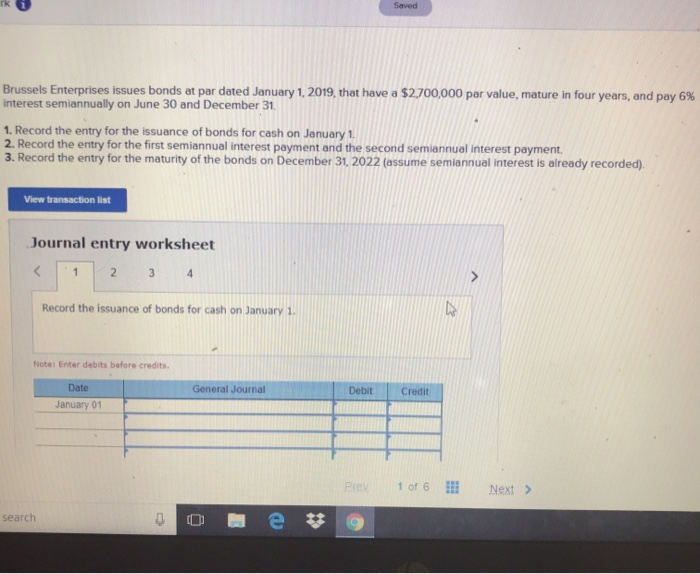

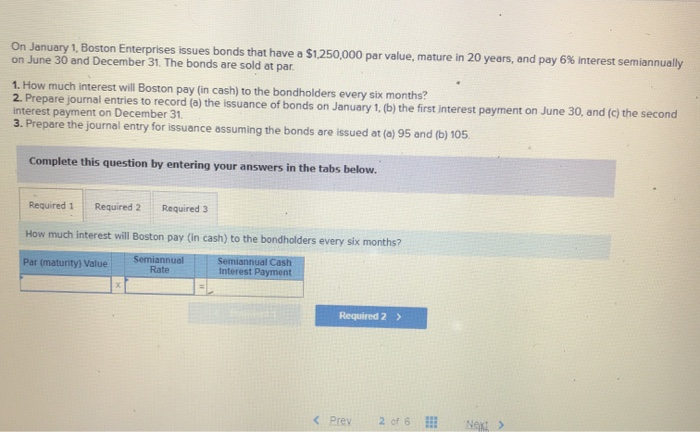

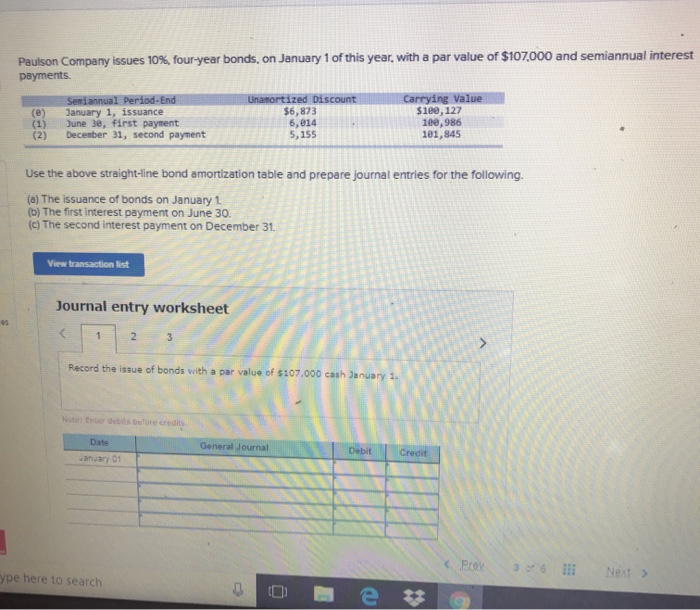

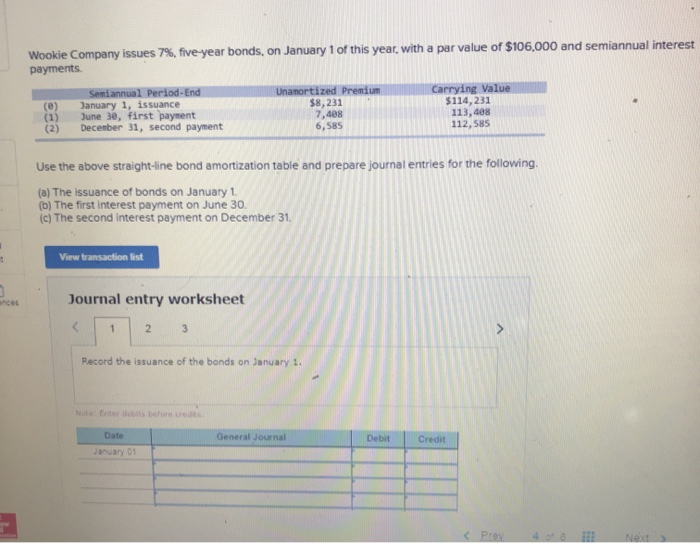

Brussels Enterprises issues bonds at par dated January 1, 2019, that have a $2,700,000 par value, mature in four years, and pay 6% interest semiannually on June 30 and December 31 1. Record the entry for the issuance of bonds for cash on January 1 2. Record the entry for the first semiannual interest payment and the second semiannual interest payment. 3. Record the entry for the maturity of the bonds on December 31, 2022 (assume semiannual interest is already recorded). View transaction list Journal entry worksheet search DO - e * 9 On January 1, Boston Enterprises issues bonds that have a $1.250,000 par value, mature in 20 years, and pay 6% interest semiannually on June 30 and December 31. The bonds are sold at par 1. How much interest will Boston pay (in cash) to the bondholders every six months? 2. Prepare journal entries to record (a) the issuance of bonds on January 1, (b) the first interest payment on June 30, and (c) the second Interest payment on December 31 3. Prepare the journal entry for issuance assuming the bonds are issued at(a) 95 and (b) 105. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 How much interest will Boston pay (in cash) to the bondholders every six months? Par maturity) Value Semiannual Rate Semiannual Cash Interest Payment Required 2 > Paulson Company issues 10%, four-year bonds, on January 1 of this year, with a par value of $107,000 and semiannual interest payments. (0) (1) (2) Semiannual Period-End January 1, issuance June 30, first payment December 31, second payment Unamortized Discount $6.873 6,014 5, 155 Carrying Value $100,127 100,986 181,845 Use the above straight-line bond amortization table and prepare journal entries for the following (a) The issuance of bonds on January 1 (b) The first interest payment on June 30. (c) The second interest payment on December 31 View transaction list Journal entry worksheet 23 Record the issue of bonds with a par value of $107.000 cash Date January 01 General Journal General Journal Debit 306 Next > ype here to search Wookie Company issues 7%, five-year bonds, on January 1 of this year, with a par value of $106.000 and semiannual interest payments (e) Semiannual Period-End January 1, issuance June 30, first payment December 31, second payment Unamortized Premium $8,231 7,488 6,585 Carrying Value $114, 231 113,488 112,585 Use the above straight-line bond amortization table and prepare journal entries for the following (a) The issuance of bonds on January 1 (b) The first interest payment on June 30. (c) The second interest payment on December 31. View transaction list Journal entry worksheet