Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Brown Limited purchased a machine (annual allowance: 30%) on hire-purchase terms during the year of assessment 2016/17 for the use of its Hong Kong

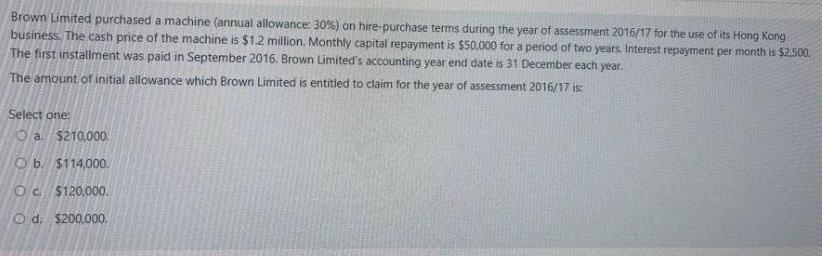

Brown Limited purchased a machine (annual allowance: 30%) on hire-purchase terms during the year of assessment 2016/17 for the use of its Hong Kong business. The cash price of the machine is $1.2 million. Monthly capital repayment is $50,000 for a period of two years. Interest repayment per month is $2,500. The first installment was paid in September 2016. Brown Limited's accounting year end date is 31 December each year. The amount of initial allowance which Brown Limited is entitled to claim for the year of assessment 2016/17 is: Select one: a. $210.000. b. $114,000. Oc. $120,000. Od. $200,000.

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below To calculate the initial allowance for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started