Question

Brown Inc. manufactures and distributes two types of household items. The items, Mops and Dusters, are manufactured on a common assembly line by the same

| Brown Inc. manufactures and distributes two types of household items. The items, Mops and Dusters, are manufactured on a common assembly line by the same direct labourers. Different direct materials are used in each type, and the machinery is retooled for each product. Until now, manufacturing overhead costs have been allocated on the basis of direct labour-hours using a plantwide rate. However, the production manager has been reading about ABC and wishes to institute it for Browns production operations. To that end, she has assembled the following information regarding production activities and manufacturing overhead costs for the month of September: |

| Cost Driver | Activity Usage | |||||||||

| Activity Cost Pool | (activity base) | Allocation Rate | Mops | Dusters | ||||||

| Materials handling | Number of parts | $ | 2.00 | per part | 2,000 | parts | 1,400 | parts | ||

| Machining | Machine-hours | $ | 14.00 | per machine-hour | 205 | machine-hours | 300 | machine-hours | ||

| Assembly | Units started | $ | 1.20 | per unit | 1,000 | units | 1,400 | units | ||

| Inspection | Units tested | $ | 3.00 | per unit | 100 | units | 1,300 | units | ||

| Direct materials | $ | 5,000 | $ | 2,800 | ||||||

| Direct labour | $ | 12,000 | $ | 12,000 | ||||||

| Each product consumed 600 direct labour-hours. |

Please include calculations. Thanks

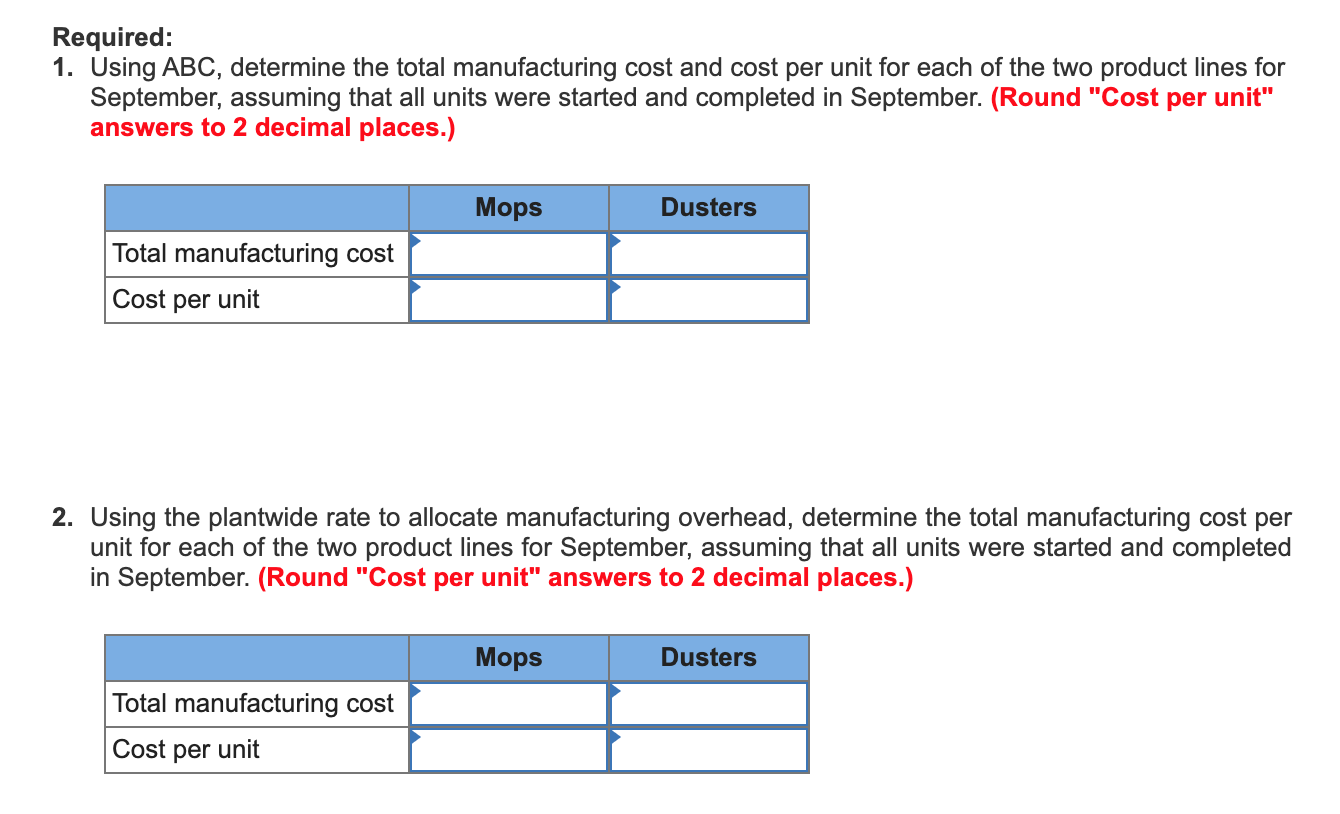

Required: 1. Using ABC, determine the total manufacturing cost and cost per unit for each of the two product lines for September, assuming that all units were started and completed in September. (Round "Cost per unit" answers to 2 decimal places.) Mops Dusters Total manufacturing cost Cost per unit 2. Using the plantwide rate to allocate manufacturing overhead, determine the total manufacturing cost per unit for each of the two product lines for September, assuming that all units were started and completed in September. (Round "Cost per unit" answers to 2 decimal places.) Mops Dusters Total manufacturing cost Cost per unitStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started