Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bryson works for a financial services firm. His work entails locating new equities for their clients' portfolios. He's looking at two stocks, A and

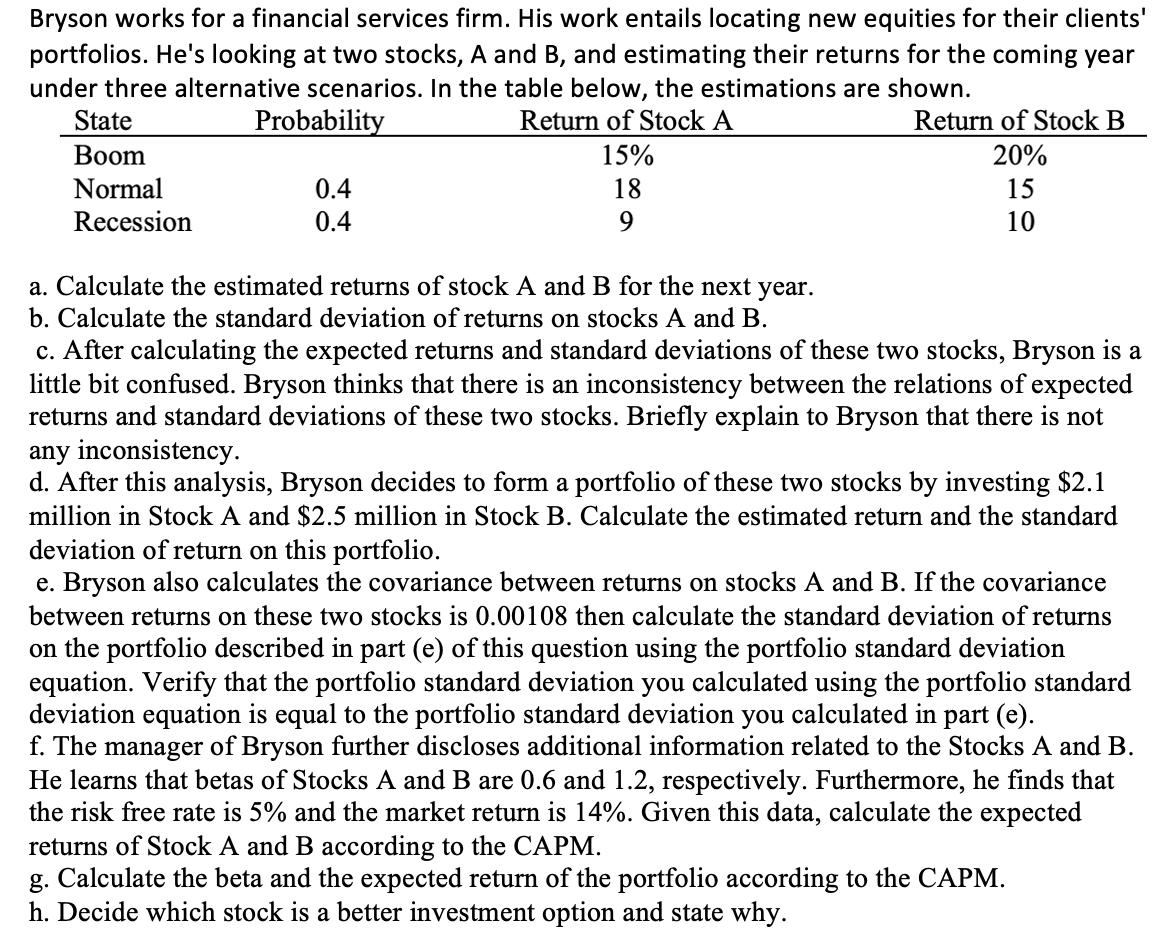

Bryson works for a financial services firm. His work entails locating new equities for their clients' portfolios. He's looking at two stocks, A and B, and estimating their returns for the coming year under three alternative scenarios. In the table below, the estimations are shown. Probability Return of Stock A 15% 18 9 State Boom Normal Recession 0.4 0.4 Return of Stock B 20% 15 10 a. Calculate the estimated returns of stock A and B for the next year. b. Calculate the standard deviation of returns on stocks A and B. c. After calculating the expected returns and standard deviations of these two stocks, Bryson is a little bit confused. Bryson thinks that there is an inconsistency between the relations of expected returns and standard deviations of these two stocks. Briefly explain to Bryson that there is not any inconsistency. d. After this analysis, Bryson decides to form a portfolio of these two stocks by investing $2.1 million in Stock A and $2.5 million in Stock B. Calculate the estimated return and the standard deviation of return on this portfolio. e. Bryson also calculates the covariance between returns on stocks A and B. If the covariance between returns on these two stocks is 0.00108 then calculate the standard deviation of returns on the portfolio described in part (e) of this question using the portfolio standard deviation equation. Verify that the portfolio standard deviation you calculated using the portfolio standard deviation equation is equal to the portfolio standard deviation you calculated in part (e). f. The manager of Bryson further discloses additional information related to the Stocks A and B. He learns that betas of Stocks A and B are 0.6 and 1.2, respectively. Furthermore, he finds that the risk free rate is 5% and the market return is 14%. Given this data, calculate the expected returns of Stock A and B according to the CAPM. g. Calculate the beta and the expected return of the portfolio according to the CAPM. h. Decide which stock is a better investment option and state why.

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a To calculate the estimated returns of stocks A and B for the next year we multiply the probability of each scenario by the corresponding return and sum them up Estimated return of stock A 015 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started