Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bruce and Rachel agreed to form a partnership on July 1. Bruce, who has been trading as a sole propietor, will invest certain business assets

Bruce and Rachel agreed to form a partnership on July 1. Bruce, who has been trading as a sole propietor, will invest certain business assets at agreed valuations, transfer his business liabilities and contribute sufficient cash to bring his contribution to a 60% interest over the new business.

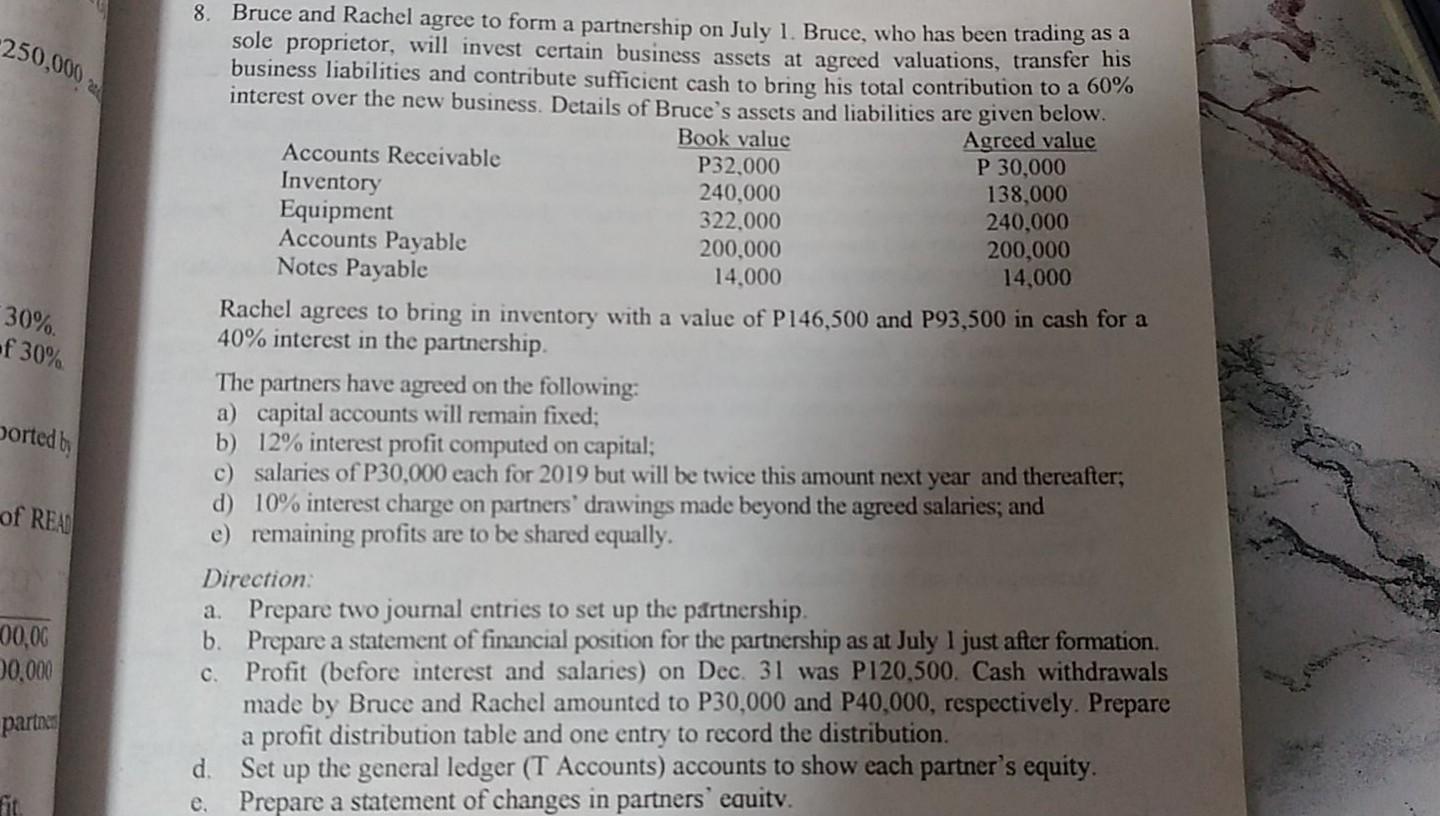

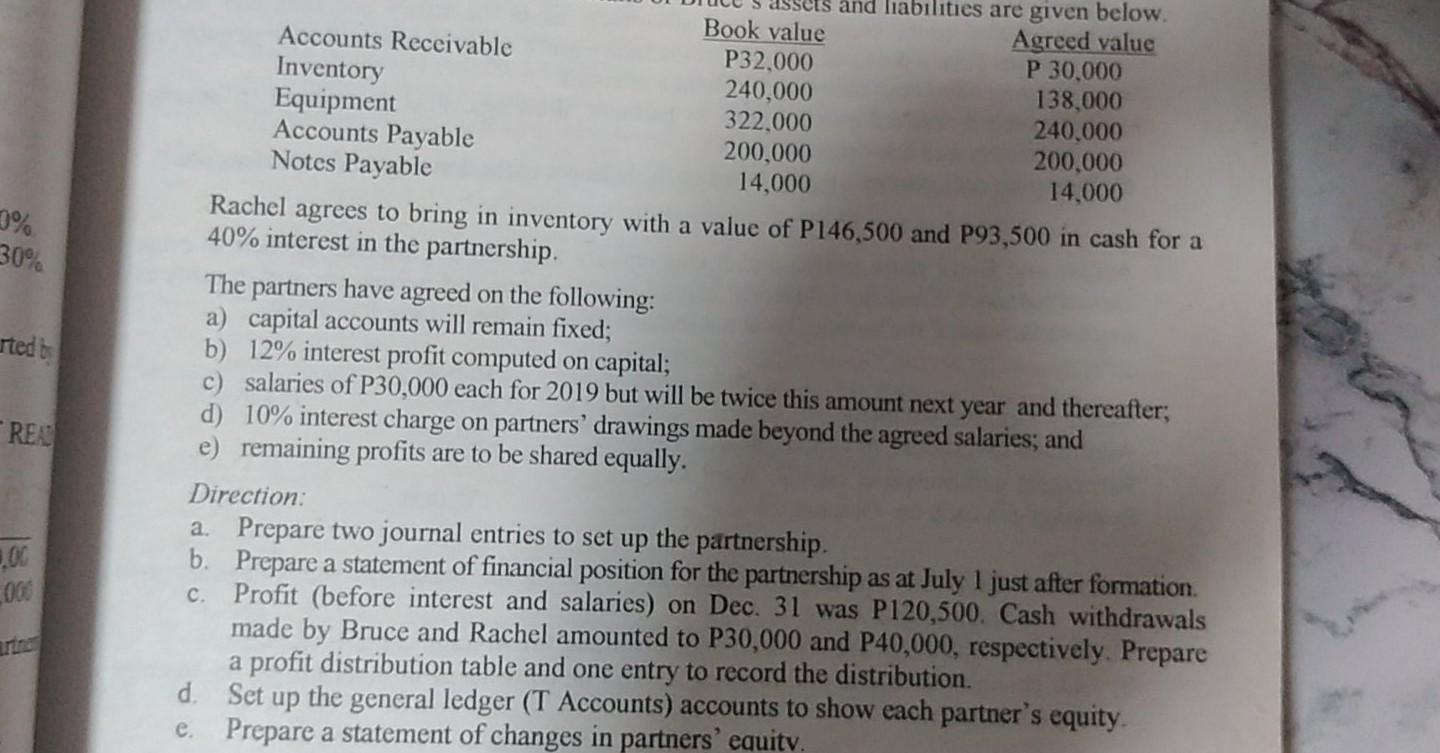

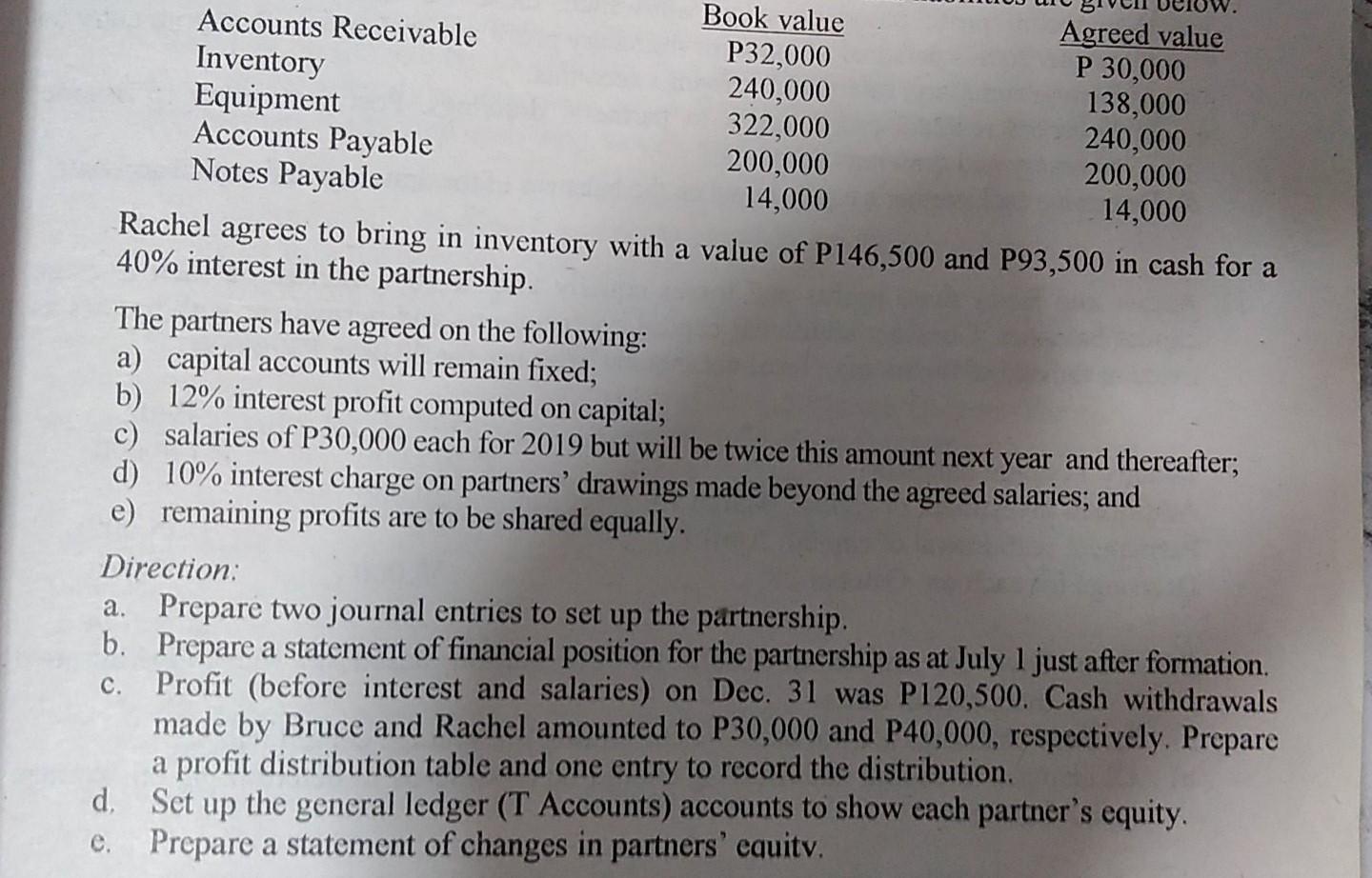

250,000 30% f 30% 8. Bruce and Rachel agree to form a partnership on July 1. Bruce, who has been trading as a sole proprietor, will invest certain business assets at agreed valuations, transfer his business liabilities and contribute sufficient cash to bring his total contribution to a 60% interest over the new business. Details of Bruce's assets and liabilities are given below. Book value Agreed value Accounts Receivable P32.000 P 30,000 Inventory 240.000 138,000 Equipment 322.000 240,000 Accounts Payable 200.000 200,000 Notes Payable 14.000 14,000 