Answered step by step

Verified Expert Solution

Question

1 Approved Answer

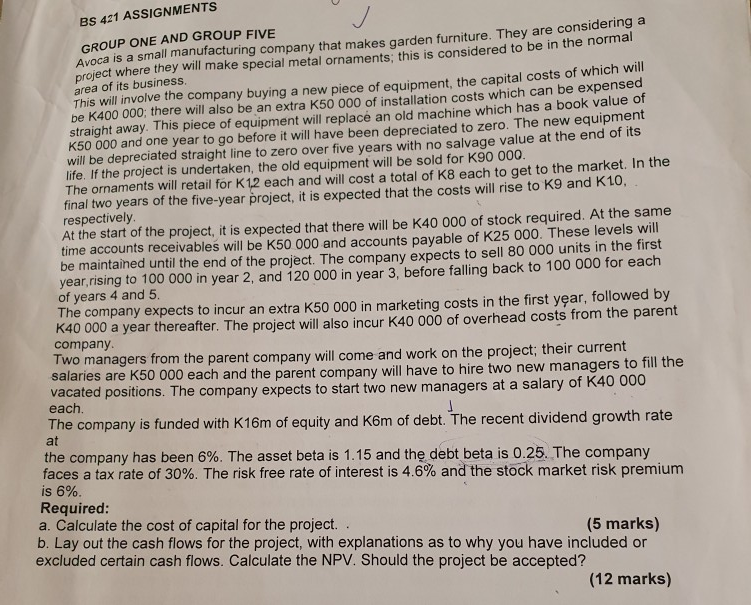

BS 421 ASSIGNMENTS GROUP ONE AND GROUP FIVE Avoca is a small manufacturing company that makes garden furniture. They are considering a project where they

BS 421 ASSIGNMENTS GROUP ONE AND GROUP FIVE Avoca is a small manufacturing company that makes garden furniture. They are considering a project where they will make special metal ornaments, this is considered to be in the normal area of its business. This will involve the company buying a new piece of equipment, the capital costs of which will be K400 000, there will also be an extra K50 000 of installation costs which can be expensed straight away. This piece of equipment will replace an old machine which has a book value of K50 000 and one year to go before it will have been depreciated to zero. The new equipment will be depreciated straight line to zero over five years with no salvage value at the end of its life. If the project is undertaken, the old equipment will be sold for K90 000 The ornaments will retail for K 12 each and will cost a total of K8 each to get to the market. In the final two years of the five-year project, it is expected that the costs will rise to K9 and K10, respectively At the start of the project, it is expected that there will be K40 000 of stock required. At the same time accounts receivables will be K50 000 and accounts payable of K25 000. These levels will be maintained until the end of the project. The company expects to sell 80 000 units in the first year rising to 100 000 in year 2, and 120 000 in year 3, before falling back to 100 000 for each of years 4 and 5. The company expects to incur an extra K50 000 in marketing costs in the first year, followed by K40 000 a year thereafter. The project will also incur K40 000 of overhead costs from the parent company Two managers from the parent company will come and work on the project; their current salaries are K50 000 each and the parent company will have to hire two new managers to fill the vacated positions. The company expects to start two new managers at a salary of K40 000 each. The company is funded with K16m of equity and Kom of debt. The recent dividend growth rate at the company has been 6%. The asset beta is 1.15 and the debt beta is 0.25. The company faces a tax rate of 30%. The risk free rate of interest is 4.6% and the stock market risk premium is 6%. Required: a. Calculate the cost of capital for the project. b. Lay out the cash flows for the project, with explanations as to why you have included or (5 marks) excluded certain cash flows. Calculate the NPV. Should the project be accepted? (12 marks) BS 421 ASSIGNMENTS GROUP ONE AND GROUP FIVE Avoca is a small manufacturing company that makes garden furniture. They are considering a project where they will make special metal ornaments, this is considered to be in the normal area of its business. This will involve the company buying a new piece of equipment, the capital costs of which will be K400 000, there will also be an extra K50 000 of installation costs which can be expensed straight away. This piece of equipment will replace an old machine which has a book value of K50 000 and one year to go before it will have been depreciated to zero. The new equipment will be depreciated straight line to zero over five years with no salvage value at the end of its life. If the project is undertaken, the old equipment will be sold for K90 000 The ornaments will retail for K 12 each and will cost a total of K8 each to get to the market. In the final two years of the five-year project, it is expected that the costs will rise to K9 and K10, respectively At the start of the project, it is expected that there will be K40 000 of stock required. At the same time accounts receivables will be K50 000 and accounts payable of K25 000. These levels will be maintained until the end of the project. The company expects to sell 80 000 units in the first year rising to 100 000 in year 2, and 120 000 in year 3, before falling back to 100 000 for each of years 4 and 5. The company expects to incur an extra K50 000 in marketing costs in the first year, followed by K40 000 a year thereafter. The project will also incur K40 000 of overhead costs from the parent company Two managers from the parent company will come and work on the project; their current salaries are K50 000 each and the parent company will have to hire two new managers to fill the vacated positions. The company expects to start two new managers at a salary of K40 000 each. The company is funded with K16m of equity and Kom of debt. The recent dividend growth rate at the company has been 6%. The asset beta is 1.15 and the debt beta is 0.25. The company faces a tax rate of 30%. The risk free rate of interest is 4.6% and the stock market risk premium is 6%. Required: a. Calculate the cost of capital for the project. b. Lay out the cash flows for the project, with explanations as to why you have included or (5 marks) excluded certain cash flows. Calculate the NPV. Should the project be accepted? (12 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started