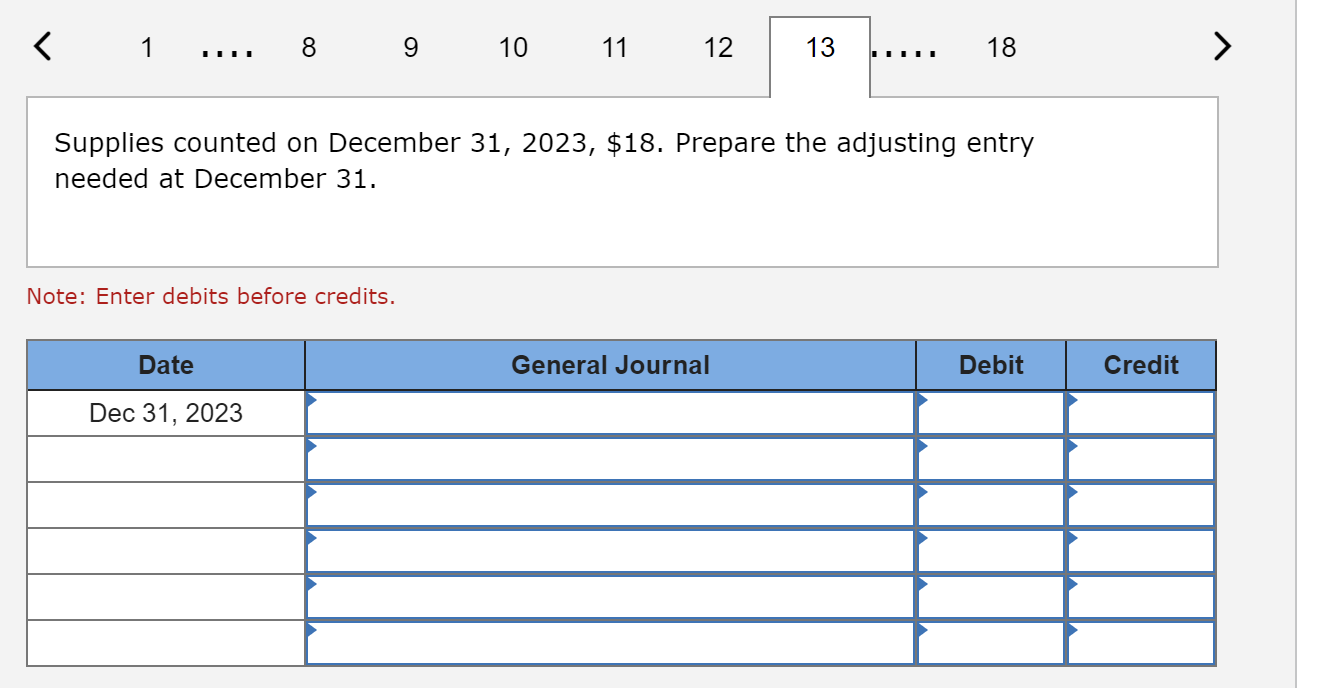

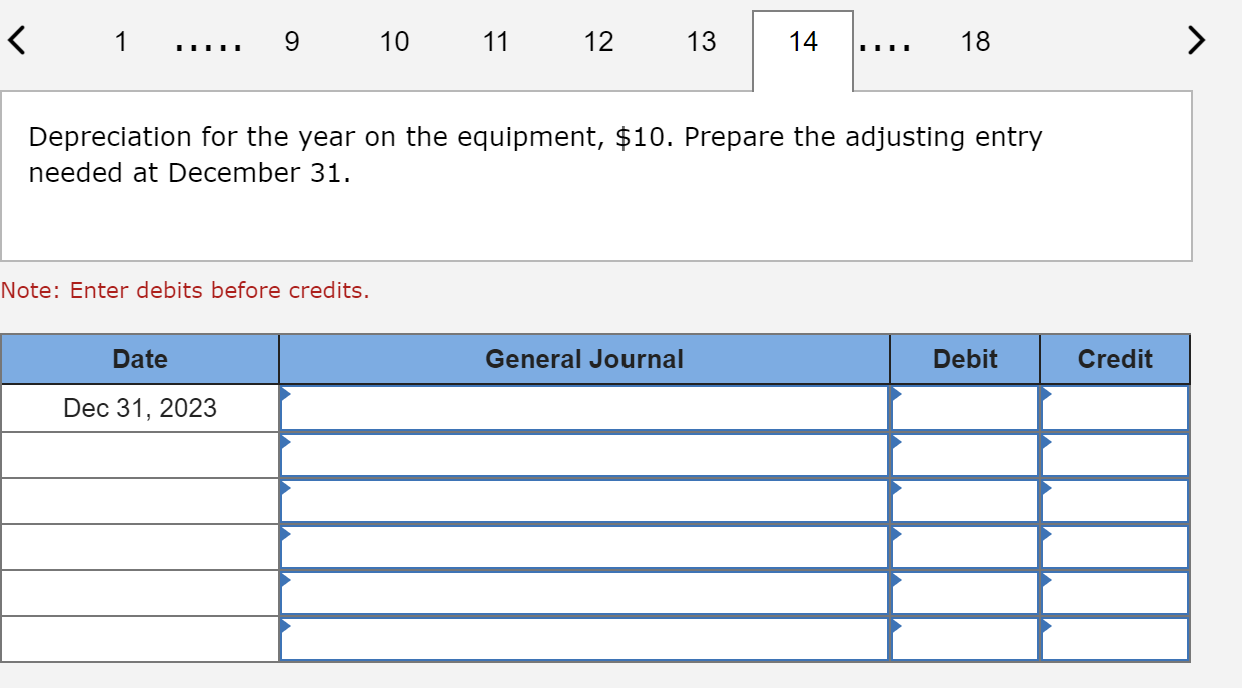

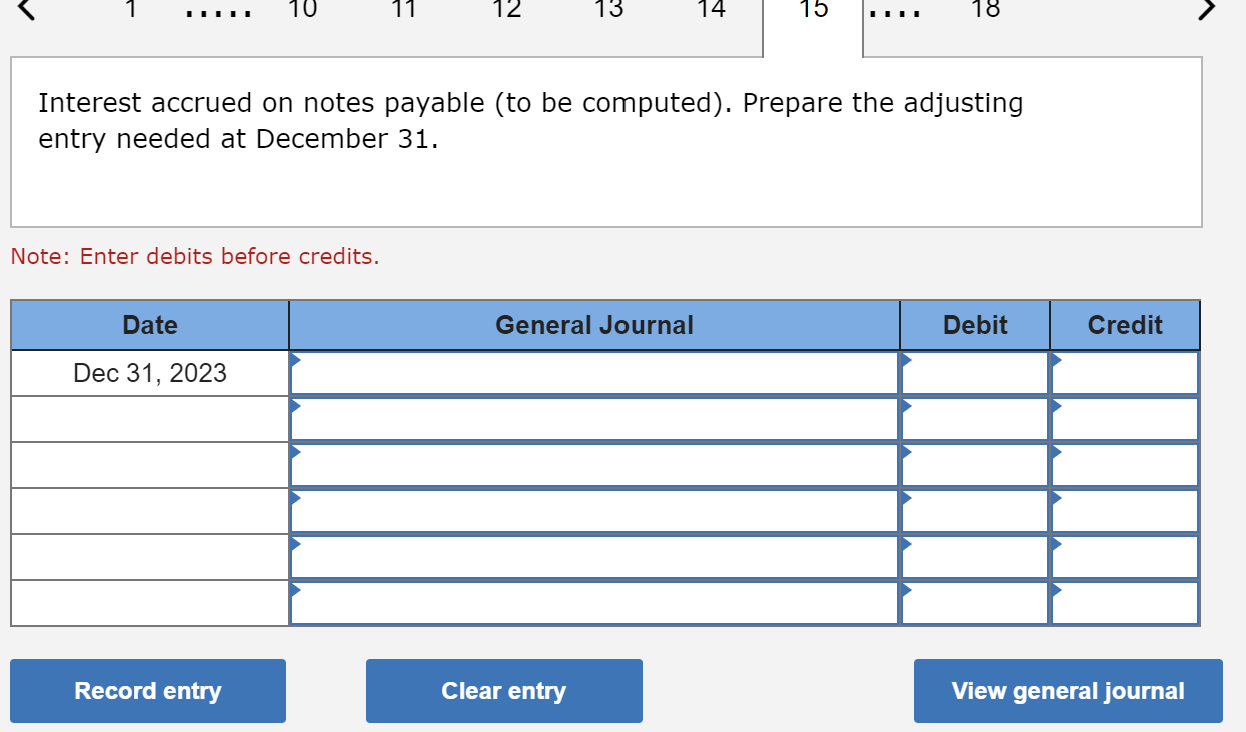

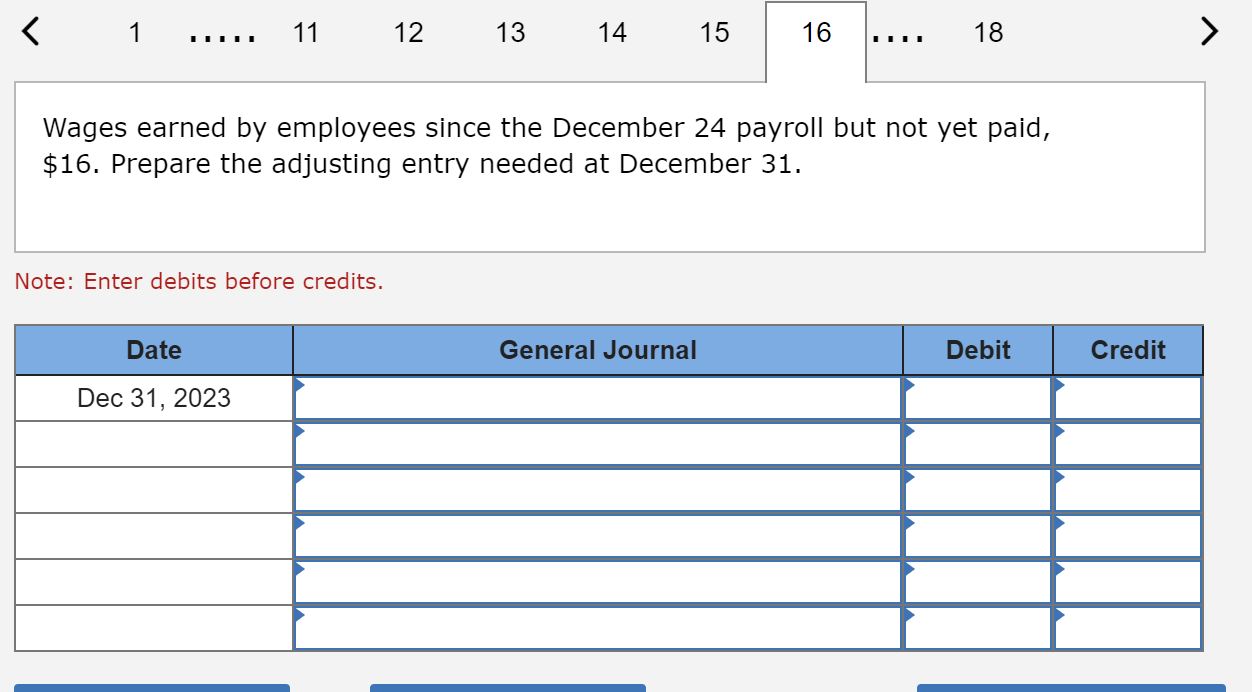

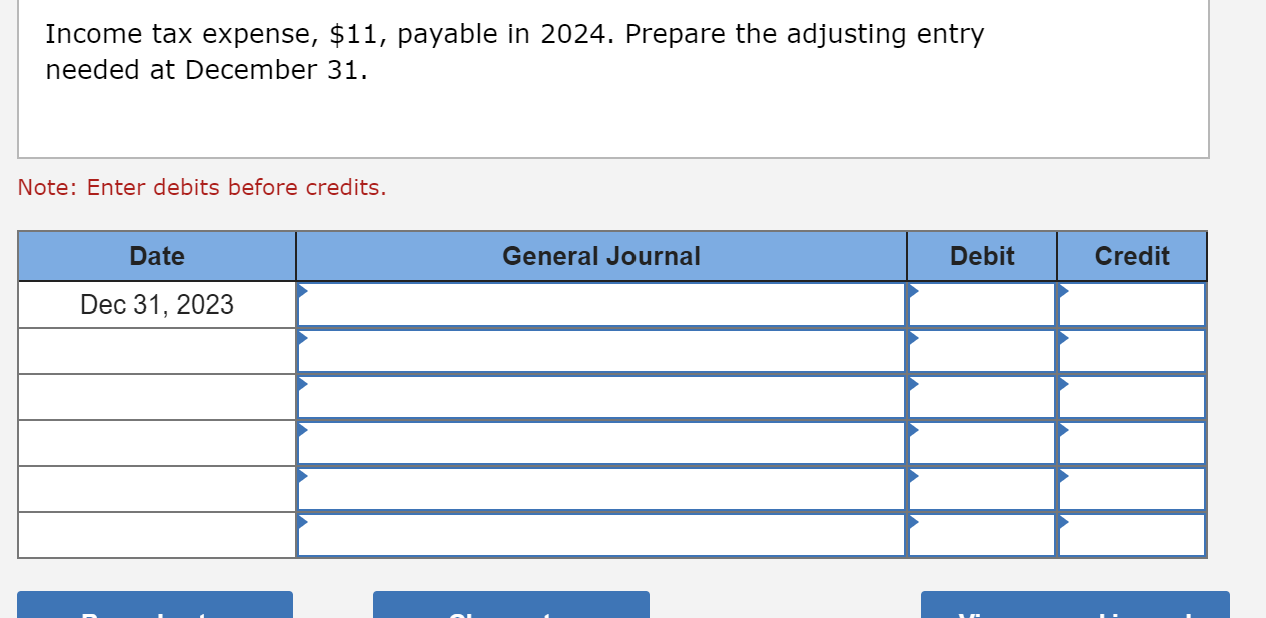

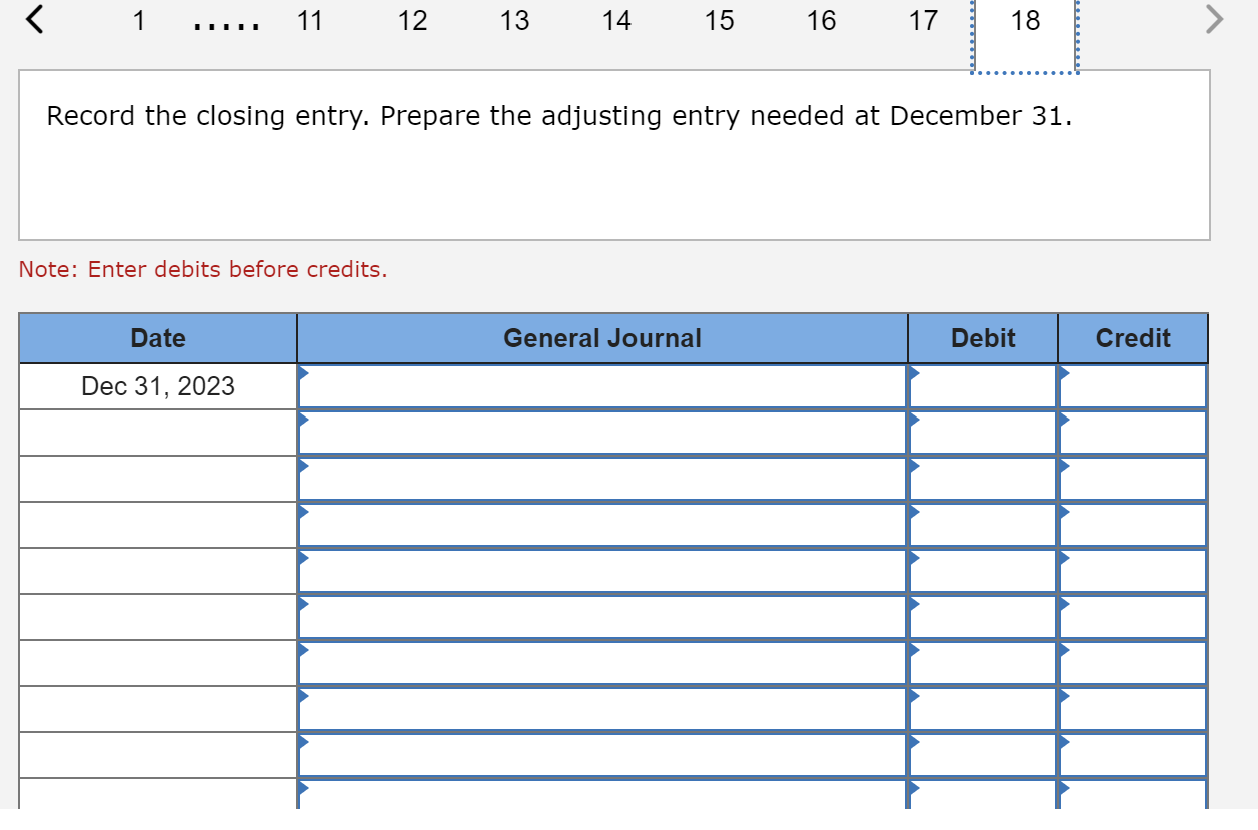

Brothers Herm and Steve Hargenrater began operations of their tool and die shop (H \& H Tool) on January 1,1987 , in Meadville, PA. The annual reporting period ends December 31. Assume that the trial balance on January 1, 2023, was as follows: Transactions during 2023 follow. All dollars are