Question

. Bryant leased a land to Joe for a period of years starting Janaury 1, 2016 at a monthly rental of P2,000. Observing the

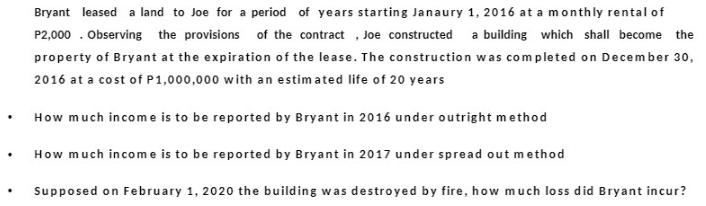

. Bryant leased a land to Joe for a period of years starting Janaury 1, 2016 at a monthly rental of P2,000. Observing the provisions of the contract, Joe constructed a building which shall become the property of Bryant at the expiration of the lease. The construction was completed on December 30, 2016 at a cost of P1,000,000 with an estimated life of 20 years How much income is to be reported by Bryant in 2016 under outright method How much income is to be reported by Bryant in 2017 under spread out method Supposed on February 1, 2020 the building was destroyed by fire, how much loss did Bryant incur?

Step by Step Solution

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Under the outright method Bryant would report the full rental income received in 2016 Since the le...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Smith and Roberson Business Law

Authors: Richard A. Mann, Barry S. Roberts

15th Edition

1285141903, 1285141903, 9781285141909, 978-0538473637

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App