Answered step by step

Verified Expert Solution

Question

1 Approved Answer

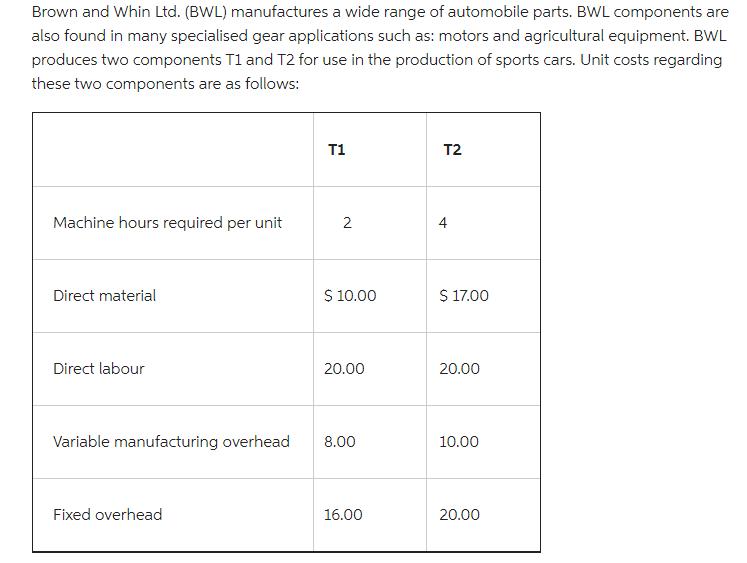

Brown and Whin Ltd. (BWL) manufactures a wide range of automobile parts. BWL components are also found in many specialised gear applications such as:

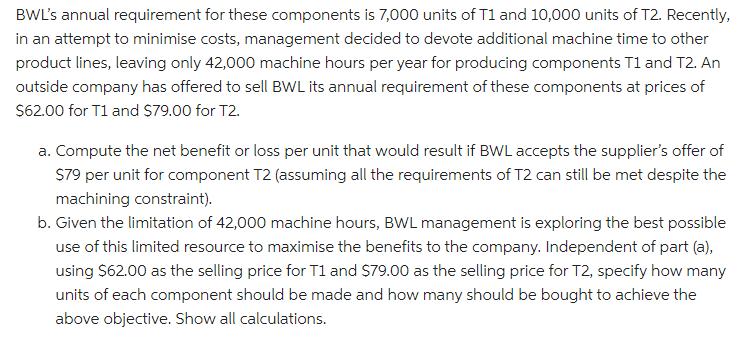

Brown and Whin Ltd. (BWL) manufactures a wide range of automobile parts. BWL components are also found in many specialised gear applications such as: motors and agricultural equipment. BWL produces two components T1 and T2 for use in the production of sports cars. Unit costs regarding these two components are as follows: Machine hours required per unit Direct material Direct labour Variable manufacturing overhead Fixed overhead T1 2 $ 10.00 20.00 8.00 16.00 T2 $ 17.00 20.00 10.00 20.00 BWL's annual requirement for these components is 7,000 units of T1 and 10,000 units of T2. Recently, in an attempt to minimise costs, management decided to devote additional machine time to other product lines, leaving only 42,000 machine hours per year for producing components T1 and T2. An outside company has offered to sell BWL its annual requirement of these components at prices of $62.00 for T1 and $79.00 for T2. a. Compute the net benefit or loss per unit that would result if BWL accepts the supplier's offer of $79 per unit for component T2 (assuming all the requirements of T2 can still be met despite the machining constraint). b. Given the limitation of 42,000 machine hours, BWL management is exploring the best possible use of this limited resource to maximise the benefits to the company. Independent of part (a), using $62.00 as the selling price for T1 and $79.00 as the selling price for T2, specify how many units of each component should be made and how many should be bought to achieve the above objective. Show all calculations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started