in millions, except per share amounts: Transactions during 2023 follow. All dollars are in millions, except per share amounts: a. Borrowed \$15 cash on a five-year, 8 percent note payable, dated March 1, 2023. b. Sold 4 million additional shares of common stock for cash at \$1 market value per share on January 1, 2023. c. Purchased land for a future building site; paid cash, \$13. d. Earned $215 in revenues for 2023 , including $52 on credit and the rest in cash. e. Incurred $89 in wages expense and $25 in miscellaneous expenses for 2023 , with $20 on credit and the rest paid in cash. f. Collected accounts receivable, \$34. g. Purchased other noncurrent assets, \$15 cash. h. Purchased supplies on account for future use, $27. i. Paid accounts payable, \$26. j. Declared cash dividends on December 1,$25. k. Signed a three-year $33 service contract to start February 1,2024. I. Paid the dividends in ()) on December 31. Data for adjusting entries (amounts in millions): m. Supplies counted on December 31, 2023, \$18. n. Depreciation for the year on the equipment, \$10. o. Interest accrued on notes payable (to be computed). p. Wages earned by employees since the December 24 payroll but not yet paid, $16. q. Income tax expense, \$11, payable in 2024. Prepare journal entries for transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in milllons rather than In dollars (for example, 5 milllon should be entered as 5 rather than 5,000,000). Journal entry worksheet Record the borrowed $15 cash on a flve-year note payable, dated January 1 , 2023. Note: Enter debits before credits. Journal entry worksheet 7818 Record the sold 4 million additional shares of common stock for cash at $1 market value per share on March 1, 2023. Note: Enter debits before credits. Record the purchased land for a future building site; paid cash, $13. Note: Enter debits before credits. Journal entry worksheet Record the wages expense of $89 and miscellaneous expenses of $25 incurred for 2023 , with $20 on credit and the rest paid in cash. Note: Enter debits before credits. Record the collection of accounts receivable, $34. Note: Enter debits before credits. Journal entry worksheet