Rachel agrees to bring in inventory with a value of P146,500 and P93,500 in cash for a 40% interest in the partnership The partners have agreed on the following: a) capital accounts will remain fixed; b) 12% interest profit computed on capital; c) salaries of P30,000 each for 2019 but will be twice this amount next year and thereafter, d) 10% interest charge on partners' drawings made beyond the agreed salaries; and e) remaining profits are to be shared equally. Direction: a. Prepare two journal entries to set up the partnership b. Prepare a statement of financial position for the partnership as at July 1 just after formation. C. Profit (before interest and salaries) on Dec. 31 was P120,500. Cash withdrawals made by Bruce and Rachel amounted to P30,000 and P40,000, respectively. Prepare a profit distribution table and one entry to record the distribution. d Set up the general ledger (T Accounts) accounts to show each partner's equity. e. Prepare a statement of changes in partners' equitv. ported by of READ 00,00 00.000 partner 0% 30% sted by and liabilities are given below. Book value Agreed value Accounts Receivable P32,000 P 30,000 Inventory 240,000 138.000 Equipment 322,000 240.000 Accounts Payable 200,000 200,000 Notes Payable 14,000 14,000 Rachel agrees to bring in inventory with a value of P146,500 and P93,500 in cash for a 40% interest in the partnership. The partners have agreed on the following: a) capital accounts will remain fixed; b) 12% interest profit computed on capital; c) salaries of P30,000 each for 2019 but will be twice this amount next year and thereafter, d) 10% interest charge on partners' drawings made beyond the agreed salaries; and e) remaining profits are to be shared equally. Direction: a. Prepare two journal entries to set up the partnership. b. Prepare a statement of financial position for the partnership as at July 1 just after formation Profit (before interest and salaries) on Dec. 31 was P120,500. Cash withdrawals made by Bruce and Rachel amounted to P30,000 and P40,000, respectively. Prepare a profit distribution table and one entry to record the distribution. d. Set up the general ledger (T Accounts) accounts to show each partner's equity. e. Prepare a statement of changes in partners' equitv. REA 1.00 000 C Book value Accounts Receivable Agreed value P32,000 P 30,000 Inventory 240,000 138,000 Equipment 322,000 240,000 Accounts Payable 200,000 200,000 Notes Payable 14,000 14,000 Rachel agrees to bring in inventory with a value of P146,500 and P93,500 in cash for a 40% interest in the partnership. The partners have agreed on the following: a) capital accounts will remain fixed; b) 12% interest profit computed on capital; c) salaries of P30,000 each for 2019 but will be twice this amount next year and thereafter, d) 10% interest charge on partners' drawings made beyond the agreed salaries; and e) remaining profits are to be shared equally. Direction: a. Prepare two journal entries to set up the partnership. b. Prepare a statement of financial position for the partnership as at July 1 just after formation. Profit (before interest and salaries) on Dec. 31 was P120,500. Cash withdrawals made by Bruce and Rachel amounted to P30,000 and P40,000, respectively. Prepare a profit distribution table and one entry to record the distribution. d. Set up the general ledger (T Accounts) accounts to show each partner's equity. e. Prepare a statement of changes in partners' equitv. C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started